13 charges from the SEC piling on accusations of regulatory evasion by the CFTC. Denouncement, investigations, and severance of banking relationships with over 7 countries. Outflows in the billions (US dollars, fortunately). Binance is going through it. The onslaught of financial, regulatory, and social pressure exuded onto the crypto industry through execution in effigy of the largest cryptocurrency exchange and its founder is the hottest mass media crypto event since the FTX humiliation.

Are we already standing at the public gallows? Or is the thick skin and nonchalant front of Changpeng Zhao, backed by significant and true reserves, enough to outlast the trials? What are the accusations against Binance and are they true?

Source: Dado Ruvic | Reuters

Briefly on Binance

Binance is a centralised cryptocurrency exchange founded in 2017 by Chinese-Canadian software engineer Changpeng Zhao (CZ). Binance’s immediate popularity was the fruits of great user experience, broad cryptocurrency selection, competitive trading fees, and robust security measures.

Later, Binance introduced its native cryptocurrency, Binance Coin (BNB), which provided users discounted trading fees and other benefits.

Through strategic partnerships, intrepid expansion into new markets, and launching of innovative products like Binance Launchpad, Binance rapidly grew its user base and trading volume. Commitment to transparency through Proof of Reserve mechanisms, continuous improvement, and its ability to adapt to market demands have played key roles in its success, establishing it as one of the world’s leading cryptocurrency exchanges.

Crimes Beyond Hubris

Complaints From CFTC

On March 27, the Commodity Futures Trading Commission (CFTC) charged three Binance entities and its founder and chief compliance officer (CCO) with multiple violations of the Commodity Exchange Act (CEA) and CFTC regulations.

The CFTC’s complaint, although not presenting new legal theories, stood out for its extensive 73-page thoroughness, delving into the scope of its jurisdiction and the application of the CEA to various aspects of the digital asset commodity industry. The core allegation being that Binance, its founder, and the CCO knowingly disregarded CEA provisions and engaged in regulatory arbitrage for their own benefit.

The complaint highlights several violations, including (but not limited to):

- Binance trading digital asset commodities as contracts in spot markets and derivatives;

- Offering retail contracts to non-eligible contract participants (ECPs);

- Operating without registration as designated contract markets (DCMs) or futures commission merchants (FCMs);

- Failing to implement a compliance program, and;

- Operating as a swap execution facility (SEF) without proper registration.

The CFTC seeks severe penalties, including a permanent ban on Binance’s participation in spot or derivative markets involving digital asset commodities, a permanent registration ban with the CFTC, disgorgement and restitution of all gains from US business (potentially extending to all customers), and civil monetary penalties that could amount to billions.

SEC’s 13 Charges

June 5, the Securities and Exchange Commission (SEC) files charges against Binance Holdings Ltd., its US affiliate BAM Trading Services Inc., and founder Changpeng Zhao.

The 13 charges include:

- Unlawfully soliciting US investors to buy, sell, and trade crypto asset securities through unregistered trading platforms;

- Engaging in multiple unregistered offers and sales of crypto asset securities and other investment schemes;

- Unlawfully offering essential securities market functions (exchange, broker-dealer, and clearing agency) on the Binance Platforms without registering with the SEC;

- Engaging in unregistered offers and sales of Binance’s own crypto assets (BNB and BUSD), profit-generating programs (BNB Vault and Simple Earn), and a “staking” investment scheme on the Binance.US Platform;

- Making misrepresentations to investors about controls implemented on the Binance.US Platform, while raising funds and attracting trading volume from investors;

- Designing and implementing a plan to evade US laws and regulatory oversight;

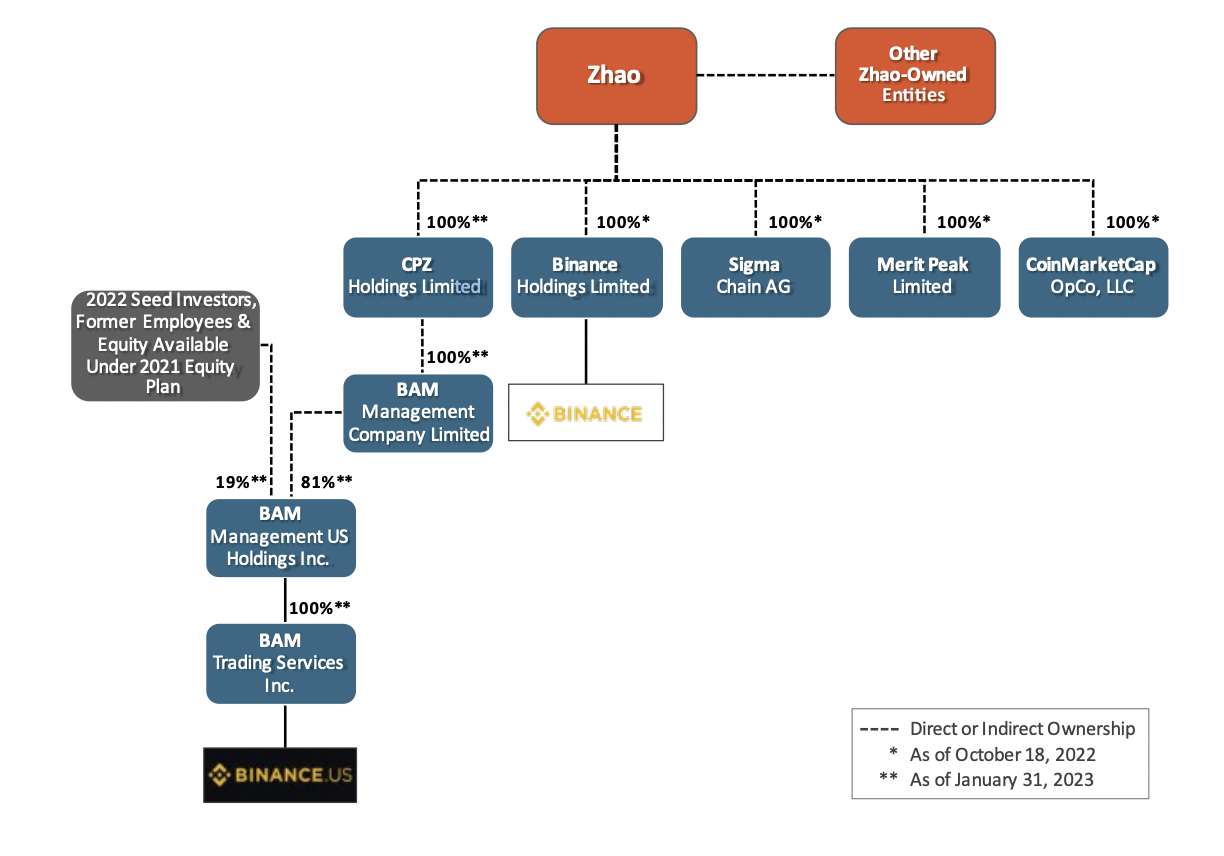

- Creating BAM Management and BAM Trading as entities to control the operation of the Binance.US Platform, while Zhao and Binance were involved behind the scenes;

- Claiming that the Binance.com Platform did not serve US persons while secretly allowing high-value US customers to continue trading covertly;

- Transferring and commingling investor assets in ways that registered entities would not be able to do;

- Failing to implement trade surveillance and manipulative trading controls on the Binance.US Platform;

- Misleading investors about the surveillance and controls in place on the Binance.US Platform;

- Violating the Securities Act by engaging in unregistered offers and sales of securities;

- Violating the Exchange Act by acting as an unregistered exchange, broker-dealer, and clearing agency on the Binance Platforms, and Zhao being held responsible as a control person for these violations.

“Binance is accused of misleading customers, of steering their money to another company that’s controlled by Binance’s CEO and of putting investors’ assets at risk,” says journalist David Gura, “according to the SEC, which describes Binance as an opaque web of corporate entities that does business around the world. And, interestingly, it has no physical headquarters anywhere, which may sound unusual, but this is how many crypto companies operate. They believe there’s no need for a headquarters. There are no borders. There’s no need for government oversight. Binance’s chief executive, who goes by his initials, CZ, says Binance’s headquarters is wherever he’s sitting. Regulators have gotten fed up with this.”

Binance responded with disappointment in the SEC’s lack of clarity and guidance, which has been reiterated by many in the industry, including by cryptocurrency exchange Coinbase. This deficiency in adequate regulation is cited as the reason for numerous lawsuits, investigations, and concerns. But the SEC has repeatedly denied a need in creating separate policies specifically for the governance of the crypto industry.

Nevertheless, Binance stated its intentions to cooperate with the investigations and its efforts to address concerns, even insisting on a collaborative and thoughtful approach to creating adequate regulation.

Chain of Stakes

Swiftly, other jurisdictions herded to ban, severe ties with, or open investigations against Binance. Between June 10 and June 28, Binance faces ceasing of operations in the UK, Cyprus, the Netherlands, and Australia. Investigations against Binance have been opened in France, Ireland and Malta, with EU officials accusing the exchange of money laundering. Binance operations became illegal in Belgium and in Nigeria, where the cease and desist was issued to a scammer company operating under the name “Binance Nigeria Limited”. But is the CZatanic Panic merited?

Source: Ramsey Cardy | Sportsfile

Questions at the Scaffold: Are the Accusations True?

Binance’s response to the SEC’s accusations reads, “the SEC’s goal here was never to protect investors; if that were truly the case, the Staff would have thoughtfully engaged with us on the facts and in our efforts to demonstrate the safety and security of the Binance.US platform. The SEC’s real intent here, instead, appears to be to make headlines.” Echoing impressions of March when US regulators shut the solvent Signature Bank following the collapse of Silvergate Capital and Silicon Valley Bank on the basis of ‘precautionary measures’.

The continuous attacks on the crypto industry by US regulators are also consistent with the US Federal Reserve’s (Fed) many failings and the pushing forward of the FedNow — a government-controlled portal which allows near-instantaneous transactions between banks. The Fed is guilty of deliberately preventing US citizens from having access to any and all decentralised finance (DeFi), this much is obvious. But the guilt of one party doesn’t necessarily guarantee innocence of the other.

Let’s dissect the accusations:

1. Violations of Sections 5(a) and 5(c) of the Securities Act: Alleges that Binance offered and sold Binance Coin (BNB) without a registration statement filed or in effect as required by the Securities Act. It alleges that Binance used means of transportation, communication, or the mails to sell securities without proper registration.

2. Violations of Sections 5(a) and 5(c) of the Securities Act: Similar to the first claim, Binance is accused of offering and selling BUSD (Binance USD) without the required registration statement.

3. Violations of Sections 5(a) and 5(c) of the Securities Act: This claim alleges that Binance offered and sold the Simple Earn and BNB Vault programs without the necessary registration statement.

4. Violations of Sections 5(a) and 5(c) of the Securities Act: BAM Trading, the cryptocurrency exchange serving customers in the US as Binance.US, is accused of offering its Staking program without the required registration statement.

Violations 1, 2,3, and 4 are viewing the offering of BNB, BUSD, Simple Earn, BNB Vault, and the Staking program as selling of unregistered securities. Perhaps following the recent ruling of XRP as not a security, these claims will be revisited.

The only aspect of violation 1 setting it aside from the following three is the unlawful methods allegedly used to sell securities without registration. The question is, if BNB & Co. are recognised as decidedly not-securities, will the charges of improper sales practices persist?

5. Violation of Exchange Act Section 5: Binance is accused of operating the Binance.com Platform without registering as an exchange under the Exchange Act.

6. Violations of Exchange Act Section 15(a): Binance is accused of operating the Binance.com Platform without registering as a broker-dealer under the Exchange Act.

7. Violations of Exchange Act Section 17A(b): Binance is accused of operating the Binance.com Platform without registering as a clearing agency under the Exchange Act.

Violations 5,6, and 7 allege that Binance’s international platform serviced US customers. Binance.com does not have registration to do that, hence why exists Binance.US, an allegedly significantly inferior platform in both interface and customer-service. The US-regulated exchange also owes some of its flaws to the stringent hoops exchanges and other businesses in the crypto industry have to jump through in the US, due to lack of appropriate regulation pairing with its severe and punitive enforcement.

8. Violations of Exchange Act Section 5: Both Binance and BAM Trading are accused of failing to register as an exchange for the Binance.US Platform.

9. Violations of Exchange Act Section 15(a): BAM Trading is accused of operating the Binance.US Platform without registering as a broker.

10. Violations of Exchange Act Section 17A(b): Binance and BAM Trading are accused of operating the Binance.US Platform without registering as a clearing agency.

In the US, a company needs a Money Transmitter licence, also known as a Money Services Business (MSB) licence in order to operate as an exchange of virtual currencies. Violations 8,9, and 10 allege that BAM Trading and Binance operate Binance.US without proper registration to do so.

This is convoluted, since BAM Trading is licensed within the US, and Binance.US is registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business. If those are not the correct licences, it took much too long for relevant authorities to address the matter.

Making for a better story than messy regulatory hoops and bureaucracy: Binance is ‘run by a global group of criminal elite’, with Zhao, BAM Trading, and Binance preying upon investors through Binance.US. If this is the case, little difference remains between Binance users and traditional bank-goers.

The accusations of shady third parties controlling Binance.US are more realistically the result of the failure of US federal regulators to make definitive law-abiding and success a possibility for the US crypto industry.

11. Violations of Exchange Act Sections 5, 15(a), and 17A(b): Zhao, the individual associated with Binance, is accused of being a control person over Binance and being responsible for their violations of the securities laws.

12. Violations of Exchange Act Sections 5, 15(a), and 17A(b): Zhao is also accused of being a control person over both Binance and BAM Trading and being responsible for their violations of the securities laws.

13. Violations of Securities Act Sections 17(a)(2) and (a)(3): BAM Management and BAM Trading are accused of making materially false and misleading statements to investors and engaging in fraudulent acts and practices related to the offer or sale of securities.

Beyond the invalidity of accusations pertaining to unregistered securities, Zhao is personally accused of orchestrating fraudulent tampering with market and assets, and the deliberate misleading of investors.

Binance has a thorough General Risk Warning, KYC, and Proof of Reserves procedures, the latter helping customers verify the accuracy of their holding balances, ensures the safety of assets and prevents unauthorised use. Binance works with third party auditors to provide proof of ownership to ensure the safety of funds. This aids in proving transparent and responsible operations. It prevents exchanges from utilising customer deposits for lending or unauthorised purposes, safeguarding customer funds and establishing trust and credibility.

Regulators maintain that this is not enough.

Relation of entities mentioned in the official complain.

Source: sec.gov

What Does the SEC Want?

The SEC seeks a court order to permanently prohibit Zhao, Binance, Binance.US, and BAM Trading from committing further violations of the federal securities laws. This injunction aims to prevent them from engaging in activities that would violate securities laws in the future, i.e. doing business in the US.

The lawsuit also intends for the defendants to disgorge their ill-gotten gains, which means they would be required to give up any profits obtained through their alleged unlawful activities. The disgorged amount would likely include any profits made from ‘unregistered securities transactions’ or other violations. Prejudgment interest would also be added to account for the time value of the ill-gotten gains.

The Commission wants the court to permanently prevent the defendants, as well as any entity controlled by them, from using the means or instrumentalities of interstate commerce for several activities related to securities, including crypto asset securities. These activities include participating in unregistered transactions involving securities, acting as an unregistered exchange, acting as an unregistered broker or dealer, and acting as an unregistered clearing agency.

Civil money penalties are obviously sought to be imposed on the defendants. The penalties would involve the payment of fines or monetary sanctions for the alleged violations of securities laws. The specific amounts of the penalties would be determined by the court.

Finally, the SEC also requests the court to order any other appropriate or necessary equitable relief that would benefit investors. This may include additional measures to protect investors’ interests or address the harm caused by the alleged violations.

Source: Dado Ruvic | Reuters

Be Still My Fudding Heart

CZ insists that everything is fine at Binance. Even as reports come in of high-level staff leaving the company and US-based employees being asked to move off-shore. The CEO just calls it natural “turnover”. Statistics are also not so bleak, showing Binance customers aren’t all running for the hills, despite a $20 billion proof of reserve assets reduction.

Whatever the result of the lawsuit, the way exchanges operate will change dramatically, and likely not just in the US. Should Binance go under, Coinbase is next on the hit list, and already engaged in its battle with the SEC.

The clear implications remain: the current US government intends to keep America hostile for the crypto industry. By targeting centralised entities with accusations of violating regulations and failing to properly disclose financial, user, and company information, the way is paved to ensure decentralised finance never reaches the US public. Beyond repetitive scandals concerning the disclosed crypto-wealthy, there exists abundance for the masses. Their majority will be discouraged from education and subsequent benefits of DeFi, through horror stories of corruption and illicit financial activities which are not native to cryptocurrency, but to human nature. Rule-bending, tax-evasion, and fraud are the result of knowing that money systems are not safe and can be abused to one’s benefit.

When one’s money is fully in their possession, anonymously, responsibly, backed only by their knowledge and unprejudiced algorithm, there is no room for crooks to dictate how one lives or take it as they please.