There is a possibility that the Taiwanese stock indices will begin to show a positive dynamic of recovery next year, despite the unfavorable state of affairs in the geopolitical space and concerns related to the possible aggravation of the situation in this environment.

The corresponding opinion is shared by Ivy Chen, general manager and head of the Taiwanese division of Allianz Global Investors. She shared her opinion on the vision of the future prospects for the movement of stock indices earlier this week during a conversation with media representatives.

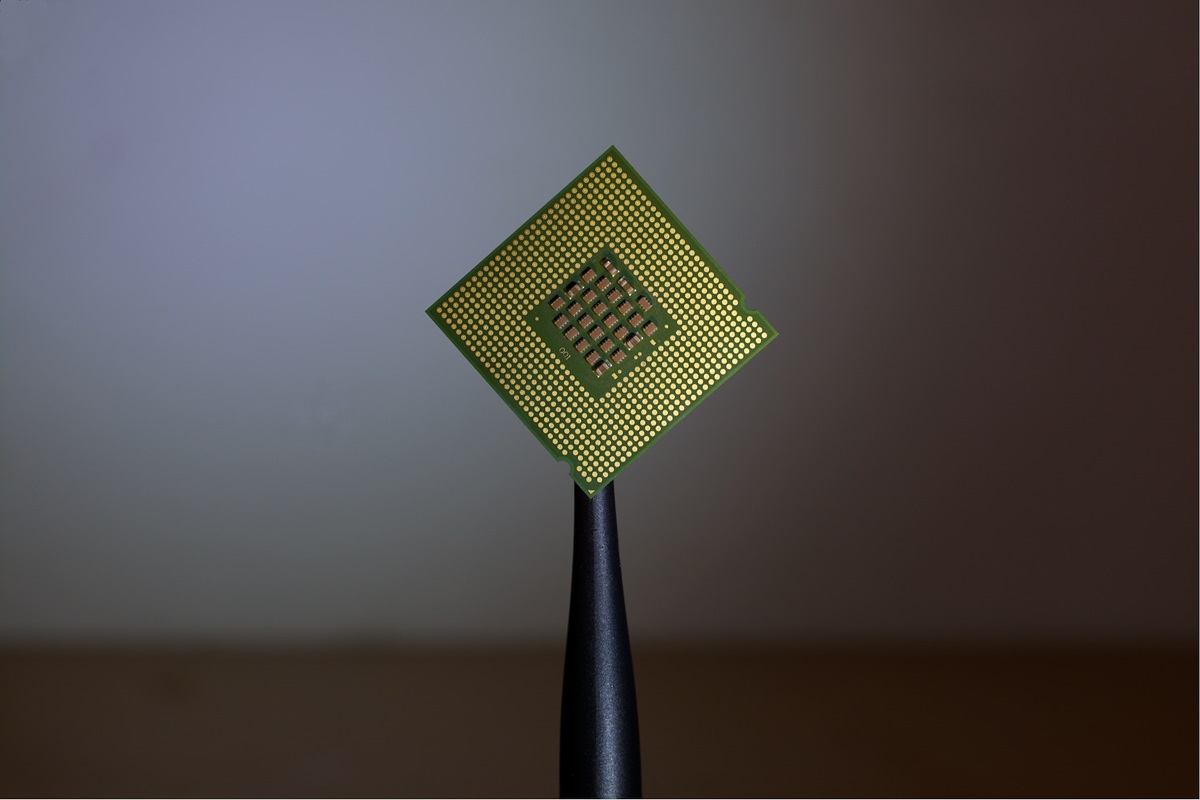

Ivy Chen suggests that Taiwanese companies that operate in the semiconductor industry will record a profit growth of about 30% next year. The manager of the island’s largest active equity fund believes that the projected trend will be facilitated by revenue growth in the chip sector.

Also, the general manager of Allianz Global Investors says that next year all companies that are registered in Taiwan, regardless of the sphere of activity, will record positive financial indicators. In her opinion, the profitability growth of the island’s firms will average 20%.

At the same time, in 2023, concerns about potential tensions between Washington, Beijing, and Taipei became a weighty argument for some investors to reduce the volume of investment in Taiwan’s economy. At the same time, this tactic of behavior was partly facilitated by the risks of slowing down the pace of development of the global economic system. Since the beginning of this year, investors have withdrawn $7.4 billion from Taiwanese stocks. This indicator is the largest in Asia.

Despite the mentioned circumstances, the Taiwanese benchmark Taiex, where the world’s main manufacturers of microcircuits, including Taiwan Semiconductor Manufacturing Co., are based, has shown growth of 16% since the beginning of this year and has become the second largest stock market in Asia after Japan.

Ivy Chen says that the risks associated with the situation in the geopolitical arena are not something unexpected or unforeseen for the Taiwanese. She also noted that such factors, to one degree or another dismantling the stability system, can arise anywhere in the world. According to her, against the background of these global challenges, which are caused, among other things, by political reasons, diversification from the point of view of the asset class or sector is an effective measure to counteract the influence of negative external circumstances.

The general manager of Allianz Global Investors is convinced that Taiwanese companies operating in sphere microcircuits will demonstrate positive financial results in the foreseeable future due to improved demand for their products from end consumers. She also noted that another circumstance supporting the implementation of the growth process will be the completion of a period of production reduction in the chip industry. Ivy Chen is convinced that the demand for semiconductors necessary for the creation and operation of artificial intelligence systems will continue to increase rapidly.

According to the general manager of Allianz Global Investors, next year the growth rate of the shares of Taiwanese companies will exceed the values that are currently fixed. Ivy Chen stated her confidence that firms’ securities will again gain the attention of foreign investors as a result of an increase in profitability. She also noted that Taiwanese companies are increasing activity to diversify their production bases. Ivy Chen said that these efforts will increase the competitiveness of companies in the future. This opinion is based on the indisputable fact that the diversification of production helps to reduce the risk of the influence of geopolitical factors.

Allianz Global Investors predicts a positive state of affairs in such spheres as the production of bicycles, textiles, shoes, and machine tools in the long term. The company’s optimistic forecasts also extend to the biotechnology industry.

Allianz Global Investors Taiwan manages onshore Taiwanese funds worth 69.5 billion New Zealand dollars (2.1 billion US dollars).

As we have reported earlier, Taiwan Economy Shows Growth.