Whether you’re looking for emerging payment technologies to integrate, struggling to understand shifts in consumer payment preferences, aiming to identify prospective regions or customer segments for paytech business expansion, or just want to evaluate market potential for your nearest digital payments strategy, payment industry analysis 2025 from PaySpace Magazine Global is just the right fit.

In this article, we’ll explore key well-established and emerging fintech industry trends, further narrowing them down to digital payments trends 2025. You will discover the most pivotal payment technology innovations, payment security trends, and market projections based on recent payment industry statistics – all essential data-driven insights in one place.

Payment Industry Analysis 2025 At a Glance: What You Should Know

The payment industry analysis 2025 reveals a landscape shaped by speed, intelligence, and deeper integration. As global revenues are expected to exceed $2.65 trillion, key digital payments trends 2025 include the rise of real-time payments, AI fraud detection, and mobile wallet adoption, now used by over 63% of smartphone users worldwide.

Within the global payment market 2025, everything changes swiftly. India’s UPI now processes over 650 million real-time transactions every day, making it not only the largest real‑time system globally but also a solid competitor to global card networks like Visa and Mastercard. Meanwhile, digital wallets are becoming utterly ubiquitous, expected to account for more than half of e‑commerce transaction value globally.

Fintech players are investing heavily in payment technology innovations like stablecoins, CBDC (central bank digital currency) pilots and agentic AI commerce. Meanwhile, embedded finance and open banking payments are accelerating. Today, they’re supporting use cases from A2A checkouts to cross-border payments and digital lending. The embedded finance sector alone is projected to reach $94.8 billion this year, while open banking now powers over 8% of Faster Payments in the UK.

As part of broader fintech industry trends, payment players are also rethinking user experience and trust. Buy Now, Pay Later (BNPL) continues to evolve under tighter regulation, and payment security trends are increasingly focused on AI and tokenization.

For fintechs, 2025 is full of promise, but also consumer and peer pressure. While the horizon is bright: white-labeled payment gateways and wallets, instant cross-border rails, smarter BNPL overlays, and AI‑driven payment orchestration, it’s not all smooth sailing. Payment security trends, compliance complexity, and interoperability gaps remain real headwinds.

Competing in a real-time, API-driven ecosystem demands agility, compliance, and innovation backed by trustworthy payment industry statistics and data-driven decisions. Some of these can be fueled by our payment industry analysis 2025.

Payment Industry Overview

Payment industry is a wide term encompassing the global infrastructure, technologies, and regulations that enable the transfer of money between individuals, businesses, and financial institutions, whether within or across separate country borders.

This sector’s scope extends beyond consumer transactions to include B2B payments, cross‑border (remittance) payments, merchant acquiring, payment gateways, and embedded finance solutions. The payment ecosystem also integrates fraud prevention, identity verification, and compliance processes to ensure security and regulatory adherence.

This wide payment solutions network combines what one could call traditional methods, such as card payments, bank transfers, and cash, with emerging, innovative digital payment systems, mobile wallets, blockchain payment rails, and different real-time payments variations. In our payment industry analysis 2025, we particularly explore how these two realms coexist and compete with each other, together forming a global payment market, which in 2025 is estimated to be around $3.12 trillion.

What You Should Know About the Global Payment Market in 2025

To understand the scope of the worldwide payment ecosystem, we should check out the most recent payment industry statistics results and growth projections for 2025. Let’s dive into the vital numbers:

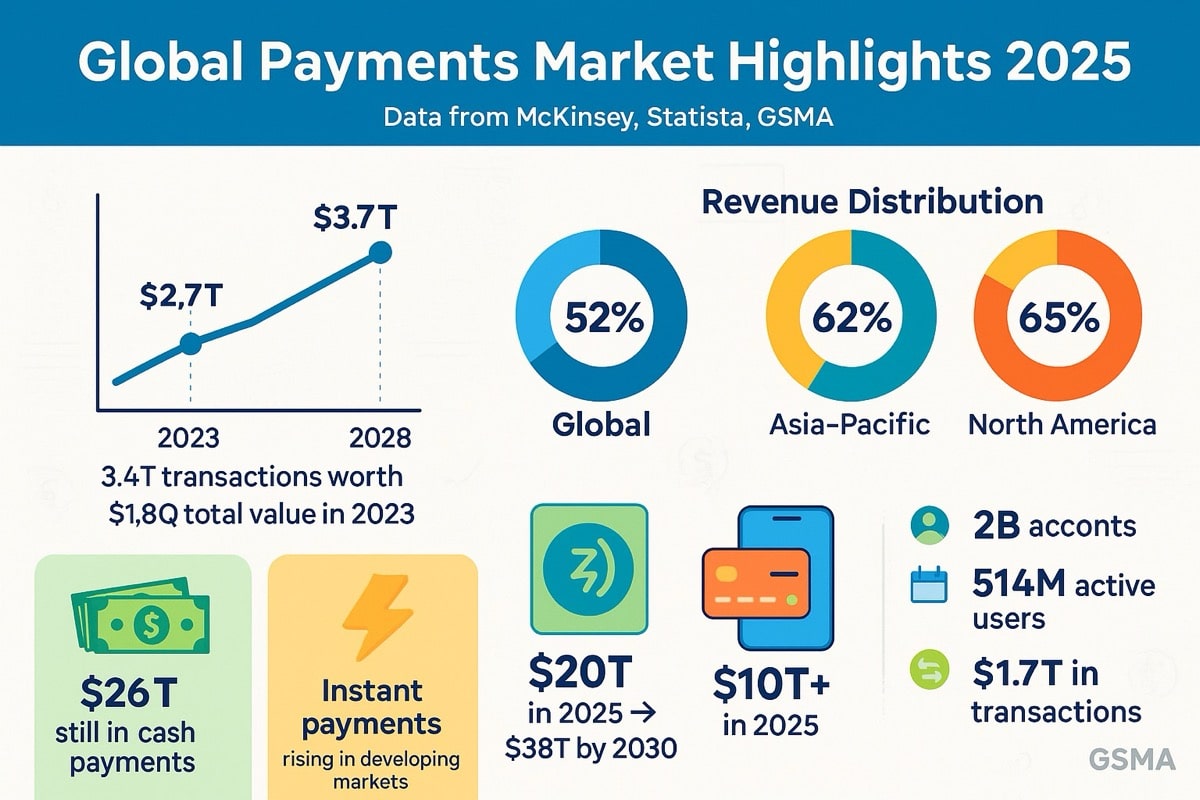

- In 2023, the global payments industry generated $2.4 trillion in revenue, growing 7% annually from 2018 through 2023. This revenue came from processing 3.4 trillion transactions of a $1.8 quadrillion aggregate value. With the projected growth of 5% year-on-year, in 2025, the payment industry revenue should reach about $2.65 trillion. By 2028, this number should surpass $3 trillion if the tempo remains unchanged. (McKinsey)

- On average, global payment revenues are almost evenly distributed between commercial and consumer payments (52% vs 48%). However, different regions display very sharp distinctions. Thus, in Asia-Pacific countries, 62% of revenues come from commercial transactions, while in North America, consumer payments make up 65%.

- About $26 trillion worth of payments are still made in cash, though instant payments are rapidly replacing paper money in developing markets with low card penetration.

- The total transaction value of the digital payments market is projected to reach $20.09 trillion in 2025, climbing further at a CAGR of 13.63% up to $38.07 trillion by 2030. (Statista)

- With rapid mobile wallet adoption globally, the digital wallet market may surpass $10 trillion in transaction value this year.

- Mobile money accounts have surpassed traditional bank accounts in low income countries. With two billion registered accounts and over half a billion active monthly users globally, mobile money services accounted for about 108 billion transactions worth 1.68 trillion in 2024 (GSMA).

What Do These Numbers Reveal About the Digital Payments Trends 2025?

Let’s start wit a fact that the cash share in global payment market is only 1,5% in 2025. Nevertheless, we shall not yet dismiss its power and vital nature for numerous settings such as in-store small-ticket payments, informal P2P exchange, shadow economies, low income budgeting, poor mobile payment infrastructure, etc. where cash is still king.

Digital payments are growing rapidly, largely driven by an impressive momentum build-up seen in digital and mobile wallet adoption. Where digital payments in general increase by 13%, wallets illustrate growth that far exceeds 25% in some locations. In low income countries, mobile money accounts boost inclusion, continuing to present a solid alternative for traditional banking forms.

While digital wallet market share statistics is impressive, real-time payments are gaining traction as well. UPI has just recently become world’s most used payment system, processing over 650 million transactions daily. If combined, popular real-time payment systems across the globe could process about $9.5 trillion in value annually. Together, these two payment technology innovations could easily overthrow not only cash but also more progressive and popular payment methods like debit and credit cards.

Main Global Payment Market Drivers in 2025

The global payment market in 2025 is being shaped by ongoing digital transformation, surging e‑commerce volumes, the rapid adoption of real‑time payments infrastructure, open banking APIs, and the global spread of mobile wallets.

Whether a payment institution wants to add CBDC (central bank digital currency) support to its platform or embed flexible payments like buy now pay later (BNPL) functionality, modular payment gateways and open banking driven payments infrastructure enables financial networks to expand and evolve hand in hand with customer expectations.

Thanks to international fintech initiatives, cross-border payment system integrations, legislative incentives like SEPA instant payments regulation, embedded finance tools integrated into global merchant marketplaces, and mobile-first cross-border payments solutions, cross‑border commerce continues to open new markets.

All these payment technology innovations are expanding transaction volumes and revenue opportunities for merchants and payment providers alike. The robust growth contributes to favourable fintech market size forecast, which, in turn, attracts strong investor attention even in a challenging fundraising environment. According to Mordor Intelligence, the global fintech market stands at $320.8 billion in 2025 and is projected to reach $652.80 billion by 2030, growing at a CAGR of over 15%.

Innovations in cybersecurity and automation, such as AI fraud detection in payments systems, are streamlining operations and boosting the safety of financial ecosystems. Thus, AI in payment fraud prevention has become a game-changer for many businesses. One example is Visa that managed to prevent about 80 million fraudulent transactions totaling $40 billion in a year. Meanwhile, Feedzai – an AI-driven financial crime prevention company, claims to have helped businesses reduce fraudulent transactions by 45% with the help of the latest payment security trends.

AI agents increasingly stand out as the next evolution step of autonomous payment technologies, enabling merchants and issuers to integrate trusted, seamless payment experiences into the tailored recommendations and insights already provided on conversational search and e-commerce platforms.

What Slows Down Payment Technology Innovations

However, the payment technology innovations momentum is tempered by rising fraud and cybersecurity risks, persistent interoperability gaps between payment systems, and the increasing complexity and cost of compliance. The rapid adoption of technologies like digital assets and AI demands coherent regulatory frameworks. However, the laws in the sector mostly remain unclear and fragmented.

Economic uncertainty and not always healthy competition in the space are forcing market players to continuously balance between splurging on AI and fintech innovations and maintaining operational efficiency. Additionally, payment service providers are under constant pressure to deliver seamless, frictionless, and tailored experiences to meet rising consumer expectations for speed and ease. These pressures create hurdles in accelerating paytech adoption.

Payment Industry Sectors That Thrive Most in 2025: Analysis and Opportunities

Since a general overview of current fintech industry trends gives you only a generic understanding of what’s happening in the global payment market, our payment industry analysis 2025 aims to provide a more granular view of payment industry sectors which are developing most rapidly this year.

Real-Time Payments

Real-time payments are one of the top digital payment trends in 2025. They are already a preferred payment method in many countries of the world due to popular domestic payment systems. Instant payments are especially popular in Asia-Pacific region, where around 186 billion real-time payment (RTP) transactions were made in 2023. By 2028, this number is expected to almost double. UPI in India and Pix in Brazil together reached nearly 200 billion transactions in 2024, being the largest RTP systems globally.

The focus point of the fintech community today is scaling up the vital RTP functionality to cross-border payments. Some regions already have well-connected instant payment systems. For example, Singapore’s PayNow works with Thailand’s PromptPay, India’s UPI, and Malaysia’s DuitNow.

In Europe, countries are being brought together through the SEPA Instant Credit Transfer and the TIPS system. In 2025, the new SEPA Instant payments regulation mandates all local banks to send and receive instant payments, a major step toward a more unified and competitive European digital economy.

Similarly, Gulf countries today use the AFAQ system, which lets people send money instantly across the region through over 50 participating banks.

However, in many other places, fast payments are still not the norm. Countries like Nigeria, South Africa, and Argentina may have local instant payment systems, but they are often at nascent stages. Besides, a single regulated infrastructure that would enable seamless real time payments on a global scale simply does not exist. Therefore, in many cases, sending money instantly across borders is difficult or not possible, mainly due to rules, technical limitations, economic issues, or political barriers.

At present, there’s strong demand for infrastructure that supports faster, cheaper, and more inclusive global money movement, especially across underserved or emerging markets.

This landscape creates a major opportunity for fintech providers to step in and bridge the global gaps in real-time payments. By building interoperable, compliant, and user-friendly solutions that connect fragmented domestic systems, fintechs can enable seamless cross-border instant payments.

Open Banking Payments Fuel The Rise Of Embedded Finance

Open banking allows third parties to access bank account data and initiate payments with user consent. This capability forms the infrastructure layer for many embedded finance solutions (integrated financial experiences within non-financial platforms), like buy now pay later (BNPL) lending, insurance, wealth, banking-as-a-service, and account-to-account (A2A) transfers embedded in e-commerce checkouts, B2B platforms, subscription services, etc.

Here are some key 2025 payment industry statistics that highlight how open banking payments and embedded finance are accelerating the transformation of financial services:

- The embedded finance market is projected to grow at a CAGR of 22.1% this year, up from $77.6 billion in 2024 to $94.8 billion in 2025.

- Most businesses that adopt embedded finance solutions (88%) witness increased engagement, while 85% say that it helps them acquire new customers.

- Open banking payments that enable the growth of embedded finance services generated approximately $10 billion in revenue in 2024, with forecasts expecting an increase to over $45 billion by 2030, (a projected CAGR of roughly 28.6%).

- Open banking payments adoption is rapidly growing in countries with strong real-time payments infrastructure. Thus, open banking payments accounted for about 8 % of all Faster Payments in the UK this March, as one in five UK consumers and SMEs now actively use open banking.

- Open banking payments have illustrated particularly strong growth with variable recurring payments (VRPs) – 70% year-on-year, as automation in payments is one of the hottest fintech industry trends.

- A2A payments powered by open banking capabilities are gaining momentum, contributing to about 15%-25% of the total e-commerce transaction value, depending on the region.

- Among subscription-based e‑commerce, 50% of consumer churn is caused by card payment failures and false declines. By contrast, open banking payments with their secure, bank‑level authentication can tap into reliable, long-lasting bank account links, dramatically reduces those issues and boosting conversion.

Open banking and embedded finance together open up significant growth opportunities for fintech players in 2025 and beyond. As open banking payments mature, they provide the foundation for seamless, real-time, account-to-account (A2A) payment experiences across e-commerce, B2B, and subscription services that fintechs can embed in their platform infrastructure.

With embedded finance outpacing payment industry bold growth projections in 2025, fintechs can deliver added value to any type of an app through integrated lending, insurance, and banking services. In high-churn sectors like e-commerce, open banking reliability helps reduce failed payments and boost conversion, making fintechs indispensable infrastructure partners in the digital economy.

Mobile Wallet Adoption Transforms Digital Payments Trends in 2025

The mobile wallet market size in 2025 is roughly estimated to be around $2.77 trillion, with projections showing continued rapid growth at a CAGR of about 27–32% in the coming years. These massive transaction volumes are influencing global payment flows substantially.

