They say, nothing costs more than something that’s free. Is it true for zero-fee platform Robinhood?

Robinhood app guide & ins and outs. Source: facebook.com

For many people, investment is a great source of passive income and an alternative to the eternal rate race. However, most brokerage firms charge significant fees for providing access to the trade market. It leaves you wondering what profit you could’ve made on those aggregate assets that have served as commission fees. Perhaps, you even feel robbed at times. Isn’t that a great time for a saver to intrude?

What is Robinhood app?

The Robinhood investment app boldly bears the name of the famous “noble” robber who stole money from the rich and gave it to the poor, claiming to be a liberating and disruptive force in the online brokerage industry which, apparently, appropriates too much of consumers’ money.

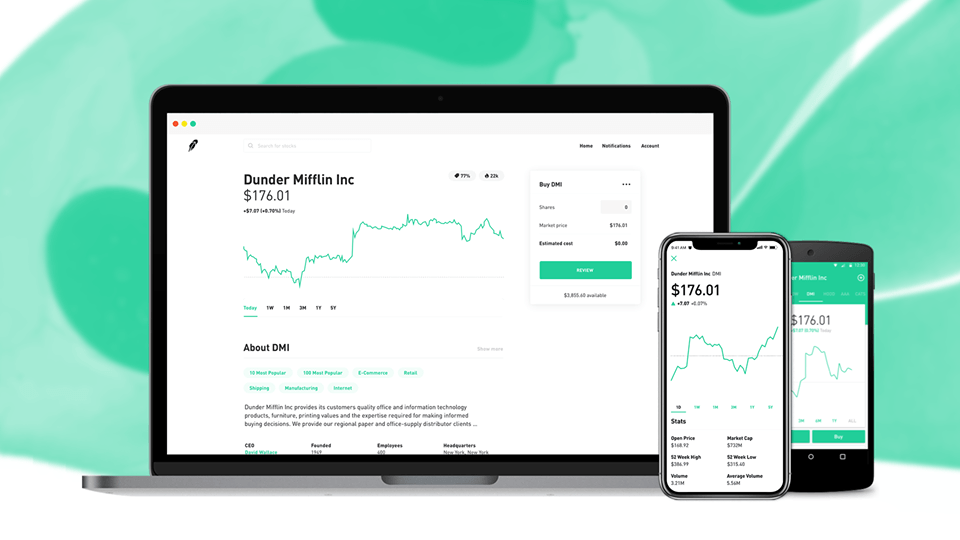

Robinhood Markets, Inc., a financial services company, was created in 2013 in California, USA. Its main product is the Robinhood smartphone mobile app, which allows individuals to invest in public companies and exchange-traded funds listed on the U.S. stock market commission-free. The company’s revenues come from interest earned on customers’ cash balances and margin lending, as well as rebates from market makers and trading venues.

Robinhood’s clients can invest in stocks, ETFs, shares, options, and cryptocurrencies like Bitcoin, Ethereum, and Litecoin, directly from their phones or desktops. According to various sources, Robinhood’s user base has grown to an approximate number between 4 and 6 million over the past 6 years. Predominantly, those are young people aged 18-29 aka Millennials who love to manage their personal finances with the help of technology.

As of May 2018, Robinhood’s platform hosted more than $150 billion in transactions. This year, it is reportedly close to raising funds of $7 billion in value. Over previous years, it has raised a total of $539 million in funding over 7 rounds. Investors in the company include Index Ventures, DST Global, and Snoop Dogg. 9Yards Capital and Chainfund Capital are the most recent backers of the project.

How to use it

The app’s interface is intuitive and simple. Registration is quick plus you can get a free stock like Apple, Ford, or Sprint when you join.

The users should be US citizens or permanent residents over 18. The registration requires a valid Social Security Number and a legal U.S. residential address within the 50 states or Puerto Rico.

Once you submit an application in your Robinhood app, it will take one business day to be considered. You’ll receive an email either confirming your approval or asking for additional information. Robinhood may request personal information, including ID proofs, or financial and tax identification information, in order to comply with U.S. government laws and FINRA rules.

