Let’s discover the top 5 innovative banking services catering to the needs of Canadians

Leading neobanks in Canada: top 5 digital-only banks. Source: unsplash.com

Neobanks in Canada face a lot of challenges competing with traditional banking institutions. The absence of an open banking system and high customer trust towards existing brick-and-mortar banks make it hard for fintech startups to disrupt the business model.

Nonetheless, a few neobanks manage to gain their loyal clients and maintain positive growth.

Koho

Koho. Source: koho.ca

Founded in 2014, Koho has become the first neobank in Canada. Technically, the fintech company is not a bank itself, so it provides services in partnership with Peoples Trust and Visa. It has raised over $57 million in funding and has grown to more than 120,000 accounts in less than two years.

The neobank offers a checking account with a prepaid Visa card. The account may be topped up through e-Transferring from a regular bank account or by direct payroll deposit. Account features include early payroll, cashback, simplified joint account, and saving goals. Those who want to stand out from the crowd, can order a limited edition Metal Card, and/or use a Premium account with additional perks.

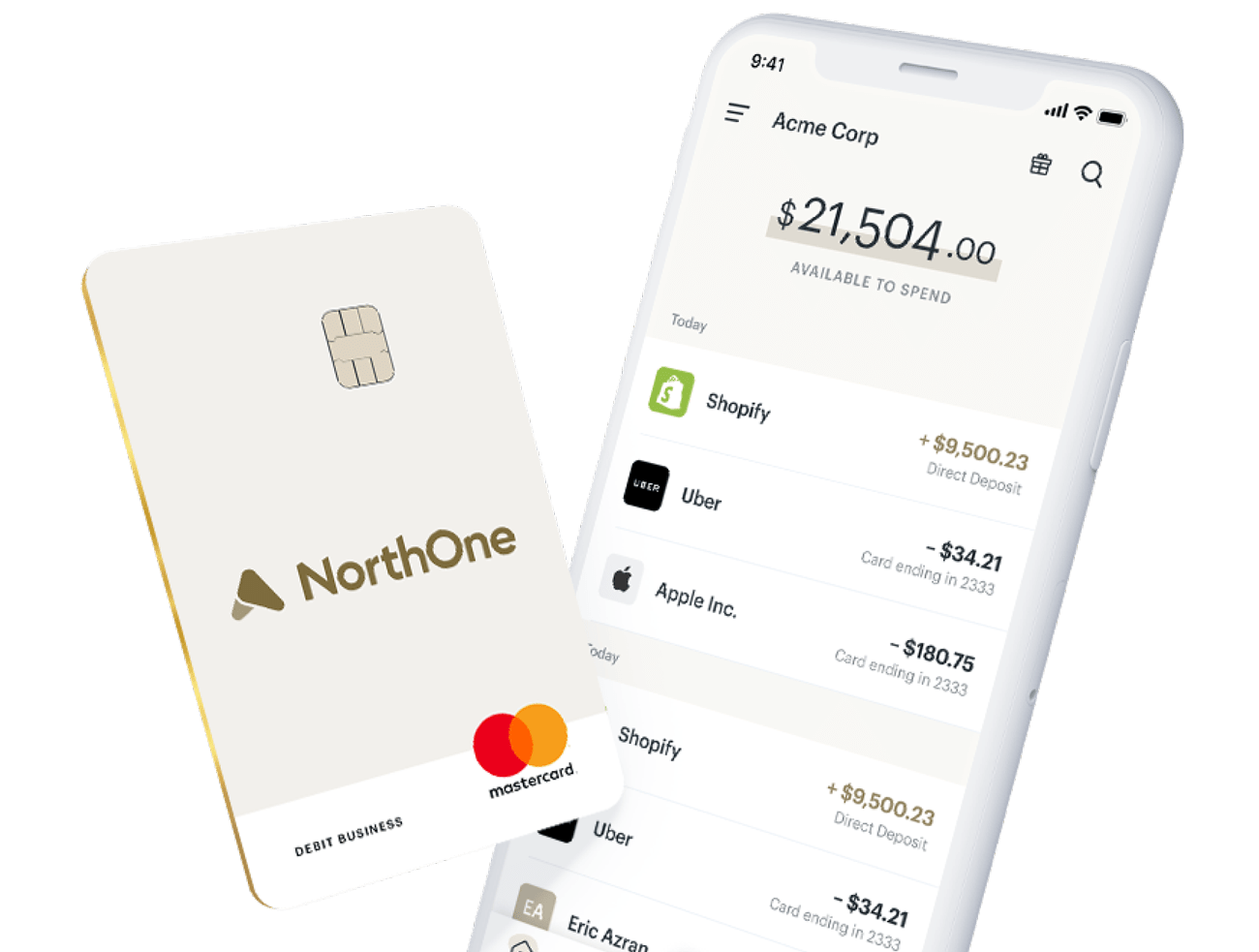

NorthOne

NorthOne. Source: northone.com

NorthOne is a digital banking platform for small businesses and freelancers. Its funding of $23 million helps to build innovative technology that makes financial management accessible and affordable for business owners. The team created an API solution that integrates with popular financial tools. It works via the proprietary app and also has a desktop version. As the company states: “NorthOne delivers all the operational banking functionality a business might need (wires, mobile check deposit, ACH, cash deposits) through a mobile app.” The platform operates both in Canada and the United States.

Neo financial

Neo Financial. Source: neofinancial.com

This startup with great ambitions was founded only in 2019. In 2020, Neo raised $50 million in a Series A funding round and closed a $25-million debt facility with a financial partner, ATB Financial. Already this year, a Calgary-based fintech company announced a first-of-its-kind collaboration with Concentra Bank to offer a CDIC-eligible high-interest savings account that works as an everyday banking account. As the partners claim, such a solution “has historically not been accessible within Canada’s consumer banking sector”. Except for Neo Savings, consumers can use Neo Credit Card, a cash-back credit card issued by ATB Financial and backed by the Mastercard network.

STACK

STACK. Source: getstack.ca

STACK offers one of the few prepaid cards available to Canadians in cooperation with the Mastercard network. It is suitable for the gig workers since the card can be loaded with cash at Canada Post offices as well as chosen retail locations around the country. Other ways of funding the STACK card include Interac e-Transfer, Visa Debit, direct payroll deposit, and free STACK-to-STACK transfers. The neobank also offers its members a mobile tap-to-pay option, automated savings, instant rewards, and bill splitting features. No FX fees and zero-commission withdrawals are among the additional benefits.

Tangerine bank

Tangerine bank. Source: tangerine.ca

Tangerine launched as ING DIRECT Canada in 1997. In 2012, Scotiabank completed its acquisition of ING Bank of Canada, and the bank changed its name to Tangerine. It offers no-fee checking and savings accounts, investment accounts, Guaranteed Investment Certificates (GIC), global ETF portfolios, and mutual funds (through a subsidiary). Tangerine’s Money-Back Mastercard is a credit card with an unlimited 2% cashback in selected categories. The neobank also offers a few flexible lines of credit as well as various loan types including a mortgage.

SEE ALSO: