The Silvergate, Silicon Valley Bank, and Signature Bank saga, in three not-so-concise parts, examines the chaos of centralized cryptocurrency companies, the failing and scrambling US banking system, and the outcomes for the crypto industry and the regular person.

Source: Unsplash

The week was long and coiling ever-tighter around the neck of the crypto industry. It was hard to keep up with which S-sounding bank was getting the hatchet, and what implications followed who. In the span of five days, three major banks — Silvergate Capital, Silicon Valley Bank, and Signature Bank — all with close ties to the crypto industry and all holding significant assets of various blockchain projects and companies, shut down.

This is part 1 of a three-part series examining the tale of three banks, the convoluted events of the past five days, the outcomes, and what this means for the regular person, and for the future of crypto.

Wednesday, March 8, 2023

US Federal Reserve Chair says no one should assume the Fed can protect the economy in a debt default

Federal Reserve Chair, Jerome Powell, has cautioned against assuming that the economy can be protected in the event of a debt default. He made these remarks at the Federal Reserve’s Semi-Annual Monetary Policy Report, during the ongoing debate on Capitol Hill about the debt ceiling and the potential consequences if the government fails to pay its bills.

Powell’s warning follows his somber outlook on the economy, where he predicted that interest rates will continue to rise in the coming year as the battle against inflation persists.

Earlier this year, the United States government surpassed its debt limit of $31.4 trillion, leading to a heated debate in Congress about whether to raise the debt ceiling.

Republicans are pushing for a tighter budget and opposing an increase in the debt ceiling, while Democrats support an increase under the current budgetary agreements. President Joe Biden is also proposing an updated budget for 2024, which includes a 5.2% increase in federal pay.

The potential devastation that could result from a US debt default is the only certainty in this situation, as bipartisan agreement remains uncertain. CNBC has reported that the Treasury has the ability to last until this summer through extreme measures. However, Congressional Budget Office (CBO) director Phillip Swagel warned last month that these measures could be exhausted sooner, and the Treasury could run out of funds before July, based on IRS data that will be revealed in April.

Fed Chair announces a US “real-time” payments system, to be rolled out by July

Also at the Federal Reserve’s Semi-Annual Monetary Policy Report meeting, Powell announced that real-time payments in the US are coming “very soon”. When asked for further details on the FedNow service and its potential relation to digital currency, he noted that while a central bank digital currency (CBDC) is still years away, the implementation of real-time payments for all banks is close.

The FedNow service has a target release date between May and July and would allow any bank in the US to offer instantly available funds and real-time payments to their customers.

Powell believes that real-time payments will be in the hands of the public very soon, which would take away any advantage that the digital asset industry has over traditional finance, other than the decentralization and privacy, that is.

Crypto-focused Silvergate Capital announces its shutting operations and liquidation

Silvergate Capital, one of the two main banks for the crypto industry (the other being Signature Bank), has announced its decision to shut down operations and liquidate the bank.

Silvergate had been struggling since the implosion of FTX in 2022, but vehemently denied any fiscally-meaningful connection to the disgraced crypto exchange, citing its relationship to FTX as “limited to deposits”. Yet by January 2023, Silvergate had laid off approximately 40% of its staff, and incurred a $1 billion net loss.

After crypto exchanges Coinbase and Crypto.com announced they would no longer accept or initiate payments to or from Silvergate Capital, the entity announced that an orderly wind down and voluntary liquidation was the best course of action.

Silvergate has indicated that all customer deposits will be fully repaid as per a liquidation plan shared with them.

Binance, Coinbase, et al. reassure users they are unaffected by the Silvergate shutdown

2022 has prepared the crypto community for tumultuous and unfortunate events, in series and then some. The downfall of Silvergate Capital naturally led to Twitter-wide concerns over the contagion effect of the FTX catastrophe.

In response, various cryptocurrency firms have rushed to assure the community that they are not impacted by the collapse of Silvergate.

Binance CEO, Changpeng Zhao, tweeted that the world’s largest cryptocurrency exchange has no losses at Silvergate and that “funds are $SAFU” — secure in the “Secure Asset Fund for Users” created by Binance that holds 10% of all trading fees to indemnify customers in case the exchange is hacked, otherwise implying the exchange’s funds are safe.

Coinbase also denied any client or corporate cash at the bank and expressed its regret over Silvergate’s decision to wind down operations. Similarly, OKX’s President Hong Fang affirmed that both corporate and customer funds are secure. However, Fang also believes that Silvergate’s shutdown could slow down the overall cryptocurrency adoption process.

The downfall of Silvergate has been linked to regulatory pressure on banks that accept cryptocurrency deposits. According to the CEO of the Crypto Council for Innovation, Sheila Warren, discouraging banks from providing deposit accounts only creates fewer options for any one sector to obtain banking services.

Via Twitter, Warren shared the countless stories of individuals and businesses already affected by the closing of SVB, including the inability of many companies to pay employees and small businesses to process client payments and pay bills. After all, those affected (and typically without redemption) are not the 1%, and the Silvergate situation proved to be no different.

Thursday, March 9, 2023

President Biden proposes to double capital gains tax

US President Joe Biden proposed a new tax hike for all, including a 25% minimum tax on billionaires and corporations, as well as doubling the capital gains tax rate from 20% to 39.6%. The proposal is part of Biden’s multi-trillion dollar Build Back Better economic package and aims to reduce the deficit by increasing revenues projected to cut down $3 trillion over the next decade.

Although polls suggest that the majority of Americans favor taxes on the wealthy and large corporations, the proposal faces little chance of passing Congress as Republicans now control the House of Representatives.

House Speaker Kevin McCarthy opposes the tax hikes, stating that raising taxes is not the answer. Biden’s proposal targets the richest 0.01% of Americans, who will have to pay a minimum of 25% tax, while Americans making over $400,000 will see an increased top tax rate of 39.6%. Long-term investments made by investors making at least $1 million will also be taxed at 39.6%, up from 20%, and corporate tax rates will be increased to 28% from 21%.

In a bid to appeal to his voter base, Biden “targets the rich”, but in the face of a rapidly devaluing currency, this plan is a deterrent to anyone attempting to make “enough money” through investment, such as enough money for a house, for starting a business, for healthcare. Anyone who succeeds at making their first million immediately loses 40% of it to now-relevant voter appeasement. Further, this is bound to increase product and service prices, as businesses paying higher tax struggle to stay afloat.

NY AG files lawsuit against KuCoin and calls ETH a security

Cryptocurrency exchange KuCoin is facing New York Attorney General Letitia James, who filed a lawsuit against them for failing to register as a securities and commodities broker-dealer and falsely representing themselves as an exchange.

The Attorney General seeks to stop KuCoin from operating in New York and block access to its website until it complies with the law. Ethereum, the second-largest cryptocurrency by market cap, is also being claimed as a security in the petition, which argues that KuCoin was required to register before selling ETH, LUNA, or UST. New York’s stricter BitLicense regulations are designed to protect consumers and prevent money laundering, which KuCoin is not accused of.

This lawsuit is part of Operation ChokePoint 2.0, which continues to target the cryptocurrency realm. The ongoing Ripple v. SEC case, which also centers around the classification of XRP as a security, may bring clarity to the issue in the United States. It remains to be seen whether the US will begin making regulations instead of prosecuting the industry in the coming years.

Friday, March 10, 2023

President Biden proposes 30% tax on electricity used to mine crypto

US President Joe Biden revealed his budget proposal for the upcoming year, which includes a 30% tax on all electricity used for mining Bitcoin and other Proof-of-Work (PoW) cryptocurrencies.

If approved, this excise tax would be implemented over the course of three years, with a 10% rate in the first year, 20% in the second, and 30% thereafter.

Cryptocurrency mining firms would be required to report the amount and type of electricity used, as well as the value of the electricity if purchased externally. Firms leasing computational capacity would need to report the value of the electricity used by the lessor firm attributable to the leased capacity, which would serve as the tax base.

The intention behind this proposal is to decrease mining activity, as the current law lacks specific tax rules regarding digital assets. The administration cites the negative environmental impacts and risks associated with large energy consumption and computational effort required for mining, all of which could be easily resolved if environmental impact, energy efficiency, and sustainability were the proposal’s actual priority.

As a result, Bitcoin briefly dipped below $20,000, as nervous investors rushed to sell off their BTC. But confident hodlers didn’t budge.

US DOJ tries to block Binance.US from acquiring bankrupt Voyager

The US Department of Justice (DOJ) has filed an appeal to contest the bankruptcy court’s decision allowing brokerage exchange Voyager Digital to sell over $1 billion of its assets to Binance.US.

The DOJ’s action was expected due to the backlash from regulators, including the US Securities and Exchange Commission (SEC), against the deal. The SEC accused Binance.US of violating federal securities laws, but Judge Wiles dismissed its appeal in favor of Voyager’s creditors.

Regulators are still trying to block the deal, which would negatively impact the creditors. If the sale is blocked, Voyager would be forced to liquidate itself, resulting in diminished returns to the creditors. The proposed sale to Binance.US is expected to provide a 73% recovery for Voyager’s customers.

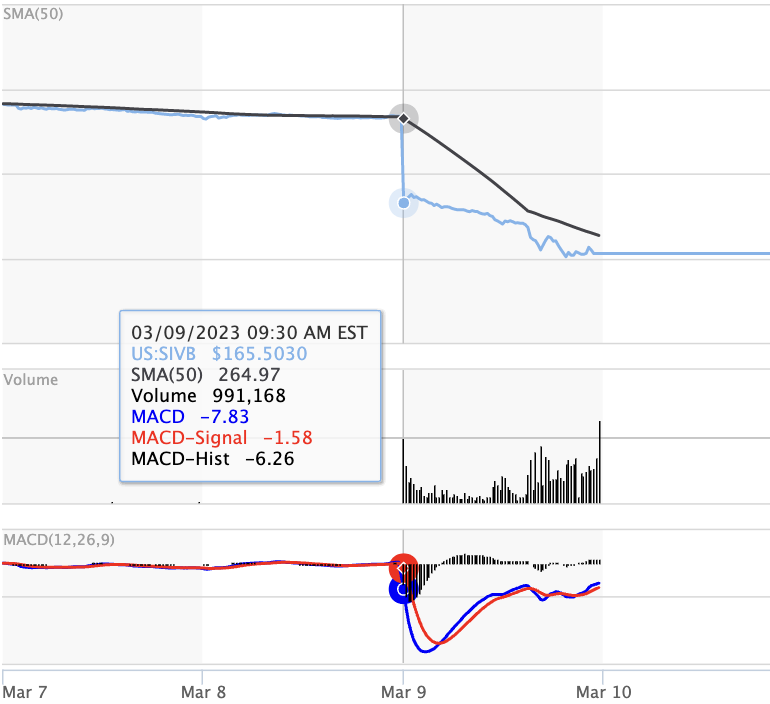

Silicon Valley Bank crashes 60%, spurring banking crisis fears

The past day has been tumultuous for all asset classes. The crypto market suffered significant losses, Bitcoin fell below $20K, and stocks have also taken a nosedive.

All major averages ended Thursday’s trading session on a bearish note. Nasdaq fell by 2.05%, the S&P 500 was down by 1.85%, and the Dow Jones Industrial Average was down 1.66%. The benchmark stock index of the banking sector, the KBW Bank Index, was down by around 8% in a day, marking the biggest one-day decline since June 2020.

SVB Financial Group, the parent of Silicon Valley Bank (SVB), was the biggest loser in the banking index, losing over 60% of its value on Thursday. The bank, with about $212 billion in assets, closed at $106.04. However, its downward spiral continued during the after-market hours as SIVB dropped by another 22% and was priced around $82.5.

Founders Fund, the VC fund co-founded by Peter Thiel, has reportedly asked companies to withdraw funds over rising concerns about the bank’s financial position. The VC now claims to have $50 million of ‘personal fortune’ at SVB.

In addition to the pessimism associated with President Biden’s tax hike proposals, Silicon Valley Bank’s parent company revealed on Wednesday that it had sold around $21 billion of securities from its portfolio, resulting in a post-tax loss of $1.8 billion for Q1.

The bank also sold $1.25 billion of common stock and $500 million of securities that typify convertible preferred shares. General Atlantic agreed to purchase $500 million of its common stock. Thus, the total amount being raised was up to $2.25 billion.

Raising money on short notice is seldom a good sign for a bank. In a recent letter to shareholders, SVB’s Chief Executive Officer Greg Becker stated that the actions were being taken because the entity expects “continued higher interest rates, pressured public and private markets, and elevated cash burn levels” from their clients as they invest in their businesses.

According to Bloomberg News, SVB does business with almost half of all US venture capital-backed startups. It is also tied to 44% of venture-backed technology and healthcare companies that went public last year, which are on the lookout for liquidity.

Executives and investors from the cryptocurrency industry, including Binance’s CZ and Anthony Pompliano, have all been discussing the current state of affairs. With Silvergate Capital’s abrupt shutdown and the recent Silicon Valley Bank incident, Wall Street has begun to question whether the sector is heading towards a crisis. While it may seem chaotic at present, only time will tell if we are on the brink of another banking crisis like the one in 2008.

South Dakota Governor vetoes bill excluding Bitcoin and other cryptocurrency from the definition of ‘money’

In positive news, South Dakota Governor Kristi Noem has vetoed House Bill 1193, which aimed to exclude cryptocurrencies from the definition of money in the state’s Uniform Commercial Code. The bill, which had received criticism from conservatives, sought to exclude digital assets with the exception of central bank digital currencies (CBDCs).

Noem argued that the bill could put South Dakota residents at a disadvantage and lead to potential overreach from the federal government in issuing a digital dollar. Conservative groups supported Noem’s decision to veto the legislation, citing concerns about financial freedom. The proposed UCC amendment would have defined money as a medium of exchange authorized by a government.

While the US continues to explore the potential benefits and risks of a CBDC, many countries, like Nigeria, have already tested or adopted them. The veto was a major step in opposing the covert ways in which the US government is aiming to prevent decentralized finance from validity and accessibility to the American public.

After a plunge, comes the cold clarity of the situation

Later that same day, following a 60% value plunge and failed attempts at raising capital, Silicon Valley Bank Financial enters talks to sell itself, according to CNBC.

While concerns have been raised about the banking sector as a whole, there may still be a market for SVB if a sale goes through. The news comes after recent reports of worry within the industry about potential heavy losses on bond portfolios. Despite its current state, large financial institutions are said to be considering purchasing SVB, including British banks showing particular interest in rescuing SVB’s UK arm.

Biden says ‘our economic plan is working’

The US economy added 311,000 jobs in February 2023, a robust number that falls slightly short of the huge gains in January but enough to keep pressure on the Federal Reserve to aggressively raise interest rates to combat inflation.

President Joe Biden touted the news at the White House, crediting his administration’s economic plan for the strong report.

While the unemployment rate rose from 3.4% to 3.6%, the job market ‘remains healthy’, with many employers eager to hire.

The Fed may yet accelerate its rate hikes to combat inflation, not as any response to February’s job data, but as a way to ensure stocks don’t tumble further and more banks don’t collapse.

After a battle to stay afloat, Silicon Valley Bank is shut down by California regulators

California regulators have shut down Silicon Valley Bank (SVB) after it collapsed, and the Federal Deposit Insurance Corporation (FDIC) has been named as the receiver. The FDIC will handle the returning of funds to insured and uninsured depositors.

Earlier the same day, Friday March 10, SVB experienced a 60% value plunge, followed by failed attempts to raise sufficient funds and considerations of a sale, but was ultimately closed. The bank had $209 billion in total assets and $175.4 billion in total deposits as of December 31st, 2022, and the amount of deposits exceeding insurance limits at the time of closure was undetermined, according to the release.

The main office is set to reopen on March 13, 2023. The Deposit Insurance National Bank of Santa Clara (DINB), created by the FDIC to protect insured depositors, will continue operating and conducting banking activities, while SVB banks will clear under the Federal Deposit Insurance Act.

USDC stablecoin issuer Circle held funds in now-closed Silicon Valley Bank

Circle, the USDC stablecoin issuer, revealed in a Reserve Report that it has an undisclosed amount of funds stored in now-closed Silicon Valley Bank.

The report was dated March 2nd, 2023, just days before Silicon Valley Bank’s closure. As of March 10, Circle has not yet commented on the matter. The closure of Silicon Valley Bank has caused concern in the banking sector and the stablecoin market, with USDC losing value against the US dollar.

Since stablecoins like USDC are pegged 1:1 to the US dollar, any fluctuation in price they may experience is much more significant and tumultuous than a change experienced by cryptocurrency like Bitcoin.

Crypto Bank BlockFi has $227 million in uninsured funds in Silicon Valley Bank

A bankruptcy document revealed that crypto lender BlockFi, has $227 million of uninsured funds held in a money market mutual fund at Silicon Valley Bank. This amount is not protected by the Federal Deposit Insurance Corporation (FDIC), potentially violating US bankruptcy law.

The filing by the US Trustee overseeing BlockFi’s Chapter 11 bankruptcy case comes just a day after the bank was shut down by a California regulator, following a rush of fund withdrawals by investors who were concerned about the bank’s attempts to bolster its balance sheet.

The FDIC provides insurance up to $250,000 per depositor, per insured bank, for each account ownership category. BlockFi was warned by the US Trustee earlier this year that it may not be in compliance, but failed to provide proof of compliance before the FDIC took control of SVB. BlockFi filed for bankruptcy protection in November and has creditors including infamous FTX.

Saturday, March 11, 2023

Silicon Valley Bank CEO sold $3.57 million in SVB stock within the past two weeks

Silicon Valley Bank’s CEO, Greg Becker, sold $3.57 million in stocks within the past two weeks before the bank’s collapse. SVB had $210 billion in assets and was the 16th largest bank in the United States. But despite efforts to raise capital and hire advisors for a potential sale, the bank ultimately failed.

Before its collapse, 95% of Silicon Valley Bank deposits were uninsured FIDC, and nearly half of all US venture capital-backed startups were related to the bank. Insider sales have been a majority of the bank’s recent activity, which should raise warning signs, and traders had been pushing the stock down with 100% bearish warnings.

The stablecoin market as a whole was negatively affected by the news. The most to suffer being Circle’s USDC after a March 2 report revealed Circle has a $3.3 billion exposure to Silicon Valley Bank.

Binance temporarily suspends USDC conversions, citing market conditions and high inflows

As concerns grow over how much of USDC’s reserves were held by Silicon Valley Bank, top cryptocurrency exchanges Coinbase and Binance temporarily suspend USDC conversions.

The bank’s collapse on Friday has sent shockwaves across the tech industry, with several companies revealing their current exposure to the California bank. Circle’s $3.3 billion worth of the cash backing USDC remains locked in Silicon Valley Bank.

The trading price of USDC, which is designed to remain pegged at $1, went into freefall Friday night, dropping from $1.00 to $0.93. Coinbase and Binance said conversions would resume once banks reopen on Monday.

Circle confirms $3.3 billion of the approximate $40 billion USDC reserves remain at SVB

In a series of tweets, Circle officially confirmed its attempts to remove the $3.3 billion balance from SVB has not yet been successful.

“Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.” The company proceeded to issue some support to SVB, as a bank which serviced many cryptocurrency and blockchain projects. “Like other customers and depositors who relied on SVB for banking services, Circle joins calls for continuity of this important bank in the US economy and will follow guidance provided by state and Federal regulators.”

Circle noted that SVB has been one of the six banking partners the company uses for managing around 25% of USDC reserves in cash.

Understanding the destabilization of the stablecoins

The banking industry seems to be going through a lot, beyond the shutdown of Silvergate and the recent issues surrounding Silicon Valley Bank. But these specific banks were known for crypto-friendliness, in other words, for having services projects, companies and venture capital funds within the cryptocurrency industry. As the crash and burn, the aftermath spreads on to the crypto sector like wildfire.

Since California regulators shut down SVB, Circle, the issuer of stablecoin USDC, confirmed that $3.3 billion of USDC cash reserves were still in the bank.

USDC, which is designed to maintain its peg despite market conditions, then began to depeg, its value dropping by 9.51% over the last 24 hours, reaching a low of $0.8774 before gaining momentum. CoinMarketCap data shows that the 24-hour trading volume spiked by 379%.

Crypto exchanges like Binance and Coinbase, had to temporarily suspend USDC trading and conversions to USD due to heightened activity and the closure of banks over the weekend. Binance also suspended the auto-conversion of USDC to BUSD as a risk-management strategy, while Robinhood temporarily suspended deposits.

Stablecoins like DAI and USDD also temporarily depeged from the US dollar.

Although the market is trading in the green for now, analysts believe this is only temporary.

The Gemini Dollar (GUSD) has also been affected, losing its peg and trading at $0.9793. The impact of USDC’s $3.3 billion cash reserves in Silicon Valley Bank has caused ripples on other stablecoins, including GUSD, which dropped to a low of $0.9636. The 24-hour trading volume for GUSD has spiked by 248%.

Despite being temporarily affected by the situation, Gemini clarified that it does not have any banking relationships with SVB, including all Gemini products and services, and the Gemini dollar stablecoin.

Bank of England places SVB’s UK arm under insolvency

Following the closure of the Silicon Valley Bank, the Bank of England has announced its intention to close down the bank’s UK subsidiary.

Although Silicon Valley Bank UK stressed their position as being a “standalone banking institution”, the bank will no longer accept deposits or make payments, according to a statement released on Friday.

The Bank of England has stated that Silicon Valley Bank UK has a limited presence in the UK’s financial system and lacks a critical function. The bank will apply to the court to place Silicon Valley Bank UK Ltd. into a bank insolvency procedure to ensure that customers’ deposits up to £85,000 and up to £170,000 in joint accounts will be returned.

In a later deleted tweet, chief executive of SVB UK, Erin Plats, wrote, “We appreciate that this is a concerning time for our clients so we are working tirelessly to support them and give more context.”

Binance CEO speculates crypto-friendly banks shutting down

In 2022, the cryptocurrency industry faced several unfortunate events, from the fall of Terra in May to the downfall of FTX in November. 2023 began on a positive note with the rise of DeFi assets prices. As global regulators increased scrutiny on the cryptocurrency industry, Binance’s CEO, Changpeng Zhao (CZ), speculated on recent events.

CZ tweeted about the shutdown of cryptocurrency-friendly banks, suggesting a possible coordinated effort to shut them down. This speculation followed the fall of Silvergate and Silicon Valley Bank, which had significant relationships with prominent cryptocurrency giants, but are no longer in operation to provide their services.

The CEO pointed out obvious errors of traditional banking practices, and how blockchain’s transparency and scalability could fix core problems of the banking industry.

CZ also highlighted that although the banks may be shut down, the blockchains are still operational, hinting at the stability and durability of DeFi, especially in comparison to centralized financial entities, tweeting “Bitcoin is volatile, but it never needed a bailout”.

Circle plans to cover any missing liquidity in Silicon Valley Bank using corporate funds

Circle, the stablecoin issuer of USDC, has addressed concerns about the recent events involving Silicon Valley Bank and its impact on USDC’s liquidity, reassuring investors that USDC is 100% collateralized with a combination of US Treasuries and cash, and that the current collateralization ratio is 77% ($32.4B) US Treasuries and 23% ($9.7B) cash held at various institutions, including SVB.

In a statement, Circle stated that it has initiated transfers of the funds held at SVB to other banking partners but that they have not yet been settled. In the event that SVB does not return 100% of the funds, Circle has committed to cover any shortfall using corporate sources, including external capital. The stablecoin issuer also confirmed that USDC has zero exposure to Silvergate.

“While USDC can be used 24/7/365 on chain, issuance and redemption is constrained by the working hours of the U.S. banking system.”

This statement highlights a crucial difference between a truly decentralized currency, or even a Proof-of-Stake (PoS) cryptocurrency, and stablecoins. If the core purpose of stablecoins is to offer the benefits of crypto, such as fast and inexpensive cross-border payments, without the volatility that is typically associated with cryptocurrencies like Bitcoin, the weekend’s events have just proven that stablecoins fail to do that. Which then begs the question, what else are they for? Collateral to borrow other cryptocurrencies or to earn interest through lending platforms? Many are beginning to see that the perceived stability of stores of value is as feeble as the stability of the US’ current banking system as a whole.

Nonetheless, USDC liquidity operations will resume as normal when banks open on Monday morning in the United States.

Sunday, March 12, 2023

Silicon Valley Bank CEO addresses employees with a ‘heavy heart’

Greg Becker, the CEO of SVB Financial Group, expressed his sadness in a video message to employees regarding the recent collapse of Silicon Valley Bank. He acknowledged the difficult 48 hours leading up to the bank’s closure and expressed concern for the employees’ job security and future.

Becker also stated that he is working together with the Federal Deposit Insurance Corp (FDIC), which has taken control of the lender, to find a partner for the bank. However, he emphasized that there is no guarantee that a deal will be struck.

Becker urged employees to ‘support each other’ and clients and to work together to achieve a better outcome for the company. He closed by thanking the employees and expressing his support for them during this difficult time.

The statement brought no clarity, and was underpinned by news of Becker’s departure to Hawaii.

Fed considers creating a fund to backstop deposits if more banks fail

The US Federal Reserve and the FDIC are considering the establishment of a new fund to backstop deposits at banks that encounter financial difficulties in the wake of the Silicon Valley Bank’s collapse.

The fund will serve as a safety net for bank deposits in case of a financial crisis. If a bank experiences financial difficulties like SVB, this fund would help ensure that depositors receive their money back, even if the bank is unable to pay them directly. The backstop deposits fund would act as a guarantee to protect customers’ money and increase their confidence in the banking system.

The agencies have discussed the creation of the new special vehicle with banking executives in order to reassure depositors and contain potential panic. The new fund is part of the agencies’ contingency planning as concerns grow about the stability of the banking industry.

Silicon Valley Bank’s collapse occurred after depositors withdrew their funds in a frenzied two-day run on the bank, which blindsided observers and shocked the markets, causing more than $100 billion in market value losses for US banks.

What happens to the insured and uninsured depositors of SVB

The FDIC has already created the Deposit Insurance National Bank of Santa Clara, which will protect insured depositors of SVB.

“All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.”

Silicon Valley Bank will reopen on Monday under the newly formed Deposit Insurance National Bank of Santa Clara. However, customers with more than $250,000 in accounts face uncertainty over when they can access their money.

Uninsured customers have been selling their deposits to pay operating expenses since the bank was shuttered by regulators. Start-up founders have been selling uninsured deposits to pay salaries as they face the “SVB effect,” with some companies selling for as little as 90 cents on the dollar.

FDIC officials have been going through the bank’s records with SVB employees, prioritizing and preparing for any looming deadlines and making necessary legal filings. Sorting out deposit recoveries usually takes the FDIC six to twelve months, but the complexity of SVB may prolong the resolution.

US Treasury Secretary says US government won’t bail out Silicon Valley Bank

US Treasury Secretary Janet Yellen has stated that a bailout for Silicon Valley Bank is not an option. However, Yellen noted that the government will assist SVB depositors and is working with regulators to determine the best course of action.

The sudden collapse of SVB Financial earlier this week has shaken the financial sector, and Yellen discussed the government’s role in aiding creditors during the largest banking failure since the 2008 financial crisis.

Yellen stated in an interview with CBS that while investors and owners of large banks were bailed out during the financial crisis, reforms have been implemented to prevent this from happening again.

The US Treasury Secretary is referring to a number of banks which received billions of dollars in financial assistance from the US government through the Troubled Asset Relief Program (TARP) to prevent them from collapsing and causing a widespread economic meltdown.

Banks that were aided and rescued by the TARP program include:

- Bank of America

- Citigroup

- JPMorgan Chase

- Wells Fargo

- Goldman Sachs

- Morgan Stanley

- American International Group (AIG)

What reforms is Yellen referring to, which prevent the government from doing ‘the same’ and aiding SVB and Silvergate? The Treasury Secretary did not elaborate.

Instead, Yellen emphasized a concern about depositors and meeting their needs. The reopening of SVB as Deposit Insurance National Bank of Santa Clara on Monday, March 13, will show just how much truth Yellen’s statements hold.

SVB collapse leaves 200 UK firms unable to pay staff and bills

Despite what Bank of England says, SVB’s ‘limited presence in the UK’s financial system and lack of critical function’ has left over 200 firms struggling or completely unable to pay staff and bills.

The UK government is said to be working on a plan to protect the affected tech companies and minimize the damage to the country’s industries. Prime Minister Rishi Sunak, Chancellor Jeremy Hunt, and Bank of England Governor Andrew Bailey are working to address the issue and come up with a solution over the weekend, reports the BBC.

Hunt stated that while the UK’s financial industry is not affected, there is a serious risk to some of the country’s most promising companies in technology and life sciences. The Bank of England has warned that the UK may already be in a recession due to the impact of the SVB collapse.

FDIC auctions Silicon Valley Bank

The Federal Deposit Insurance Corp (FDIC) has launched an auction for Silicon Valley Bank, with final bids due on Sunday afternoon. The FDIC is reportedly seeking a quick resolution, but it may take until late Sunday evening to determine the winning bid, or no deal may be reached at all.

The collapse of SVB Financial has caused concern in both the US and UK governments, as many tech startups are already affected.

Only a few days prior to the closure of Silvergate, FDIC Chairman Martin Gruenberg revealed that US banks are facing over $620 billion in unrealized losses, indicating that the collapse of Silicon Valley Bank may not be an isolated incident.

The sudden downfall of the California-based bank has brought to light the widening gap between the value that large lenders have placed on their bonds and their actual worth on the market. This has caused concern among investors who fear that this trend could lead to a wave of bank failures in the future.

The situation is particularly alarming given that SVB’s collapse was the largest bank closure since the financial crisis of 2008. The bank’s failure was caused by a plunge in the value of bonds it acquired during boom times when it had a lot of customer deposits to park. The FDIC has warned that similar depreciated assets that have not yet been sold are a problem across the banking sector.

During a period of near-zero interest rates, banks collected a lot of bonds and treasuries. However, as the Fed began a year-long interest rate hike to fight inflation, the value of these assets has only decreased. The impact of this situation on other banks is an important development to watch for in the near term.

US officials mull over bailout of all Silicon Valley Bank deposits

As concerns in the banking sector heighten, US officials are prompted to explore ways to mitigate potential panic. The Treasury Department, Federal Reserve, and Federal Deposit Insurance Corp (FDIC) are discussing the possibility of bailing out all deposits at the now-defunct financial institution, including uninsured ones.

