In Finland, digital banking channels are the norm rather than an exception. Let’s see which neobanks can gain momentum in Finland in the near future.

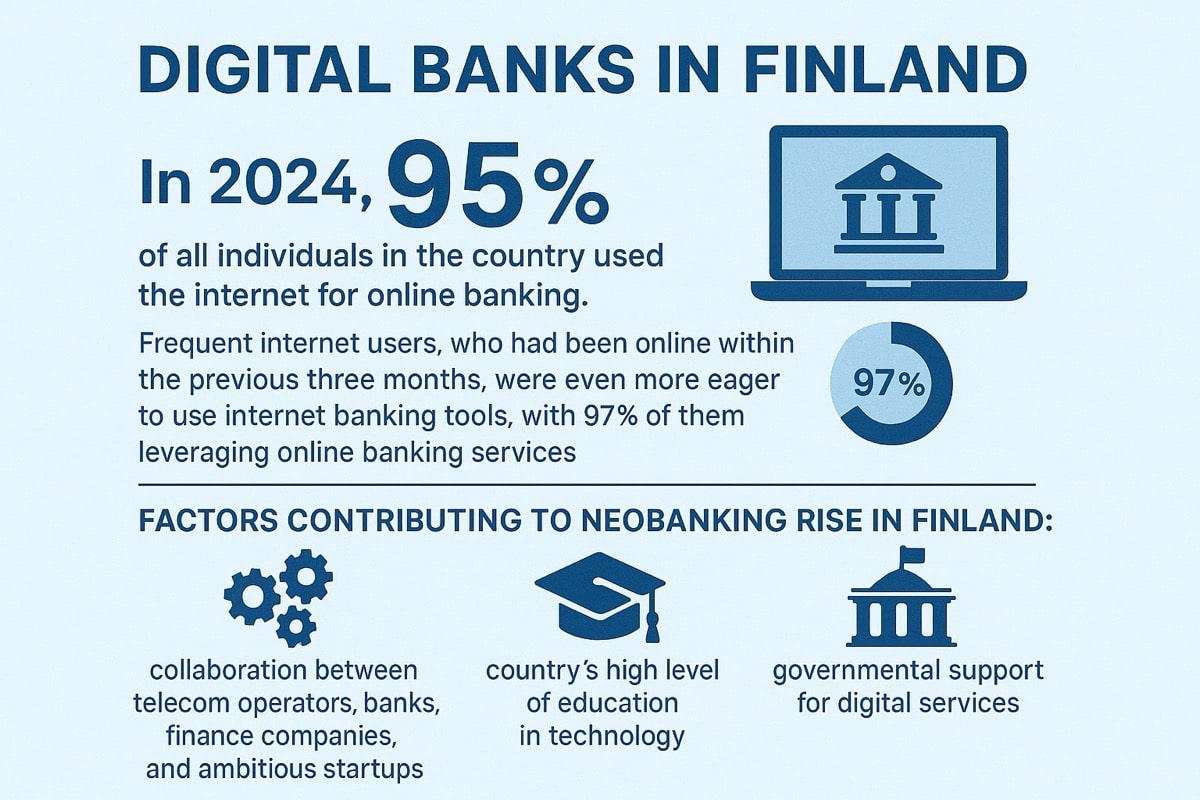

Finland has one of the most advanced fintech sectors in the world due to the innovative collaboration between telecom operators, banks, finance companies, and ambitious startups. Along with other Nordic countries, Finland is one of the most digital societies in Europe.

In 2024, 95% of all individuals in the country used the internet for online banking. Frequent internet users, who had been online within the previous three months, are even more eager to use internet banking tools, with 97% of them leveraging online banking services.

Nearly half of Finns have reduced their use of cash during the 2020 pandemic, and most believe that their use of cash has decreased permanently. While dealing with digital payments, neobanks are presenting a strong competition to banking apps of legacy financial enterprises.

The increased flexibility, speed, remote access to banking services from every corner of the world, and convenience offered by digital banks give them a great advantage over traditional banking institutions.

1. Holvi

Holvi Payment Services offers online business banking for the self-employed. The digital account has reporting, invoicing, automated accounting, real-time expense tracking, receipt scanning, VAT calculators, and tax preparation features as well to simplify one’s financial routine. Holvi Business Mastercard can be used on job trips and elsewhere. For small business sellers, there’s the Holvi online store with a pre-built storefront. Holvi is not exactly a bank, but it received a payment institution licence from the Financial Supervisory Authority of Finland (FIN-FSA). The fintech holds all customer funds in separate accounts at partner banks, where they’re protected under deposit insurance.

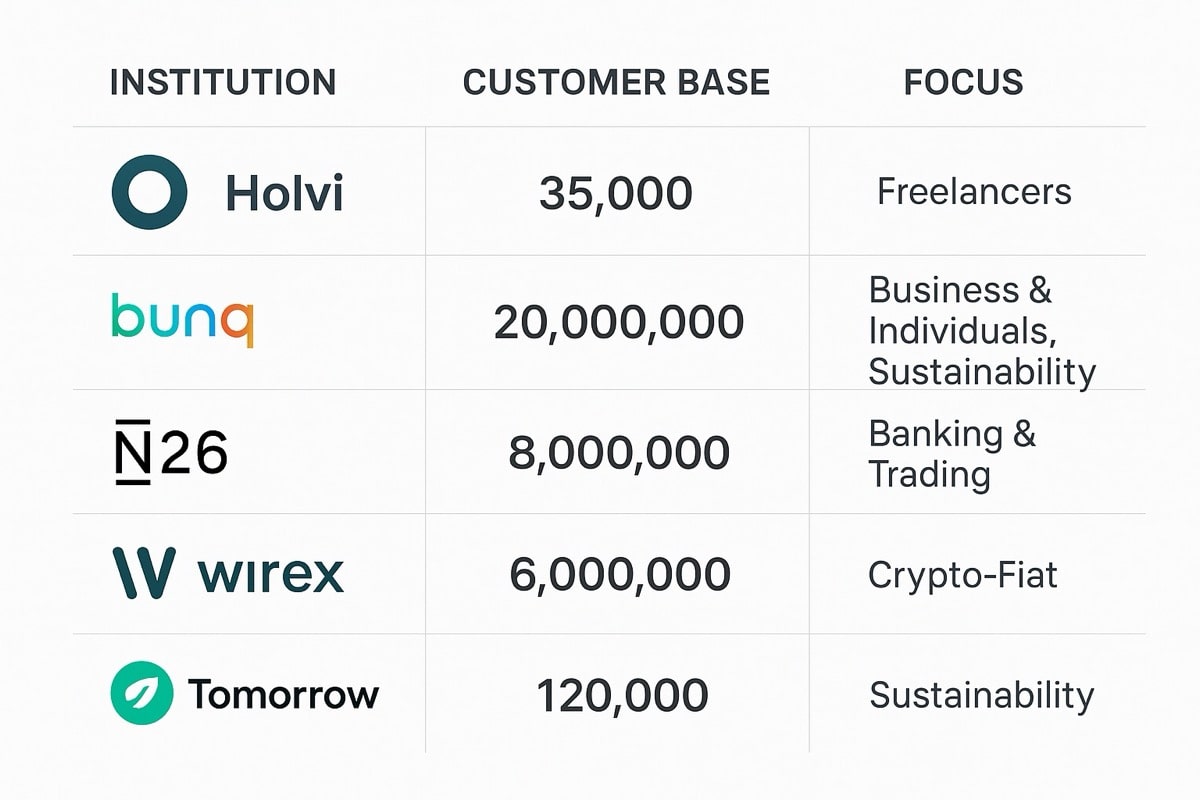

In 2016, Holvi was acquired by Spanish global banking group BBVA. In 2021, BBVA accepted an offer to sell the neobank to Keru Fintech Investments, a new company owned by Holvi’s co-founder Tuomas Toivonen. Today, Holvi operates in multiple European markets (Finland, Germany, Austria, and more) and has over 35,000 business customers in its main markets.

2. Bunq

Dutch neobank Bunq, founded in 2012, describes itself as an open IT platform for digital banking. It supports third-party APIs, so the app has flexible functionality. APIs can be used, for example, to link the account to an accounting package or transfer money internationally in partnership with Wise. The app also has budgeting and analytics features, a conversational money AI assistant with tips on how to best manage your finances in different locations, a bill splitting option, and a desktop version.

The young bank has expanded its range of services in recent years to include a savings account, travel insurance, cashback and savings bonuses, easy investments, and a range of physical cards specifically designed for travelling, business, or making an environmental impact. This neobank appeals to both individuals and businesses with ethical investment choices and Easy Green subscription plans to help offset CO2 emissions by planting new trees.

Since its inception, Bunq has been self-funded by its founder and CEO, Ali Niknam. In 2021, the company decided to raise some external capital, leading to the largest Series A round for a European fintech company at the time. The startup raised $228 million (€193 million) at a $1.9B valuation. Since then, Bunq raised a €44.5 million growth round in 2023 and an additional €29 million in 2024 to accelerate development and support expansion plans. Today, Bunq now has €4,5 billion in user deposits, having recently surpassed the milestone of 20 million users onboard.

3. N26

The German digital bank has about 8 million customers in 25 markets. N26 offers three different personal banking plans and an exclusive business bank account option for freelancers and the self-employed. The in-house app allows users to set spending and withdrawal limits, save and budget using Spaces, and instantly send money with MoneyBeam. Its Wise integration allows customers to get a real exchange rate for international transfers.

N26 has also recently expanded into the mobile communications industry, offering local mobile plans and international eSIMs, as well as cryptocurrency, stock, and ETF trading.

In 2021, N26 raised over $900M in Series E, skyrocketing its valuation to over $9 billion. As of the end of 2024, N26 reported that its customer deposits had surpassed €10 billion for the first time.

4. Wirex

Wirex is a licensed e-money issuer with the Financial Conduct Authority (FCA). Its digital payment platform combines both fiat and crypto banking solutions. The company launched its first product — a Bitcoin-supported debit card — in 2015, becoming a pioneer in this field. In 2019, Wirex announced the launch of a brand new next-generation Wirex Visa Travelcard in the APAC region “where people need payments redesigned for the future”. It was unique in a way, allowing them to store and use hybrid crypto-fiat assets in over 150 currencies. As Mastercard has expanded its cryptocurrency program, Wirex has become the first “native” cryptocurrency platform to gain principal membership. That means that Wirex can now directly issue cards on Mastercard’s network.

Its newest service, “X-Accounts”, created in partnership with a digital asset custody platform Fireblocks, will give users easy access to DeFi, offering quick crypto deposits and high-interest rates on both fiat and crypto holdings. To provide higher interest rates, Wirex introduced X-Accounts Plus, a fixed-term account option.

Despite some controversies and criticism, Wirex announced that it turned profitable in 2019 (which is quite remarkable for a 5-year-old fintech startup). Since then, the company has maintained financial growth, reporting a 64% increase in revenue last year. At the time of its last crowdfunding campaign (2022), the company raised a total of $23.3 million across four funding rounds. Wirex’s latest valuation data suggests that the company’s worth is about $165 million. It boasts over 6 million users across 130 countries, and $20 billion in transactions processed.

5. Tomorrow

Tomorrow is a neobank based in Germany offering personal accounts, sustainable investments, and a wooden debit card. It was officially founded in 2018, but launched mobile current accounts with a free Visa debit card and climate contribution only in March 2019. Tomorrow also offers its customers savings accounts. Tomorrow positions itself as a social business helping individuals combine financial choices with positive environmental impact. The bank funds and promotes renewable energy, solar power, wind power, and sustainable agriculture. It has already attracted over 120,000 customers.

Finland’s progressive approach towards neobanking is further reinforced by its governmental support for digital services innovation. The Finnish government has implemented several policies aimed at fostering an environment conducive to fintech startups. This includes regulatory frameworks designed to ensure the security and reliability of fintech operations, which in turn boosts consumer confidence in using digital-only banks.

Another factor contributing to the rise of digital banks in Finland is the country’s high level of education in technology. Finnish universities have strong tech programs that produce a skilled workforce, driving innovations in the fintech sector, including neobanking services. Collaboration between academia and businesses is encouraged, often leading to breakthroughs that can be commercialized in the fintech market.

Moreover, Finland’s broader push towards sustainability and reducing carbon footprints resonates with the principles of many neobanks, which often emphasize their green credentials. This synergy between national objectives and neobanking values enhances consumer alignment towards digital banks.

Lastly, the Finnish fintech ecosystem is bolstered by several incubators and accelerators like Helsinki Fintech Farm, which provide resources, mentoring, and networking opportunities to fintech startups, including neobanks. This ecosystem support significantly accelerates the growth and establishment of innovative banking solutions tailored to modern financial needs.

This article was updated on Sept. 15, 2025 with the recent data on online banking use, digital banks’ numer of customers, funding and valuations, as well as relevant infographics.