What options are worth considering?

How to choose the best payment solution for your online store. Source: shutterstock.com

If you are reading this, you probably have your own online store, or at least have some thoughts of launching one. It is a complicated process and there are hundreds of things to consider, but today we would like to talk about a payment solution. This point is believed to be one of the most vital parts of a successful online store. Moreover, this point directly affects a store’s growth and revenue.

PaySpace Magazine would like to share the list of the most significant aspects that should be considered while choosing the right payment method.

1. The checkout process – smooth and swift

Help your business by considering a one-click shopping option. Source: shutterstock.com

It is not a big secret that shoppers are eager to get around all redundant steps and go from, “That looks nice,” straight to, “I’ve just paid for it,” as soon as possible. As a retailer (if you are one), you should know that the longer a buyer has to wait until payment is accomplished, the higher the chance the customer will have doubts (whether or not to buy their chosen things), also known as second thoughts. Sometimes people start to think something like, “Do I really need this?” or, “Let’s postpone it,” but everybody knows what it actually means. It is similar to the abandoned cart problem, or even can be compared with, “We’ll contact you,” after a not very bright job interview.

People don’t want to waste their time, and nowadays, most shoppers are familiar with such a thing as “one-click buying”, which such retail giants as Amazon are kindly providing. Competition is increasing. Time is money.

The right payment solution must reduce any excessive friction for the client. The best solution is the one which relieves shoppers from superfluous movements, and gives an ability to pay for a purchase on the go, on the fly, sitting on the sofa, etc (in brief, without the need for a card). Help your business by considering a one-click shopping option.

2. Diversity of payment options

Clients are more pleased when they know there are different payment options. Source: shutterstock.com

Clients are more pleased when they know there are different payment options. It doesn’t mean you have to use multiple differing systems (for more details, see point 5), but the multiplicity of payment methods is what an online shop really needs. Different clients have a variety of methods to pay for their purchases, such as pay with a banking card right away, pay with invoice (sometimes this is called “pay later”), or even pay in parts. More and more people choose the latter option since it is much easier to just split the payment into a few parts. For instance, your new earphones cost $300. This item can be paid with three $100 installments.

3. After-purchase experience, refunds, returns, chargeback

Clients do not like to wait for a refund to be processed. Source: shutterstock.com

If you are in the retail sector, then probably you have already faced such phenomenon as refunds. A client could file a refund request, or wouldn’t pay at all, or might contact client support requesting to postpone the payment they have made. This entire process is time/resource-consuming, particularly for you. Make sure that the payment service provider you’ve chosen is able to take care of this issue and consequently handle it. In addition, your client support team must be available 24/7.

When it comes to returns and refunds, your payment solution must be smooth for customers with the ability to compromise.

Clients do not like to wait for a refund to be processed. Furthermore, let’s not forget about the thing that is called “psychological brake”, which can form in clients’ minds. This brake would hold customers back from shopping at your store if they still remember that rough situation with a refund or chargeback. Or even if they are still waiting for a refund, who knows what can happen with an untrustworthy payment solutions provider.

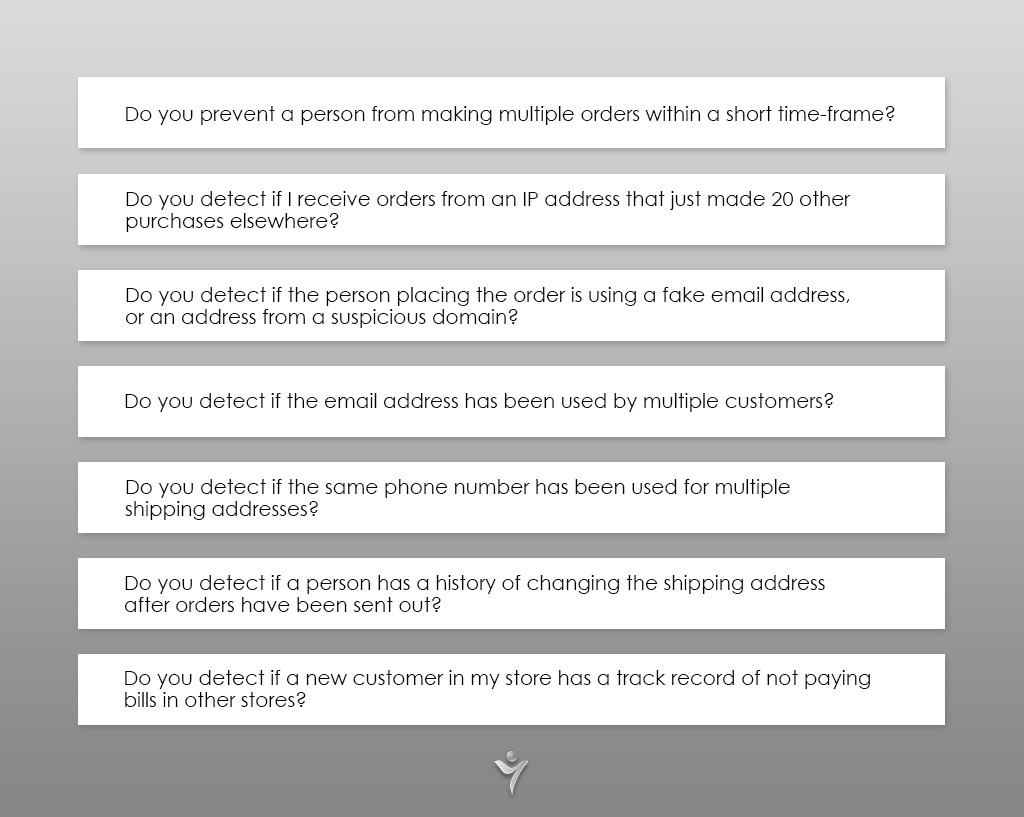

4. Fraud protection

A good payment service provider should have a substantial fraud protection system. Source: shutterstock.com

This is a very important point. Fraud can pose a genuine threat to your online retail business. A good payment service provider should have a substantial fraud protection system.

There are some questions you should ask a provider to understand whether it can protect your store:

5. Optimization and streamlining

Let’s return to point 2, and recall that a good payment solution must be able to integrate several payment options into one. After all, it is not convenient to have three, four, or even five different payment systems. If you have one streamlined, straightforward, and reliable solution, your efforts and resources could be cut by half (if not by a third).