The proposal, which involves “extraordinary intervention,” seeks to prevent a wave of fear in the country’s financial system, according to sources. The White House has also examined the option in subsequent meetings. If the government fails to find a buyer for the failed bank, the plan would be among the potential policy responses.

To address the potential consequences of the SVB’s downfall, officials are reportedly considering safeguarding all uninsured deposits at the closed institution. Authorities have discussed the plan over the weekend and will decide whether to implement it after the FDIC auction of SVB, which is accepting bids until late Sunday.

Bank of London submits bid for Silicon Valley Bank’s UK arm

Bank of London is leading a consortium of private equity firms that have submitted an official proposal to purchase Silicon Valley Bank UK. A statement from the bank confirmed that they have submitted the bid to the Prudential Regulation Authority at the Bank of England, His Majesty’s Treasury, and the board of Silicon Valley Bank UK.

As previously reported, the FDIC was holding an auction to sell the now-closed Silicon Valley Bank. Final bids were due by the end of Sunday.

The potential sale of Silicon Valley Bank UK comes amidst a great deal of uncertainty in the financial sector, following the largest banking failure since the 2008 financial crisis, despite Bank of England’s comments on SVB UK’s insignificance within the UK financial sector.

“Silicon Valley Bank cannot be allowed to fail given the vital community it serves,” commented Bank of London CEO Anthony Watson.

Ripple confirms undisclosed amount of cash in Silicon Valley Bank

Ripple CEO Brad Garlinghouse has confirmed the company’s connection to the collapsed Silicon Valley Bank. Although he did not specify the amount, Garlinghouse confirmed that Ripple had cash in the bank.

Ripple is a tech company that provides solutions for cross-border payments and remittances. Their primary product is RippleNet, a decentralized network that enables financial institutions to process cross-border payments quickly and securely. Ripple uses XRP, a digital currency, as a bridge currency to facilitate these transactions, making them faster and more cost-effective than traditional payment methods.

The company has been in a long-standing lawsuit with the US Securities and Exchange Commission (SEC) over the definition of XRP as a security. Garlinghouse wrote:

“It’s ironic that so much of what’s happening (as some companies scramble to make payroll) highlights how broken our financial systems still are – i.e. wires are still not 24/7/365, rumors lead to collapse and the frictions of moving money within a deeply fragmented system.”

The financial sector remains concerned about the implications of the largest bank failure since 2008, and the number of entities exposed to the collapse (such as Circle, and now Ripple) continues to grow. Garlinghouse assured his Twitter following that Ripple “remains in a strong financial position”.

All Silicon Valley Bank depositors will have access to their money on Monday

The US government announced that all Silicon Valley Bank depositors will be able to access their funds on Monday, March 13.

As part of the government’s commitment to helping affected depositors, expressed by the US Treasury Secretary Janet Yellen, the Federal Reserve has launched a Bank Term Funding Program (BTFP).

The SVB Financial collapse has caused concerns about the largest bank failure since 2008. The Federal Reserve’s initiative aims to protect deposits at the failed institution and prevent a bank run. The Fed stated that the program will enhance the banking system’s capacity to safeguard deposits and provide credit and money to the economy, and they are ready to address any liquidity pressures that may arise.

What’s the difference between this program and the 2008 bank bailouts? Only one. The government does not intend for Silicon Valley Bank or Silvergate to survive. Why? Because on Monday morning, March 13, US regulators shut down Signature Bank.

All’s well that ends well.. well?

In a joint statement released by the US Treasury, Federal Reserve, and FDIC on Sunday evening, the three entities took “decisive actions to protect the U.S. economy by strengthening public confidence in our banking system.”

Citing “a similar systemic risk exception” for Signature Bank — a New York-based bank known for its innovative approach and, unsurprisingly, crypto-friendliness — the statement also announced that it was closing the bank.

The press release closed out with an ostentatious declaration of the US banking system’s remaining resilient and on a solid foundation. Good news for regular citizens, some 75% of whom have debt averaging $92,727. Perhaps a steady inflow of debtors and their repayment will help maintain some of that solid foundation.

Signature becomes the third prominent bank in the crypto industry to shut down in the span of a week, leaving the community wondering: how far is the government willing to go to block access to decentralized stores of value and banking? And what will be their next move?

This concludes part 1 of a three-part breakdown of the Silvergate-Silicon Valley Bank-Signature story. Part 2 will pick up from the events of Monday, March 13, and lead a critical discussion of banking, regulation, overreaching, and the future of crypto.