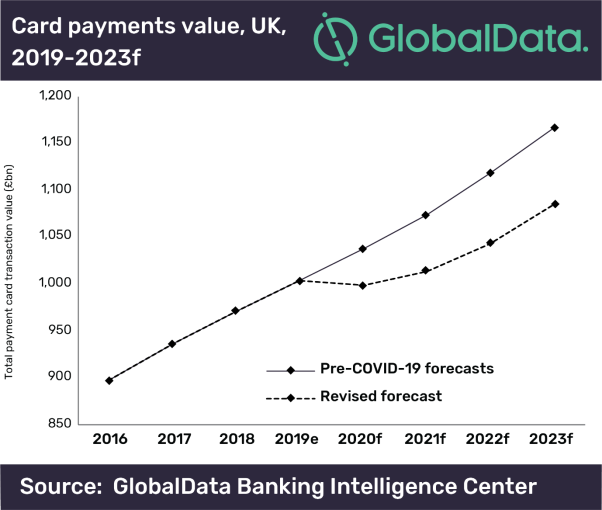

The general growth of payment transactions in the UK has been revised down amid the coronavirus outbreak

UK consumers switched to digital payments amid coronavirus. Source: pixabay.com

According to GlobalData, the payment transactions across the UK are expected to rise at a compound annual growth rate (CAGR) of 3.5% by 2023 due to stable card growth.

Besides, the report found that the value of cash withdrawals in the UK is more likely to decline by a CAGR of 4% over three years. Meanwhile, the card transaction value will grow by 3%.

As to the total transaction value, it has been revised down from a CAGR of 3.8% to 2%.

SEE ALSO: