Web Summit 2018 speakers talk on how digital technology is transforming the global economy

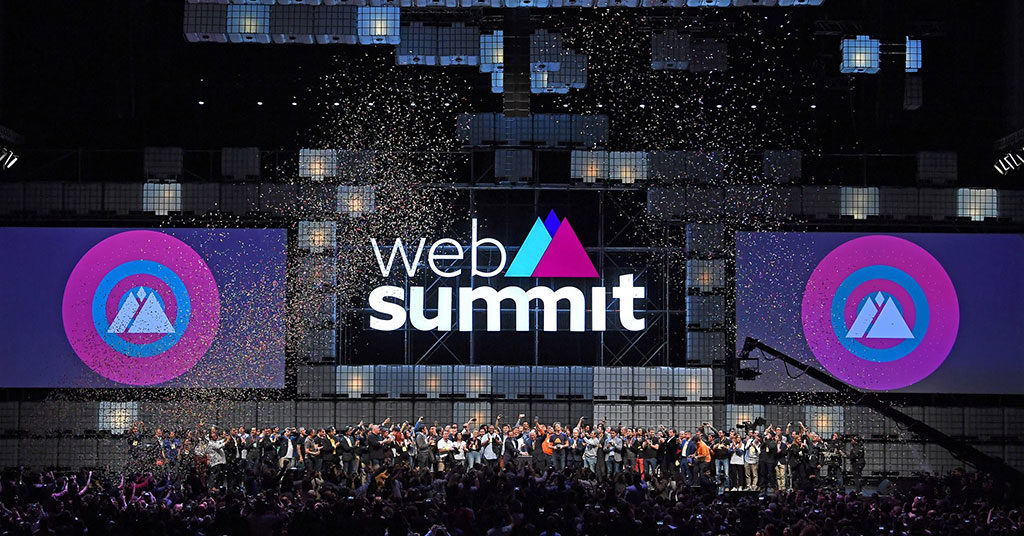

Web Summit 2018: how digitization is transforming economies. Source: flickr.com

This year, Web Summit 2018 gathered over 2000 startups, 1500 investors, and a total of 70000 participants at Lisbon, the Portuguese capital. A lot of expert insights have been shared at this massive event, but in our report we would like to focus on the «Cashing in: How digitization is transforming economies» discussion involving President and CEO of Accion Michael Schlein, President of European Banking Federation Wim Mijs, and founder and executive chairman of WorldRemit Ismail Ahmed.

Mobile technology is the key

As Wim Mijs believes, mobile technology gives us an incredible opportunity to bring financial services and bank accounts to people that have not had access to finance, including those who live in illiterate countries.

Michael Schlein agreed that many people can take for granted having access to easy and convenient digital payments. However, the global financial system still fails to provide appropriate services for more than 3 billion people. Therefore, there is a potential to create a financially inclusive world, but we have a long way to go to get there.

The Forum Stage. Source: flickr.com, photo by Sam Barnes

Founder and executive chairman of WorldRemit Ismail Ahmed thinks the significant digitization we’re seeing particularly in developing countries is driven by the phenomenal success of mobile money.

Fintech & Trust

Michael Schlein noted that of those 3 billion people mentioned previously, 80% have cell phones, so increasingly they’re exposed to technology, «but it’s a big thing to go from living in a cash world to beginning to transact digitally».

Commenting on obstacles on the way of the popularization of digital technologies, Wim Mijs mentioned a generational difference. Technologies are quickly adopted by a young population, but older people need to be helped over a certain threshold. That’s why employees at banks are trained to help people. Moreover, it helps both bank and new technology to be trusted. The expert also emphasized the importance and usefulness of educational platforms, tools, and programs aimed at helping people to learn about new technologies.

Speaking of European countries, Wim Mijs stressed that there is a completely different set of problems. For instance, the virtualization of money in the developed countries sometimes leads to over-indebtedness, because you don’t realize exactly how much money you spend.

A general view of Centre Stage during the Web Summit 2018 Opening Ceremony at the Altice Arena in Lisbon, Portugal. Source: flickr.com, photo by Sam Barnes

Michael Schlein referred to the McKinsey study funded by the Gates Foundation which had shown that if we could create a digitally financial inclusive world, it would be worth four trillion dollars to the economy, and on average in the developing world, it would be worth 6% of GDP.

Schlein also listed a couple of projects Accion has worked with which are trying to solve the problem of financial exclusion:

- Konfio, Mexico, is using 5000 different sources of data to estimate the needs of small mom-and-pop shops, which are invisible to the banking system, and to lend them money;

- Lidya, Nigeria, is a similar company which is also digitizing small businesses and therefore they become visible to the banking system.

Last week Accion announced a partnership with MasterCard. Over the next four years, they’re going to work with 10 million small mom-and-pop shops and individuals to help them make that journey towards digitalization, to make them financially inclusive.

SEE ALSO: How is the global FinTech market developing: research & infographics