While some countries are consistently moving towards cashless economies, cash remains prevalent over other payment methods in several regions globally. What are the reasons for such persistence and what can be done to finally move cash from its pedestal?

Contactless bank cards and mobile wallets are increasingly popular among consumers across the globe. The rise of online payment methods is also visible due to relentless e-commerce growth. Many businesses do not even offer cash payments as an alternative. However, throughout the years, cash persistently remains among the top three most popular payment options in many countries. Let’s dive into some interesting statistics.

Cash Usage Statistics

The share of global cash use fell by 8% in 2023. However, cash remains a vital payment tool for billions of people, accounting for 16% ($6 trillion) of global transaction value and a double-digit share of payment value in thirty of the forty markets covered by the latest Global Payments Report by Worldpay.

According to Statista, as of June 2023, cash was a dominant payment method for in-store payments in dozens of countries across the world.

| Country | Share of transaction number | Share of transaction value |

| Thailand | 87% | 64% |

| Malta | 77% | 65% |

| Slovenia | 73% | 59% |

| Austria | 70% | 52% |

| Italy | 69% | 49% |

| Spain | 66% | 51% |

| Portugal | 64% | 44% |

| Germany | 63% | 38% |

| Lithuania | 62% | 61% |

| Greece | 62% | 48% |

| Slovakia | 60% | 51% |

| Cyprus | 59% | 50% |

| Ireland | 54% | 44% |

| France | 50% | 35% |

| Latvia | 49% | 39% |

While in the US, for example, cash is used only for 16% of purchases, nearly half (49%) of small purchases that require transactions under $10 are still made with cash. Moreover, when it comes to in-store purchases, cash is the most commonly used form of payment, with 67% of respondents favouring it over other alternatives. According to Pew Research Center’s latest report, six out of 10 adults in the US still regularly carried cash with an average value of $73 as of 2022.

Although the general tendency is towards cash usage decline, certain economic environments produce temporary or constant surges in banknotes use. For example, in 2022, cash payments increased in the UK for the first time in a decade, growing by 7% to £6.4bn. The reason for this was a critical surge of the living costs which led to more tight budgeting patterns. However, already in 2023, British consumers and businesses used cash for a record low 12% of transactions, although there was a rise in the small percentage (2.6%) of people who predominantly use cash for most day-to-day purchases. Nevertheless, cash still remains the second most frequently used method of payment in the UK after debit cards.

Where Cash Comes in Handy the Most

There are several specific situations where using cash makes more sense as well as offers more benefits to the customer or merchant.

Small-Size Transactions

As we have already mentioned, cash might be the payment method of choice for smaller transactions even in those countries where other alternatives dominate (like the US). Why does it happen?

In some countries, using a bank card, especially for small amounts, may incur transaction fees, which makes the trade disadvantageous either for the customer or the merchant. To avoid these fees, cash becomes a more attractive option. Some retailers even set minimum purchase amounts for card payments to avoid paying processing fees and customers simply have no other choice than to pay in cash.

Besides, in some countries, contactless payments are limited to certain amounts. If the purchase exceeds this limit, the buyer must insert their card and enter a PIN. Besides enhanced security, this safety measure is adding more friction to the checkout process and making cash quicker for small payments.

Various local transportation providers (especially served by private entities) or street vendors may also prefer cash payments as they deal exclusively with low-value transactions.

Informal Settings

Cash is often more preferable in informal transactions like P2P exchange, one-time sale of a used item, giving pocket money to a child, selling fresh farming produce due to a temporary surplus, etc.

Besides, certain countries have a large share of the informal or shadow economy. Informality is huge in low- and middle-income countries, accounting for between 13% of workers in Mongolia and 98% in Benin, Honduras, Mali and Uganda.

In these regions, due to various reasons like high taxes, an unfavourable business environment, etc. companies function without official registration at all, hire employers informally without an official contract, or hide the actual salary amounts from the government. In such cases, payouts occur only or mostly in cash. Therefore, cash is further used for purchases and payments.

Poor Infrastructure

Cash eliminates the need for card readers, internet connections, or a mobile payment infrastructure, making transactions simpler and faster in certain environments with poor infrastructure and low business income levels. In some areas, particularly rural or underdeveloped regions, there may be limited access to card terminals, stable internet or mobile networks.

For many micro businesses, dealing with cash brings a desired and often critical liquidity, as they don’t have to wait until the funds arrive in their bank account. Therefore, many small businesses, street vendors, and informal markets may not accept cards, particularly in developing regions or areas with weak financial infrastructure.

Personal Reasons

Cash transactions do not leave a digital footprint, which appeals to people who are concerned about data privacy or who prefer to keep their purchases private (whether for personal, cultural, or security reasons). Some people lack trust in digital payments or financial institutions, especially if they were once impacted by banking crises or technological failures.

Other personal reasons that motivate one to use cash might be driven by cultural peculiarities, tech aversion, complexity of digital payment methods available, etc. Cash might also be traditionally more preferable in certain circumstances. For example, in some cultures, tipping is done predominantly with cash, and people are simply used to it.

Low Income Budgeting

For people in debt or critical financial conditions, cash is often the best way to budget smartly. Unlike with credit cards, you can see exactly how much you have left, you can physically divide the sum into different envelopes for better categorisation and better visualise available funds. With cash, you cannot spend more than you have so don’t risk increasing an existing debt.

Statistics show that people tend to spend more when using cards as opposed to cash. More than half (58%) of people surveyed by Forbes said card payments are most likely to make them spend the most money, doubling the chances for impulsive purchases. One-fifth (22%) of respondents use cash in most cases and 14% prefer cash payments as they give them more control over what they spend. Psychologically, the act of physically parting with money is more tangible than swiping a card. This can encourage more mindful spending.

What Can Slow Down Cash Use?

Various factors contribute to a vivid decline in cash use in many regions. Let’s look at the examples that have already proven their efficiency.

Developed Digital Payment Infrastructure

If a country has an aim to transit to a cashless or mainly cashless economy, developing a solid infrastructure for digital payment means and contactless cards is a must. Here we speak not only about payment terminals but also about stable Internet connection and mobile connectivity.

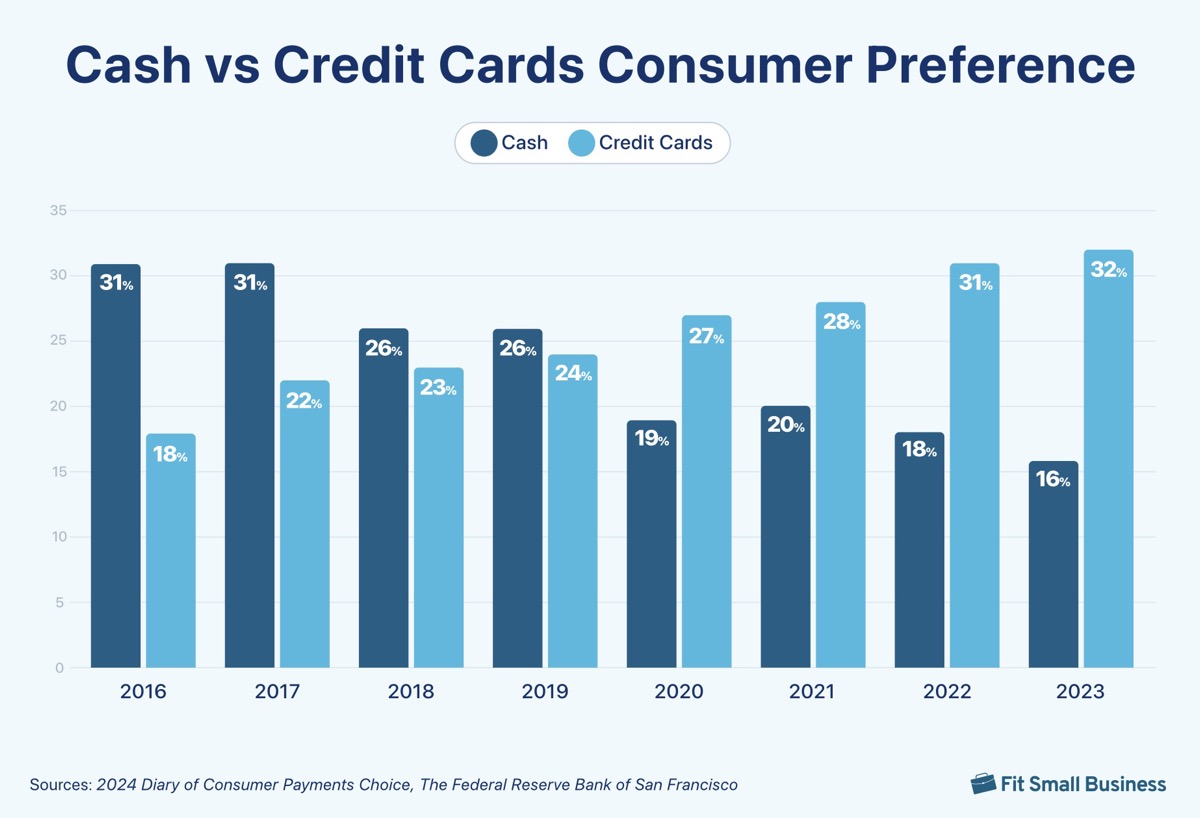

The rise of convenient remote or online payment alternatives also naturally plays its role in substituting cash. Since the pandemic when more people became acquainted with e-commerce and contactless payment methods, the use of cash has steeply declined while the use of credit cards has grown proportionally.

The growth of mobile banking apps and fintech solutions allows for easier, faster, and more secure digital payments, further reducing the need for cash. At present, digital wallets are the fastest-growing payment method for both e-commerce and in-store POS. Forecasts suggest a compound annual growth rate (CAGR) of 13% from 2023 to 2027 for e-commerce, with digital wallets responsible for 86% of the spending by 2027.

Government Initiatives Promote Financial Inclusion and Digital Literacy

Some governments actively promote cashless societies through incentives for businesses and consumers to adopt digital payments. These efforts include creating a digital transaction infrastructure (such as national payment systems and high-speed internet access) and educating the public about the benefits and security of going cashless. Another important factor is the decreased cost of accepting digital payments, which enables smaller merchants to provide their customers with more payment options.

Sweden is the brightest example of such efforts as banks, buses, street vendors and even churches in this country are equipped with necessary payment terminals and expect plastic or virtual payments. The nationwide Bank ID system that’s available on mobile phones greatly facilitated the transition to cashless. The country also has several homegrown fintech solutions, e.g. Klarna, Trustly, iZettle, or Swish, that make transactions seamless.

At the same time, it is important to provide proper security methods for this digital infrastructure. In the very same Sweden, the rising level of financial crime is now pushing the authorities to reconsider its anti-cash stance and review proposals to improve access to physical banknote utilisation.

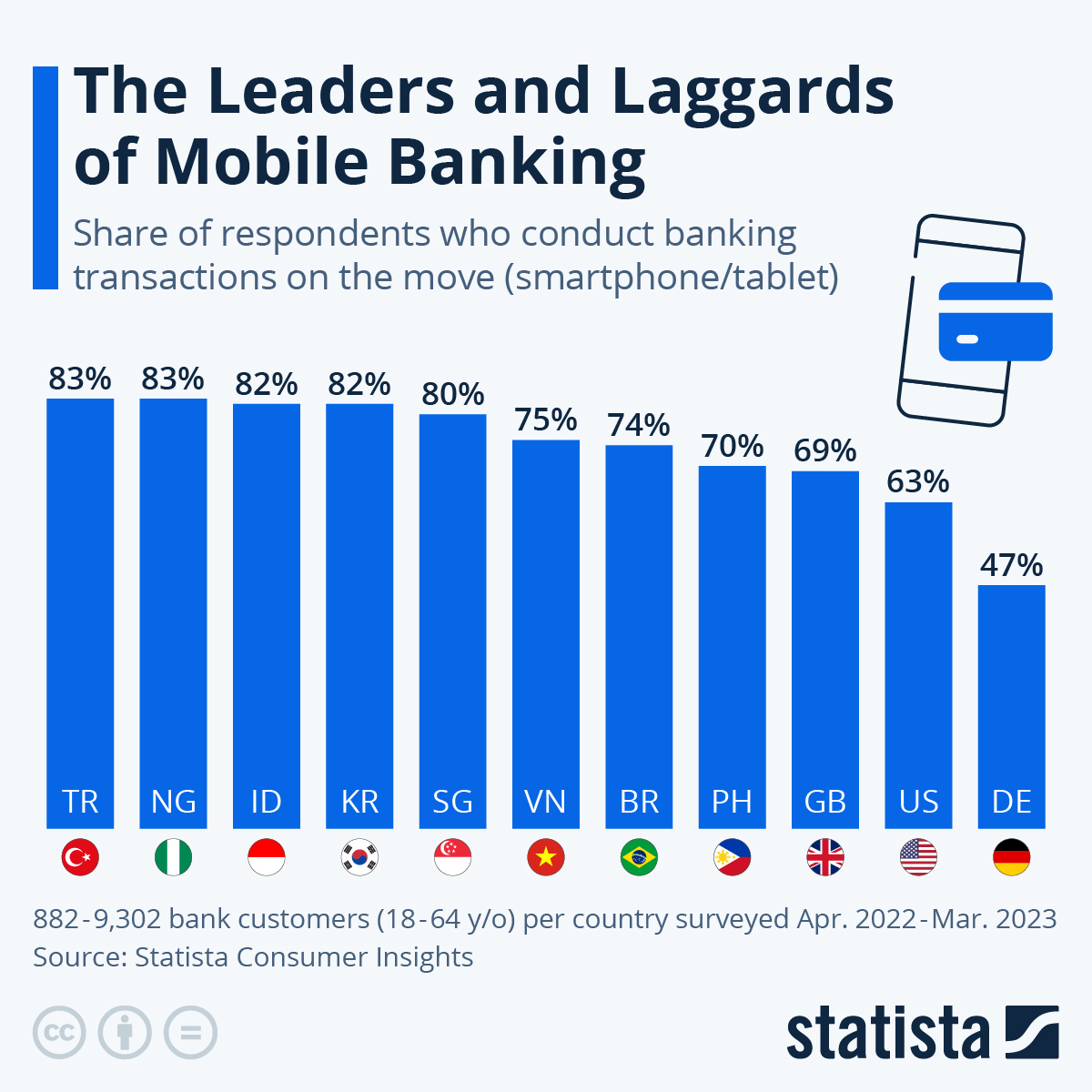

In many emerging economies, expanding access to banking services, especially in remote areas is often happening through mobile banking and digital wallets, which can significantly reduce dependence on cash. Turkey and Nigeria lead the global rating with the highest share of mobile bankers – 83% each.

In this case, boosting financial inclusion with mobile banking services also translates to gradual cash decline. Thus, in Turkey, the share of cash transactions at POS decreased by 10 percentage points between 2018 and 2023, though it still remains very high (70%). In Nigeria, which is still highly dependent on cash, the number of e-payment transactions quadrupled from 428.2 million in 2012 to 16.3 billion in 2021. Besides, the number of POS terminals in the country increased to 1.1 million POS in 2022 from 155,000 in 2017. Cash payments in Nigeria are forecast to decline by 4% by 2027 as the country experiences a significant shift towards digital payment methods.

Limited Access to Cash

Countries that don’t want their citizens to rely heavily on cash, may resort to the reduction of physical cash in circulation, the number of ATMs and bank branches. Another obstacle towards obtaining cash may be additional withdrawal fees. Even if such processes do not occur with the intention to limit cash use, they tend to have such a side effect.

For instance, major banks in the UK have closed dozens of branches in the last five years or introduced practices of branch sharing. Moreover, since 2019, more than half of existing ATMs have been removed from the streets of British towns. Further 37,000 free ATMs are considered to be at risk of closure or conversion to a pay-to-use model. As a result, almost four out of ten UK adults (39%) were living largely cashless lives in 2023, using cash only for 12% of total payments.

Rewards for Cashless Payments

With cash payments you may feel you have more control over your budget, but with the incentives provided by credit card, mobile banking and digital wallet providers you can reap far more benefits. Some examples include cashback offers, loyalty points, and partner discounts for using cards and mobile payments. These bonuses can additionally motivate customers to refuse cash in favour of more profitable alternatives. Besides, mobile banking apps can provide users more control over their stored funds. They often come with integrated budgeting tools, categorisation and spending insights that allow users to manage their personal finances easily.

Bottom Line

While digital payments are growing in popularity, especially with contactless technology, cash continues to play a major role in small transactions across the globe and for in-store payments in dozens of countries. Countries that depend heavily on cash lack sufficient banking and mobile network infrastructure and also have large shadow or informal economies which typically use cash as a payment method. Regions with low financial inclusion levels also mostly leverage cash as digital payment means are usually linked to a bank account.

To decrease cash dependence, governments might introduce different incentives, expand the digital infrastructure and limit availability of ATMs. They should also work on the safety and trustworthiness of the national banking system and tech infrastructure so that people might use bank cards and mobile wallets with more confidence. Banks and fintechs, in their turn, can introduce rewards and special offerings to boost customer loyalty.