Find out how does TransferWise work and what fees it has

International money transfer services guide: TransferWise. Source: transferwise.com

Transferring money to another country is necessary for both individuals and businesses. There are numerous options of doing that, and today we will start to explore the most prominent international remittance services. The first point of our review list is British unicorn startup TransferWise.

A bit of history

Although the company was founded in London and is headquartered there, both co-founders – Taavet Hinrikus and Kristo Käärmann – are Estonian. Taavet worked for Skype and received his salary in euros, but he lived in London and he had to pay bills in pounds. Kristo worked at Deloitte and lived in London. He earned his salary in pounds, but in Estonia, he had to pay a mortgage in euros.

After a while, they got tired of traditional money transfers that took a lot of time and money. Therefore, they figured out how to make international transfers easier, which later became a billion-dollar business. The idea was simple. They didn’t actually send money across the border but paid each other’s debts locally. If they could only create a safe global network of people in similar conditions… Well, with fintech, they could.

The business started in 2011. During the first four years, it shifted more than £3bn of customers’ funds along 300 currency routes. Now they are moving over £4 billion every month globally, being available in 71 countries and covering over 1600 currency routes.

How TransferWise works

The firm achieved this success by matching people transferring money in one direction with people transferring it in the other – so-called P2P transfers.

When you send money with TransferWise, it never actually crosses any borders. Source: transferwise.com

When you send money with TransferWise, it never actually crosses any borders. Users create their accounts and enter the sums they are going to send online and convert to other currencies. TheTransferWise platform continues the process by internally matching buyers and sellers. Smart algorithms check the corporate accounts in the country of recipients and transfers money locally. TransferWise computers simultaneously verify that both sides have the money ready to swap. Therefore, the process is quick and simple.

Customers are updated via email at each stage of the transfer. They can also track their transfers with mobile apps and the website in any corner of the world.

Fees

The transactions are based on a mid-market rate which is always openly shown at the main website page. The convenient pricing calculator will immediately show what sum goes to the recipient. There are no conversion fees or any additional hidden costs.

Senders can choose the fees they are willing to pay. Standard low-cost fees are quite small (less than 0.5% of the amount converted). For instance, sending out £1000 to EU countries which use the euro will cost you £3.95. If you want a fast and easy transfer from a debit or credit card instead of a bank account, it will get more expensive – around 0,7% of the sum (£6.92).

The less common the currency is, the bigger the fee. For instance, transferring the same sum into Indian rupees will cost £5.48, Russian rubles – £10.37, while when you send to Ukrainian hryvnia accounts, it will cost £18.43. Nevertheless, the fees do not exceed 2-3% of the transferred amount, while traditional banks can charge much more.

If you are not satisfied with a current rate, you can subscribe to currency exchange alerts. Get daily exchange rate updates for currencies that interest you, or set a target exchange rate point to make a transfer at the right time for you.

It’s free to get a multicurrency borderless account and TransferWise debit Mastercard. Source: transferwise.com

The guaranteed exchange rate is usually valid for 24 hours. This period is needed for account verification, receiving money from the bank, etc. Some exceptions exist, though. Check them up at the official website.

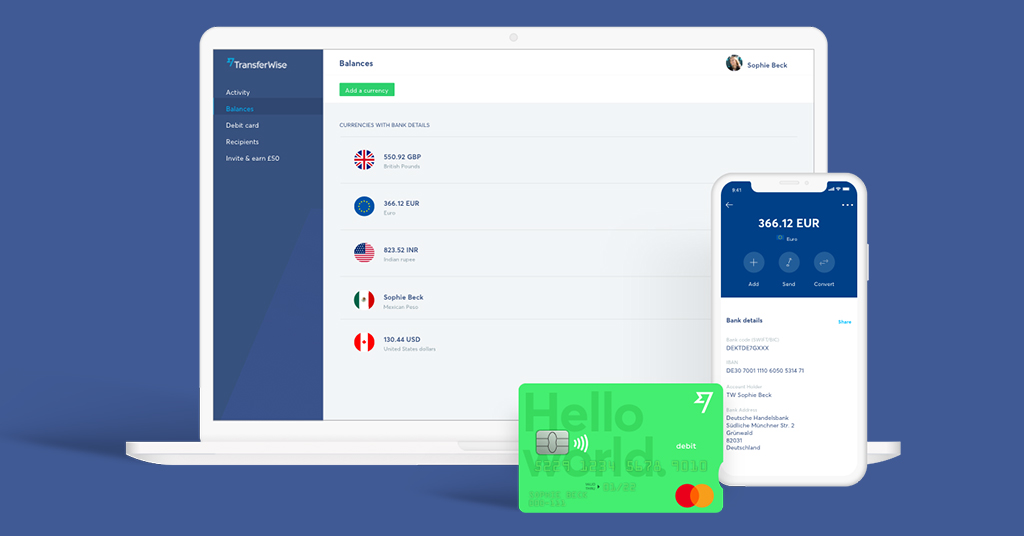

It’s free to get a multicurrency borderless account and TransferWise debit Mastercard — though cards are only available to customers in Europe at the moment. The pricing for currency conversion can be found using the given link.

Please, pay attention that the company has changed some pricing policies from this June. See how the fees have altered for both ordinary transfers and borderless accounts. This webpage will also tell you why the prices have changed and what exactly you are paying for.

You can also hold and manage money within your TransferWise business account. The fees are only slightly different from personal offers. Here you can get more detailed information. There are convenient business account options for freelancers, e-commerce businesses and regular enterprises.

You can also hold and manage money within your TransferWise business account. Source: transferwise.com

Pros & Cons

➕Mid-market exchange rate and low commission make money transfers almost 8 times cheaper than similar bank systems. Borderless account multi-currency transactions can get up to 14 types cheaper than PayPal.

➕Speed. Transfers usually take from a few seconds to 1 day (depending on the currency, state policies, banking limitations of your account, etc.)

➕Fixed rate from the moment of completion of payment. If the rate changes within a few hours, it will not affect the amount sent.

➕Free account and debit card.

➕Simplicity of use.

➕Transparent policies.

➕Currency tracking alerts that can help you save even more.

➕Free ATM withdrawals up to £200 per 30 days with TransferWise debit Mastercard.

➖ It does not support transfers into cash at the other end, as do many rivals, such as leader-of-the-pack Western Union with its 490,000 agent locations.

➖ The borderless account has no digital banking features (budget planner, expenses categorization, savings or credit options, etc.)

➖ Debit cards are available only in Europe.

➖ Current fees got a bit higher lately.

➖ No joint accounts available like in other P2P payment systems.

➖ Customer service not available 24/7.

➖ TransferWise can only handle your money during normal banking hours, not on the weekend. Transfers may take a little longer if the country you’re sending to has a national holiday.

SEE ALSO: