Increasing adoption of contactless technology led to debit card payments growth

Malaysia to increase its contactless debit card payments. Source: shutterstock.com

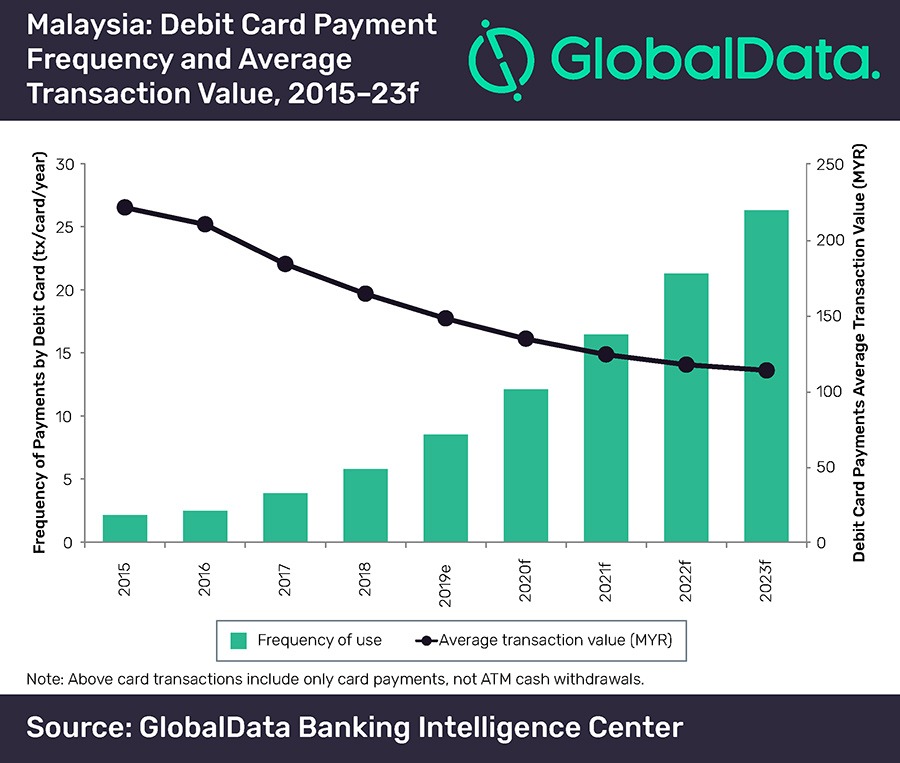

GlobalData reveals that the Malaysian payments market remains cash-reliant. Although, the total number of card payments is expected to increase to 1.9 billion in 2023, compared to 854.2 million in 2019.

While credit cards are the most favored card type for payments, the share of debit cards is set to increase from an estimated 25.8% in 2019 to 41.8% in 2023.

All debit cards in Malaysia shifted to contactless by January 2018, as a part of the Malaysian Chip Card Specification initiative.

The report reveals that the number of contactless POS terminals in the country increased by 90.3% in 2018 to reach 207,562. This way, the number of contactless payments via debit cards rose at an annual rate of 288% from 12.8 million in 2017 to 49.7 million in 2018.

SEE ALSO: