The robo-advisory market evolved due to the 2008 financial crisis as small investors looked for wealth managers who charged lower fees

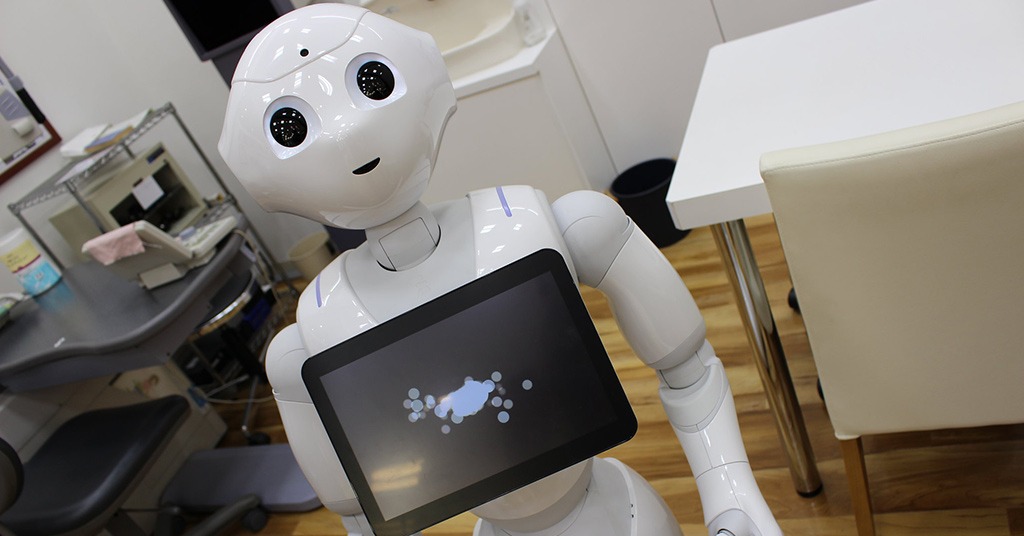

Robo-advisor industry to exceed $2.5T over 3 years. Source: flickr.com

According to LearnBonds, robo-advisors are expected to jump to $2.5 trillion in value by 2023, compared to forecasted $1.4 trillion in 2020.

A typical robo-advisor collects financial data from clients through an online survey and uses the information to offer advice and automatically invest.

They usually charge low fees, around 0.25% per year, requiring small opening balances, from as little as $10. As to traditional wealth advisors, they charge investors around 3% per year. They take a further percentage off profitable investments and require a deposit of hundreds of dollars.

The data reveals that the number of investors using robo-advisor financial planning services will hit 147 million by 2023.

The automated financial advisors were initially introduced in the US, further representing the leading robo-advisory industry in the world. Some of the largest players on the global market are Betterment, Wealthfront, Personal Capital, Nutmeg, FutureAdvisor, and The Vanguard Group.

The entire US robo-advisory industry is believed to hit a $1 trillion value this year, with hybrid robo-advisors as the largest and the fastest-growing segment.

Hybrid robo-advisors provide an automated investment platform with access to expert human advice from financial advisors. The trend appeared because of customer’s demand for a more tailored solution for complex investments.

China ranked as the second-largest robo-advisory industry worldwide after the US with a $700 billion difference. The UK is expected to hit $24 billion market value in 2020, whereas Germany ranked in fourth place with $13 billion worth. Canada is the fifth-largest robo-advisory market worldwide forecasted to reach $8 billion value this year.

SEE ALSO: