The buzzword of today – metaverse – drives closer attention and huge investments from all major tech players. Retailers and banks cannot stay behind.

Source: Pixabay.com

Although banking in the metaverse may seem like a futuristic concept, the future where avatars apply for credit at a virtual bank branch may not be as distant as you think.

The term “metaverse,” which first appeared in the cyberpunk novel “Snow Crash” by Neal Stephenson, describes a persistent immersive digital space which creates a sense of presence in a realistic environment.

Facilitated by blockchain, AR and VR technologies, metaverse promises enhanced virtual experiences to digital natives who already spend half of their lives online. Additionally, metaverse might implement existing social media elements such as avatar personalisation and interaction, content creation, social reputation, etc.

Currently, metaverse-like experiences can be mainly observed in multiplayer online video games, e.g. Second Life, Fortnite, Decentraland, Roblox, and Active Worlds. Nevertheless, businesses of all kinds are already experimenting with the technology, looking for new effective means to advertise to a younger digital audience.

What is the metaverse in banking?

The banking industry is one of the most active explorers of metaverse technology. Being the next logical evolutionary stage of the Internet, the metaverse offers immersive experiences and new ways for brands to connect with their customers.

When applied to the banking sector, the metaverse is a virtual meeting place for people to interact with financial advisors and assistants without leaving the comfort of their homes. Although brick-and-mortar bank branches are globally shutting en masse, the need for personal connection hasn’t gone away. That’s where banking in the metaverse may come to the rescue.

Besides, the virtual world has its own economy. Avatars inhabiting the metaverse can buy and sell virtual goods, monetize their creations and services, and earn token rewards. All these transactions are typically registered on the blockchain. However, brands setting up their storefronts in virtual worlds promote and sell their physical goods as well. Combining all these shopping experiences into a seamless solution requires innovative payment systems. Thus, it is only a matter of time for hybrid banking digital payments infrastructure to emerge in the metaverse.

Are there banks in the metaverse?

Metaverse Deutsche Bank

One of the most obvious uses for metaverse digital banking is to create “virtual branches” on popular platforms. Therefore, major financial institutions are already working on their metaverse presence.

HSBC purchased land in The Sandbox last year to engage with online sports fans and e-sports enthusiasts. Although the bank doesn’t plan to offer financial services in the metaverse per se, its virtual location will focus on raising awareness of the history of the brand and its sustainability initiatives. Additionally, HSBC has launched a fund to capture investment opportunities in the metaverse for its rich clients in Hong Kong and Singapore.

PKO Bank Polski, the largest bank in Central and Eastern Europe, has set up a virtual branch in the metaverse of the Decentraland platform. Today, platform users can visit the virtual PKO Rotunda to get acquainted with Polish contemporary art. However, the bank expects that its metaverse branch may soon be used for onboarding and training new employees, as well as creating a new virtual channel of communication with customers.