About 5 billion users – more than 60% of the global population – now engage with mobile wallets. They are especially popular with Millennials and Gen Z, who make up 67% of the user base. The estimations of digital transaction values handled by mobile wallets near $10 trillion per year, with some fintech market size forecasts expecting them to reach $17 trillion before the decade end. Digital wallet market share statistics suggest that over 60% of online and offline shopping purchases are paid for with popular wallets.

What Boosts Mobile Wallet Adoption

In 2025, mobile wallet adoption continues to reshape digital payments trends, emerging as a cornerstone of modern e‑commerce transactions and seamless checkout technology. While retail and e-commerce still dominate mobile wallet transactions, segments like public transportation, bill payments, cross-border payments, and food delivery also see substantial growth and formalization through mobile wallets.

This rapid expansion is driven by several enhancements in security, user experience and convenience of mobile wallets:

- biometric authentication adoption in mobile wallets has reached over 50%;

- integration of loyalty programs, rewards, and personalized offers within wallets increases consumer engagement;

- mobile wallets integrate emerging technologies, including crypto asset management, AI-driven fraud prevention, and digital ID functionality, adding versatility and security to mobile payments.

Blockchain and Crypto Use Cases Set Mobile Wallets Apart From Other Payment Means

Payment gateways worldwide also evolve from accepting purely traditional fiat payments to integration with online and mobile crypto wallets. This functionality is gaining traction: 31 million crypto wallets are used for everyday payments, with stablecoins comprising 68% of the given transaction volume.

Blockchain-based digital wallet functionality is also a critical enabler for central bank digital currency (CBDC) technology being piloted in different countries. India’s digital rupee circulation alone surged 334% year-over-year, reaching ₹10.16 billion (~$122 million) by March 2025. Digital yuan and cross-border wholesale CBDC projects are also actively growing, requiring relevant infrastructure to function. These developments signal that mobile wallets are not only scaling rapidly but are also incorporating emerging payment technology innovations, such as cross‑border payments, central bank digital currency (CBDC), and cryptocurrencies — driving the future of digital payments.

AI in Payment Fraud Prevention, Optimization and Transactional Commerce

In 2025, AI-powered systems are revolutionizing payment fraud prevention, operational optimization, and the broader landscape of transactional commerce. AI-driven tools have slashed false positives by up to 60%, significantly improving authorization accuracy and reducing unnecessary payment declines. Besides, thanks to AI, fraud detection rates in payments industry have soared to as high as 95%, enabled by real-time anomaly detection that processes millions of transactions in seconds.

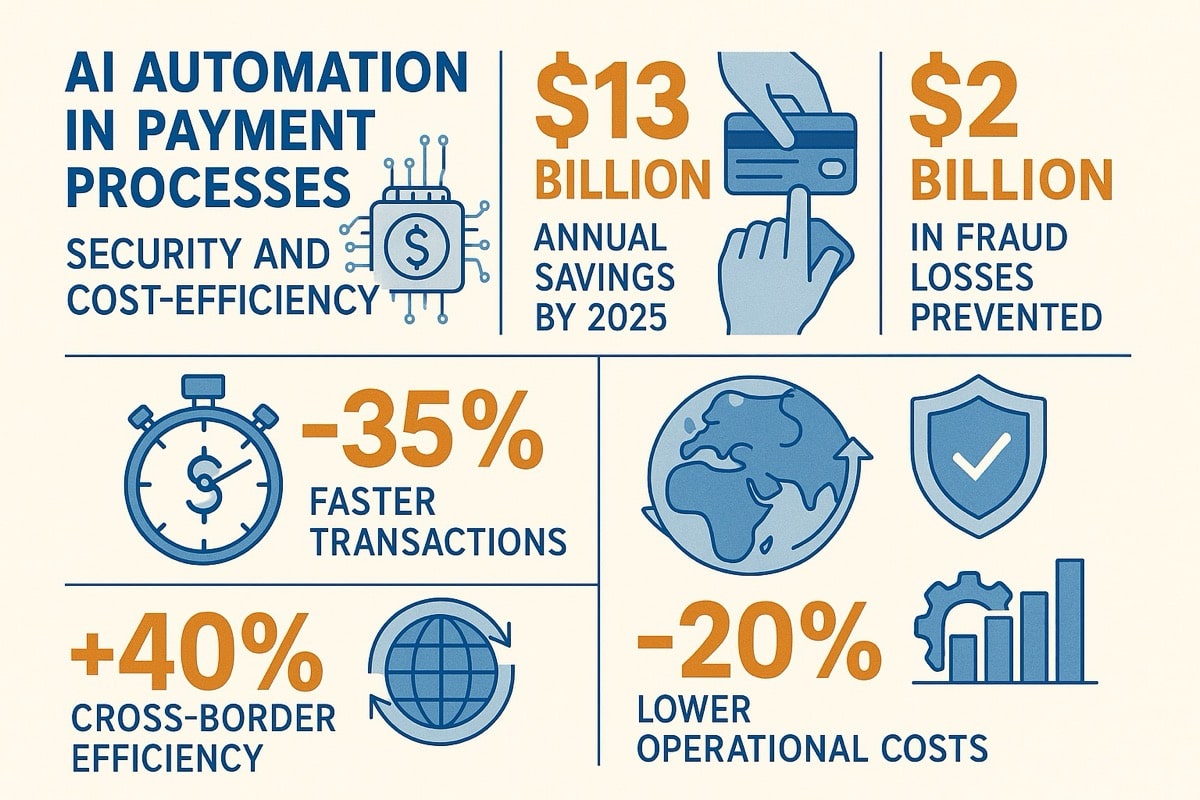

AI automation in various payment processes is not only about security, but also about cost-efficiency. The global payments sector is projected to save a staggering $13 billion annually by 2025 through AI-driven insights and automation, while AI-enhanced security solutions have already prevented $2 billion in fraud losses. Beyond fraud control, AI accelerates transaction speeds, cutting processing times by around 35%, boosts cross‑border payment efficiency by 40%, and reduces operational costs up to 20%.

In the realm of transactional commerce, AI drives personalized experiences, with 73% of e-commerce businesses leveraging AI to tailor payment flows, increasing conversion rates by up to 35%. As agentic AI capabilities rapidly scale up, 80% of payment companies acknowledge AI as essential for future transaction ecosystems.

Major fintech and payment players, including Visa, Mastercard, and PayPal are spearheading the shift into agentic commerce, embedding AI agents into the heart of their vast digital payments infrastructure by combining secure tokenization with developer tools and consumer-centric control.

To Sum Up

The payment industry analysis 2025 shows an intricate landscape accelerating toward real-time, data-driven, and deeply embedded experiences. Global payment revenues are projected to surpass $2.65 trillion, with real-time and mobile wallet adoption reshaping the financial fabric.

In 2025, real-time payments are expected to reach 575 billion transactions globally, accounting for 27.1% of all electronic payments. Meanwhile, digital wallets are set to drive 54% of global e-commerce spend, highlighting major digital payments trends 2025.

These shifts are fueled by payment technology innovations such as AI fraud detection, open banking payments, increasing integration of cryptocurrencies into larger financial systems, and the rollout of CBDCs (central bank digital currencies).

The embedded finance market is growing rapidly, reaching $94.8 billion this year, as businesses embed financial services into their platforms. AI-driven automation is also saving the sector over $13 billion annually and accelerating transaction times by 35%.

Opportunities for fintechs include delivering seamless A2A checkouts, AI-native fraud prevention, and white-labeled cross-border payment gateways and wallets. But rising regulatory pressure, data privacy expectations, and payment security suffering from sophisticated fraud trends pose serious challenges.

Nevertheless, where one sees an obstacle, there’s always a spark of opportunity. Therefore, the global payment market 2025 will reward those who blend speed, security, and personalization with trusted infrastructure and intelligent innovation.