Mobile money is one of the main drivers of financial inclusion in low-income economies where such financial accounts surpass traditional bank ones.

World Bank’s Global Findex 2025 report revealed a state of financial account ownership in low-income countries, where 32% of adult citizens had a mobile money account in 2024 vs just 26% of bank account owners.

Moreover, mobile money services were also the ones to facilitate most savings in the given economies. Thus, only 13% of people over the age of 15 in low-income countries said in 2024 that they had saved money using a traditional bank account or similar product. This number rose to almost 28% when the option of saving via mobile money accounts was also included. The same indicators differed much less in middle-income countries, where savings rates via traditional avenues and with mobile money included were almost identical (with a minor 1%-5% difference).

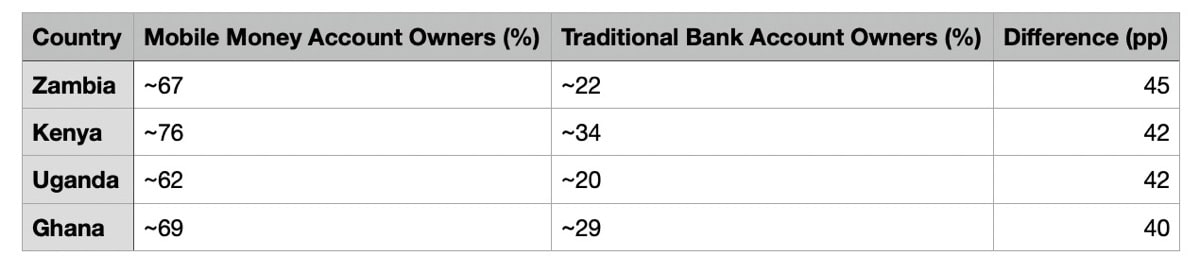

The mobile money technology is especially actively developing in Sub-Saharan countries. The countries with the largest difference (40%-54%) between the owners of mobile money accounts and traditional bank accounts are also situated on the African continent: Zambia, Kenya, Uganda, Ghana.

As for the other important findings of the latest World Bank report, the tendencies are the following:

- the number of banked citizens is growing: 79 % of adults in low‑ and middle‑income countries had a financial account in 2024, up from 51 % in 2011 and 74 % in 2021;

- globally, there are still about 650 million people without formal banking accounts;

- 53% of the unbanked population lives in Bangladesh, China, Egypt, India, Indonesia, Mexico, Nigeria, and Pakistan;

- In Sub-Saharan Africa, the use of mobile money services grew from 27% in 2021 to 40% in 2024;

- in Latin America & the Caribbean region, adult mobile‑money account usage climbed from 22 % to 37 % between the last reporting periods;

- formal savings in developing economies increased from 24% to 40% over the last three years;

- in Sub-Saharan Africa, this indicator changed from 23% to 35%;

- in Armenia, Uganda, Zambia, Ghana, and India, the increase in account ownership between 2011–2024 surpassed 50%;

- globally, men have more access to formal banking accounts (81% vs 77% for women);

- in Sub-saharan Africa and MENA, the gender gap in account ownership is more pronounced – 12%-15%;

- the main barriers to financial access are inability to afford a mobile phone (69%-77%) and lack of mobile network coverage (54%).

World Bank president Ajay Banga said that giving more people access to financial services can make a big difference in their lives and help grow entire economies.

He explained that the World Bank is working to update payment systems and reduce legal barriers so that individuals and businesses can get the money they need to build new ideas and create jobs.

The Bank representative also stressed that better access to mobile banking in developing countries is crucial, as it helps people save money more easily.