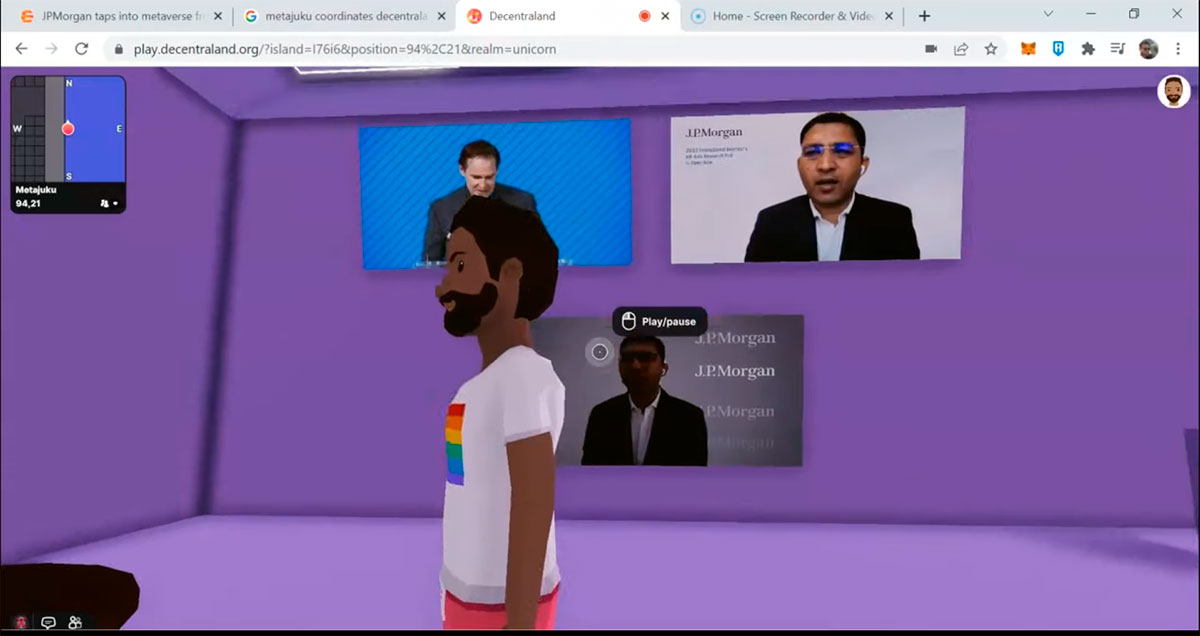

JP Morgan Chase also created a lounge area on the Decentraland platform. The virtual space gives visitors information about the bank’s blockchain and tech-driven initiatives.

Portuguese bank BPI has recently established a virtual branch which customers can visit using Meta’s Oculus VR headset. Customers can experiment with the new virtual reality offering at more than 100 physical branches around Portugal. At present, it works like an immersive media presentation of various banking offers like savings, mortgages and personal loans. However, the bank believes its VR location could eventually serve as a new online banking and sales channel.

Meanwhile, EQIFI – a DeFi platform powered by the regulated and licensed EQI bank – partnered with the smart contract-based gaming platform Polkacity. The bank has already launched an EQIFi NFT card which gives its owners the ability to get a free bank account with EQIBank (subject to terms & conditions), a real debit & credit card for NFT card holders, as well as the ability to spend POLC crypto in the real world.

How will augmented reality be used in banks?

With the development of metaverse technology, traditional banking experiences will also transform. Augmented reality (AR) and virtual reality (VR) will help banks to address the challenge of customer service personalisation.

While full-scale metaverse experience requires expensive headsets and other specific haptic tools, AR is available on ordinary smartphones. Therefore, many financial institutions have already used AR and VR technology in their banking apps to improve the customer experience.

The integration of AR into financial services offers innovative ways for banks to engage with customers through marketing, virtual payments and remote advisory support. For instance, Westpac Banking Corporation and Current provide financial data visualisation and budgeting through smartphone-based AR. Mastercard has continuously explored using AR visualisation for credit card holders to understand all benefits and features of the financial products they use.

Axis Bank created an AR app that guides customers to the nearest ATMs and bank branches. App users scan the surroundings with their phone cameras and see directions overlaid on top of the real-world image.

Besides, AR technology is helpful for internal use in the banking industry. When it comes to employee training, a person’s avatar can appear in the real-world bank locations, chat with each other and get a spirit of company culture, norms, and expectations. The metaverse banks will provide an interactive platform for these efforts to continue. For instance, trainees might scan an item, document or interface and get an AR manual on dealing with a specific issue.

How will the Metaverse change banking?

JP Morgan Metaverse Bank

People are quickly getting used to those experiences which facilitate their lives. We could observe it at the peak of the pandemic, when many customers were forced to choose online shopping. They liked the experience and the trend accelerated even as the pandemic eased.

Once customers try banking in the metaverse, they will expect similar levels of interaction and visualisation from other banking channels. It is particularly true for the Gen Z and Millennial customer base who are digital natives. Besides, young tech-savvy consumers discover both retail and financial brands in a virtual environment, be it social media (Web2) or metaverse (Web3).

Therefore, banks must meet consumers where they are. If their main target audience explores and enjoys virtual worlds, banks and fintechs should get into the metaverse as well. It is one thing for a financial advisor to explain some budgeting or investing concepts verbally, and completely another – to try it in an immersive simulation at the metaverse banks.

Moreover, new types of virtual financial needs call for innovative banking solutions. For instance, an increasing number of individuals and businesses invest in real estate in the virtual world. That allows suggesting virtual mortgages or other types of virtual credit will soon be vital components of banking in the metaverse.

What are the risks of the metaverse for banks?

Nevertheless, banking in the metaverse may have some disadvantages too. The banking industry will move out of their comfort regulated zone and navigate a complex blockchain environment.

While there are no proper regulations regarding the blockchain and crypto industry, financial institutions face potential risks of metaverse presence. These include virtual property rights, jurisdictional considerations, AML and KYC procedures, as well as market risks of NFT trading.

When the question of virtual crediting arises, banks will face another challenge of determining the creditworthiness of an avatar. This dilemma calls for new approaches for data collection to be considered. However, the most prominent risk of the metaverse is maintaining cybersecurity. Banks should already figure out solutions for data storage and protection in the virtual environment.

All things considered, interactions in the metaverse would ultimately disrupt the banking sphere. This will increase complexity for the risk management professionals who will likely play an increasingly prominent role in the banking segment.