The Xinja banking app can be called anything but boring

Xinja bank guide: how to get started and why. Source: facebook.com

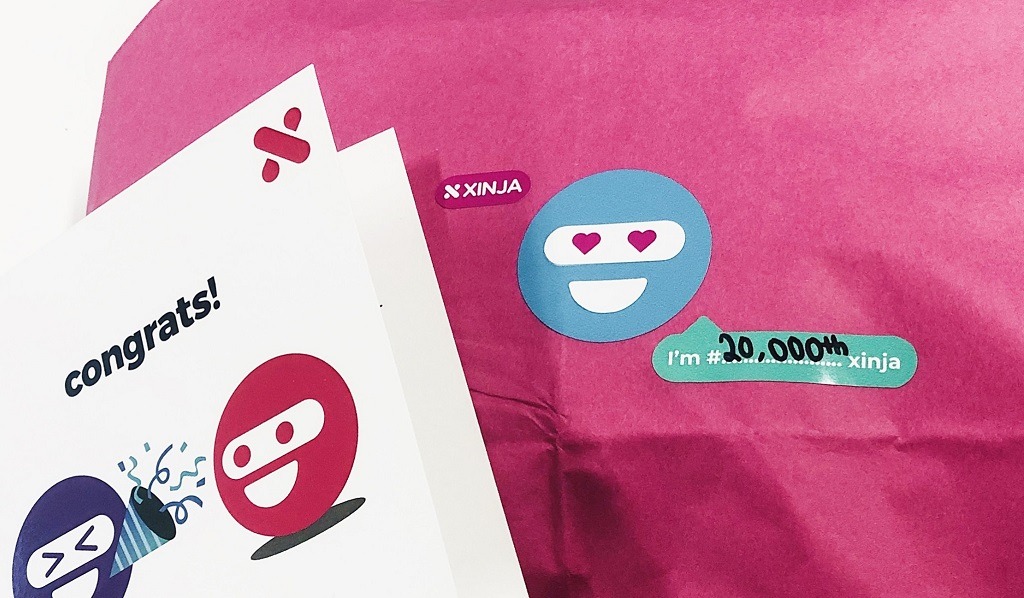

Bright color schemes, animated ninja-emoji characters, pirate ships and treasure chests — all these descriptions may fit an online game, but in reality, they are part of the daily banking experience for many Australians.

The Xinja banking app can be called anything but boring. It will help you get perfect control of your finances with fun and ease. The bank’s passionate team aims to bring back humanity to banking with the help of cutting-edge technology. Paradoxical as it may seem, it works for thousands of customers, enabling them to make intuitive, optimized, fast & better money decisions.

About Xinja bank

This Australian neobank was founded in 2017 and granted a full banking license by the Australian Prudential Regulation Authority after two years of operations. Xinja was the second national digital-only bank to be recognized as an authorized deposit-taking institution.

Xinja is one of the few innovative fintech startups that promote customer transition to alternative banking in Australia. Along with Up, Volt and 86 400, the neobank is trying to make dents in an extremely consolidated banking market dominated by the four major incumbents – CommBank, ANZ, Westpac and NAB. In fact, they have really succeeded at this. The latest research from the RFi Group Global Digital Banking Report revealed that consumer trust in new digital-only banks is only slightly lower at 6.5 – out of 10 – compared with traditional banks earning 7.5 trust points.

Moreover, the bank also looks very promising for investors. This March, Emirates’ World Investments (WI) and Xinja Bank announced that WI will invest A$433 million in the leading Australian neobank over the next 24 months, subject to the relevant approvals.

This Australian neobank was founded in 2017. Source: facebook.com

The developing team members come from banking, customer experience, and technology backgrounds. Xinja products strive to combine mobile banking with money management. And they do it in a unique way.

Unlike other financial institutions, Xinja’s app advantage is that it has been built in the cloud and is not weighed down by legacy infrastructure. Instead of purchasing a ready-made banking software solution, Xinja’s founders decided to choose an event sourcing-based microservices architecture, made up of a mix of best-of-breed banking platforms.

Products & Features of Xinja

This non-traditional approach allowed Xinja team to integrate an SAP digital banking platform for its core banking, adding Apple Pay and Google Pay as payment options much quicker than many institutions could do.

The bank launched the first app and a prepaid card before introducing transaction accounts and a savings account called Stash, which attracted around A$400 million in deposits in less than eight weeks.

Current Bank account

Customers can open a Xinja basic bank account within minutes. Using it charges zero card maintenance, annual account, or ATM fees. Zero currency conversion fees and zero international ATM withdrawal fees make it great for traveling. When buying overseas, Mastercard’s standard daily foreign exchange rates apply.

The account is supplemented with the Xinja Debit Mastercard. Before a person has received a physical debit card, they can set up Google Pay and Apple Pay for routine transactions.

You can top up your account with a maximum of $245,000 per person. Since the government protects up to $250,000 under the FCS (Financial Claims Scheme), all you can lose if something happens to the bank is $5.

Stash

Products & Features of Xinja. Source: facebook.com

Although Xinja is not opening any new Stash accounts at the moment, the service enrollment will renew soon, once the situation in the country and the global market stabilize. The bank limited deposit opening due to the higher than expected deposit flows and an RBA rate cut. Xinja didn’t want to compromise its lucrative 2.25% savings rate, so they stopped creating new accounts instead.

Some changes to interest rates did happen, despite all the cost-cutting efforts. Namely, the Stash interest rate has been reduced to 1.80% as of Monday, May 11, 2020.

To open a Stash savings account, a customer must have a Xinja bank account, to begin with. Stash accounts have their own BSB and account number, so you can easily transfer money from your Xinja bank account or from any other bank account to start earning interest on your savings.

Stash accounts pay a variable interest rate at the end of each month, this is deposited directly to your Stash. Interest is calculated daily on the balance of your Stash at 12 a.m. (AEST) each day, and paid on the first day of the following month. The interest rates on the Stash are tiered, but currently, the same interest rate of 1.80% p.a. applies to both tiers, which are: balance up to and including $50K, and balance between $50K – $245K. Greater sums cannot be deposited.

Money can be withdrawn to the main bank account at any time for daily spending.

Debit Card

Debit Mastercard can be used both nationwide and internationally. It’s a contactless card, so you don’t need to enter your PIN if the transaction is less than AUD$200 (this amount could vary overseas).

Your daily limit on purchases depends only on your available balance. You can withdraw up to $2,000 daily at any domestic and international ATMs where Mastercard is accepted. Some ATMs, however, may have smaller withdrawal limits.

The card is directly linked to your Xinja account. If you no longer want to have a Xinja Debit Mastercard, you’ll also have to close your Xinja Bank Account linked to that card.

If your card is lost or stolen, you must first lock your card via the app and contact Xinja support immediately.

Direct Debit

Direct Debits are available on both your Xinja Bank Account and Stash Account. Hence, Xinja totally supports your subscriptions. You can establish a Direct Debit Request with any merchant that you make regular payments to provided they participate in the direct debit scheme.

If there are insufficient funds on your account when a Direct Debit payment is due, the bank may still allow it to be processed leading to an overdrawn balance.

Direct Debits are available on both your Xinja Bank Account and Stash Account. Source: facebook.com

Money Transfers

To begin with, you can transfer available funds between your own accounts using the ‘Pay & Transfer’ button.

If you wish to transfer money to other people, use the ‘Send Money’ feature. You must provide the following details:

- the name of the account you wish to transfer funds to;

- the account BSB and account number;

- a reference for the transfer.

Inbound and outbound payments are processed 5 times each day. Depending on the time of day that a payment is made, your funds may arrive almost instantly, or not be processed until the next business day. While payments typically happen overnight on business days, it can take 1-3 business days due to a variety of factors.

Loans

The company is planning to launch lending products in mid-2020. No details are available yet.

Money management

Xinja will automatically categorize your spending, so you can track where your money is going, while providing a daily spend figure. You’ll also receive instant notifications for all your incoming and outgoing transactions.

How to sign up for Xinja account

This process is quick and requires no paperwork.

- Download the app from Google Play or the App Store.

- Fill in your personal details. They include your name, date of birth, email, mobile number and address.

- Get verified. Verification is usually completed in a matter of minutes.

- Once your account is created, you can also add a Stash savings account.

How to deposit money to your Xinja account

How to deposit money to your Xinja account. Source: facebook.com

There are two basic ways to get your Xinja prepaid card loaded.

- Making a direct deposit to your Xinja BSB/Account number.

- With the help of the Xinja instant top-up feature. It works with ‘Debit Cards’ issued in Australia only. The debit card must bear your name which coincides with the account holder name. Credit cards and Prepaid Cards will not work wherever they were issued. Instant Top-Up is limited to $2000 per day.

Performing an instant top-up is easy.

- Open your Xinja Bank app and select ‘Pay & Transfer’ then ‘Instant Top-Up’.

- Select ‘Add a new debit card’.

- Enter your Debit Card details.

- Check again and confirm your details are correct.

- Choose an amount to deposit.

- Enter your Debit Card’s CVV.

- You have successfully topped up your account.

Availability

All Australian residents over 14 with a legal address in the country can join the Xinja community. However, amidst the pandemic crisis, the bank has put a hold on accepting new customers.

Whether or not the possible boost in existing customers’ loyalty outweighs the potential loss of momentum in the long run, only time will tell. Nevertheless, this decision apparently hasn’t helped the bank to preserve one of the highest savings rates in the market.

SEE ALSO: