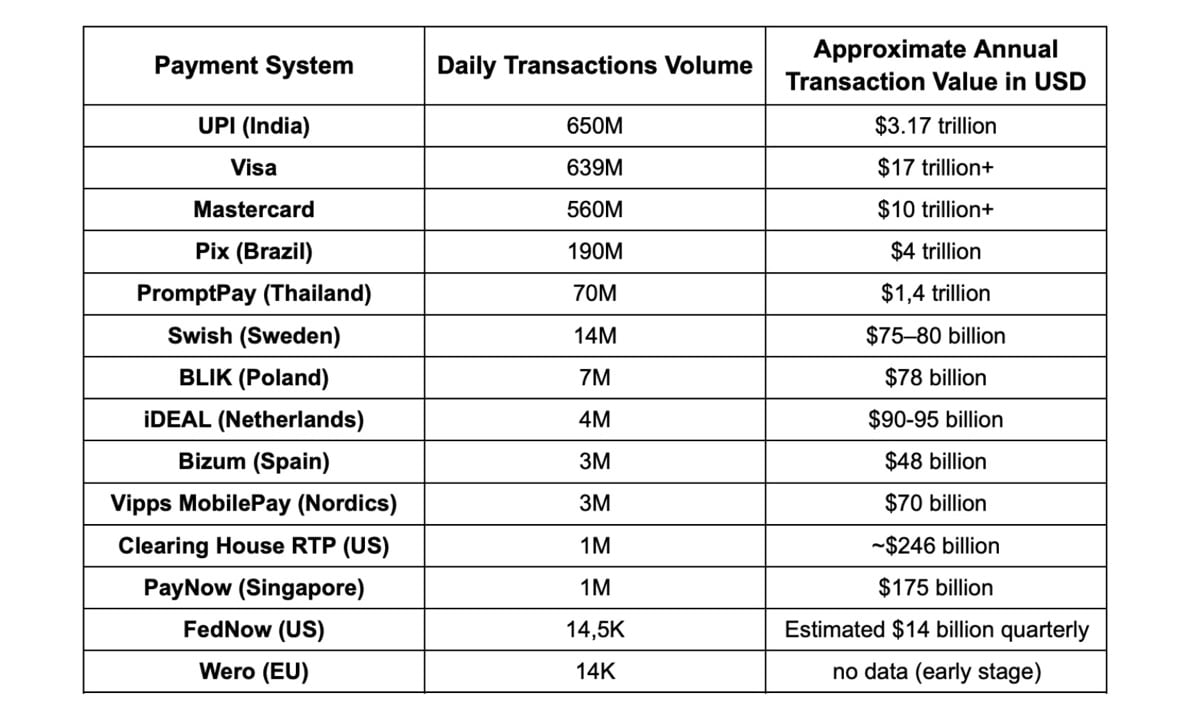

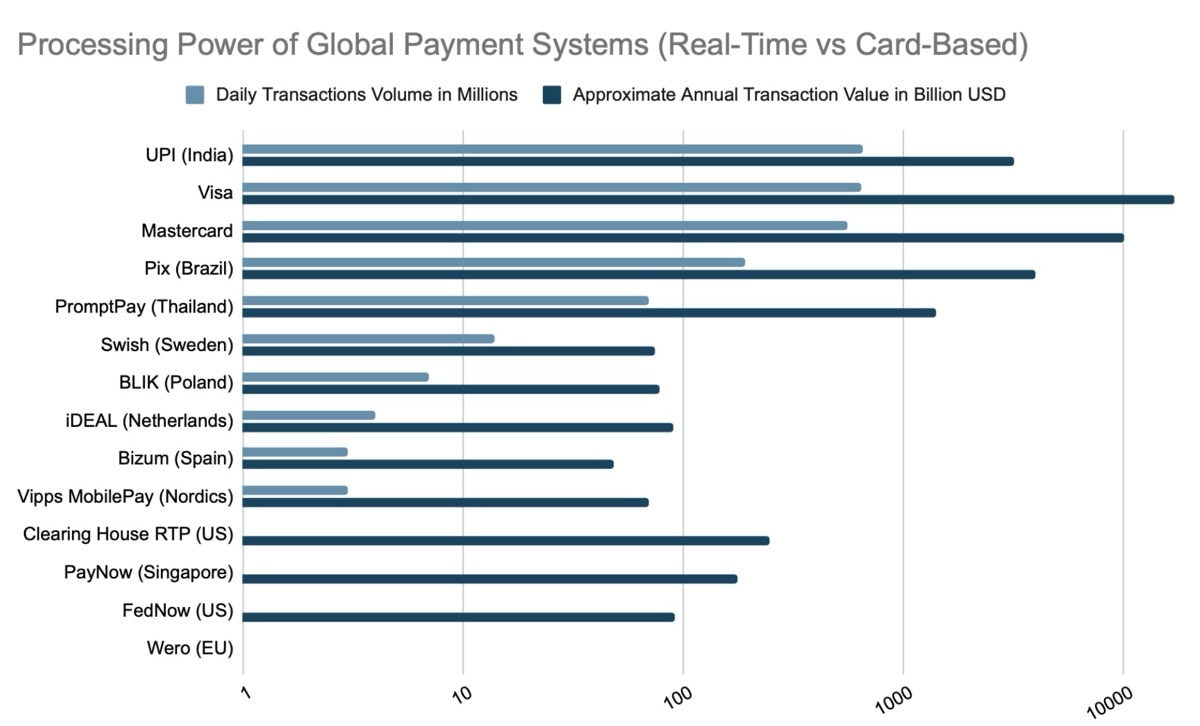

As India’s UPI has surpassed the industry giant, Visa, with over 650 million daily transactions, we prepared a brief illustration of the global payment networks’ processing volumes and values. Can real-time payments beat the cards?

PaySpace analyzed the publicly available data of 14 different payment systems and networks, including UPI, iDEAL, Pix, BLIK, PromptPay, Swish, Bizum, Vipps, PayNow, Wero, FedNow, RTP, and, of course, Visa and Mastercard. Although some statistics were openly and promptly announced, others were calculated approximately based on various reports, so the estimates may not reflect the latest data in some cases. Nevertheless, the overall picture is clear.

While some regional real-time A2A payment systems illustrate minor payment volumes and process far less than major global card networks, Visa and Mastercard, we should understand that they are more limited in reach and have much shorter histories of operations. If UPI could reach a critical payment settlement milestone in nine years, the possibilities for other systems are endless.

What’s even more interesting is that, combined, all real-time payment systems presented in this comparison could process about $9.5 trillion in value, which is close to Mastercard’s potential. At the same time, alternative payment rails for instant settlement don’t have 60+ years of expertise behind them. The oldest of them all, iDEAL, was established in 2005, and the newest addition to the list – Wero – was launched only last year.