In order to fund your trading activities, you need to link your individual or joint bank account to the app profile. The company recommends linking a checking account rather than a savings account to avoid potential transfer reversals.

To do that, follow these simple steps:

- Click or tap the Account icon.

- Choose Transfers in the app or Banking in the web interface.

- Add New Account under Linked Accounts.

- Choose your bank from the list of major banks, or scroll down and tap More Banks to search for your bank.

- Enter your online banking username and password.

- Choose the account to link.

- If your bank is not on the list, linking an account will require some manual verification. You can find more information here.

Now you are ready to start trading. Look for the stock’s detail page and choose the type of order you’d like to make. Confirm it and submit.

Features and Fees

There are two types of accounts available for different investing needs:

- Robinhood Instant

A default option is a margin account. You’ll have access to instant deposits and extended-hours trading. The funds processing is immediate when you sell stocks or make a deposit (up to $1,000).

- Robinhood Gold

The advanced option gives you access to more buying power and larger instant deposits. The package includes professional research from Morningstar, Nasdaq Level 2 Market Data, investing in the margin. You can try a premium account for free during the 30-day period. The next usage costs $5 a month. If you use more than $1,000 of margin, you’ll pay 5% yearly interest on the amount you use above $1,000. Your interest is calculated daily and charged to your account at the end of each billing cycle.

Robinhood Cash Management. Last December, the company announced a plan to go after banks by offering a cash management account that would earn 3% interest. More than 850,000 people had signed up for the accounts, which weren’t made active before this feature disappeared from the website. It appeared that the company had not consulted federal regulators about insuring the cash accounts. Hence, they couldn’t provide this service in a secure and legal way. As of now, the new accounts have been postponed for an indefinite term and labeled as “Coming soon”.

Fees. Commission-free trading doesn’t mean that all your activities will be completely free. You won’t pay Robinhood a commission for using their app. However, keep in mind that relevant SEC & FINRA fees may apply. Check the detailed fee information here.

Data and Tracking. Robinhood’s servers claim to stream real-time market data from exchanges. Informative tools such as candlestick charts and indicators for stocks and cryptocurrencies on Robinhood Web can help you better understand the markets and analyze the latest trends.

Customers also receive financial newsletters and get access to podcasts that bring free, daily, and understandable financial news. Smart notifications arrive in advance of scheduled events — like earnings, dividends, or splits.

You can create a customized stock and cryptocurrency watchlist to track the assets that mean the most to you instead of distracting to all the trends.

Drawbacks and Criticism

Although the platform is very popular and low-cost, many experts and users don’t recommend it as a main investment tool, so you can try to

find some Robinhood alternatives for a few significant reasons:

- Mutual funds and bonds aren’t supported. You can’t invest in over-the-counter equities, foreign stocks, fixed-income assets, and foreign exchanges. Robinhood also lacks an automatic dividend reinvestment program, which means a waste of some earning opportunities.

- For investing, Robinhood supports only individual taxable accounts (often called brokerage accounts). You can’t use it as a means of saving for retirement as with a tax-advantaged account. It’s also not a good option if you’re investing for long-term goals, for a child, or as a couple (no joint accounts available).

- The news feed and research capabilities for the free accounts are quite superficial, with basic charting and only 5 years of price history available. If you want a deeper analysis of the market, you should upgrade for the pre-paid premium features.

- Portfolio analysis is quite shallow and limited too. It doesn’t show many perspectives.

- You cannot consult with live assistants or phone support.

- Despite the simple interface, it’s hard for a newcomer to trade on the platform. The Help center is mostly dedicated to technical details and issues, they won’t teach you any trade tricks.

- Robinhood does not integrate with personal financial management apps.

- The statements of the real-time data are a bit exaggerated. Surely, your orders will always be completed at the real-time price, but the charts and data you see on screen may get delayed as appears from intentional comparison with other services.

- The watchlist is practically non-customizable and inconvenient to use.

- The absence of fees for every transaction may encourage customers to buy and sell stocks spontaneously. However, the majority of investors lose money when they actively trade instead of giving their investments time to build up. They also consider more risky options when there are no additional strings attached.

SEE ALSO: