Currently, there is a tendency in Vietnam, in which foreign companies are expand their chip testing and packaging capacities in this country, and homegrown firms are eyeing investments.

To a large extent, the mentioned tendency is related to the diversification of industrial activity outside China. At the same time, foreign companies are interested in maintaining their presence in Asia, which is what can be described as a space of significant opportunities and promising prospects. The diversification of industrial activity is taking place against the background of growing tensions in the context of Beijing’s relations with Washington and European capitals. The United States has already restricted the shipments of advanced chips and equipment for the production of microcircuits of the corresponding category to China. Some of Washington’s allies have joined these export control measures. Expectations are also actively circulating that Donald Trump, who won the United States presidential election this month, will decide to significantly increase tariffs on goods imported from China.

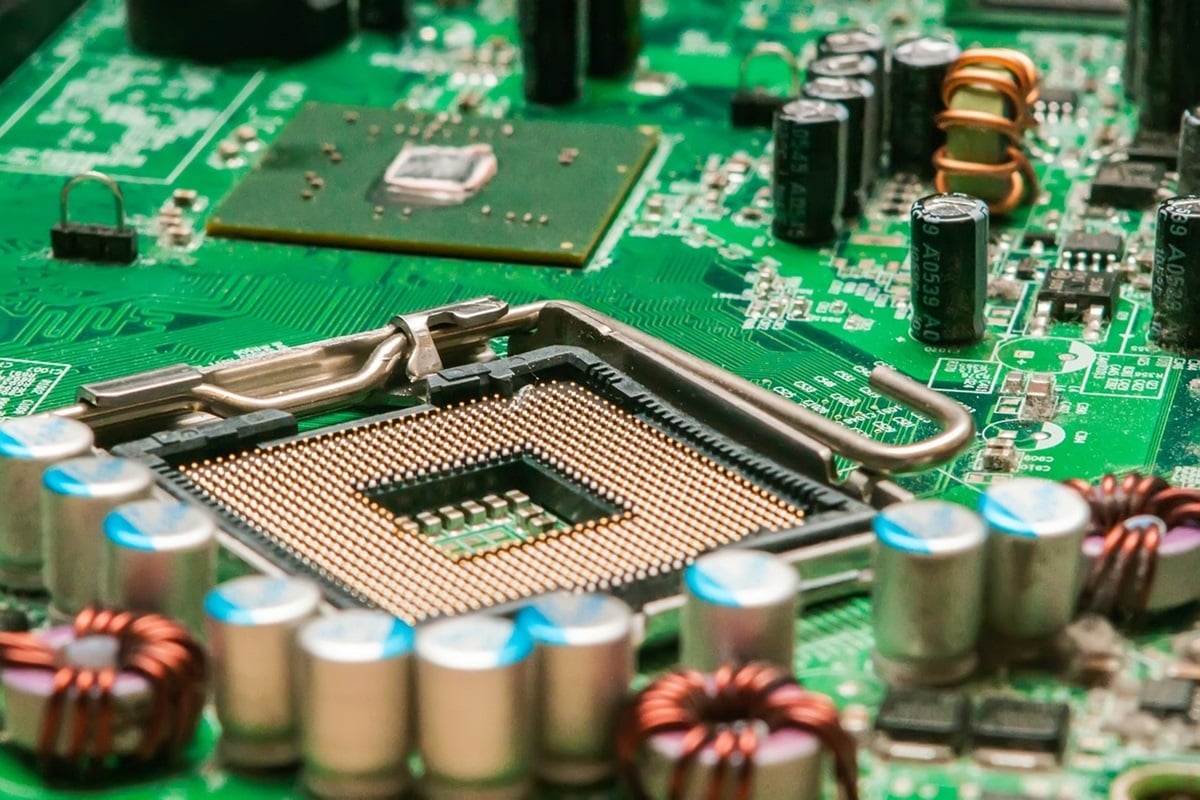

The semiconductor back-end manufacturing sector, which differs from the more strategic front-end microcircuits making in foundries by having less capital requirements, is currently dominated by Taiwan and China. At the same time, Vietnam is one of the fastest-growing countries in the mentioned $95 billion sector.

Hana Micron’s vice president for Vietnam, Cho Hyung Rae, during a conversation with journalists said that the company is expanding its presence in this Southeast Asian country. The relevant decision was made by the mentioned firm, based in South Korea, to satisfy the requests of industrial customers who wanted to move some of their production capacity outside of China. Hana Micron is investing about 1.3 trillion won ($930.49 million) in Vietnam. These funds will be used to boost packaging operations for legacy memory chips.

United States-based Amkor Technology last year announced plans to build a 200,000-square-meter factory in Vietnam. The cost of this project is $1.6 billion. The company also stated that the mentioned factory will be its most extensive and advanced facility, delivering next-generation semiconductor packaging capabilities.

According to media reports, referring to a business executive who is aware of the details of Amkor Technology’s activities in Vietnam, some of the equipment installed at the specified plant had been transferred from factories in China. In this case, in a certain sense, there is an illustrative example of a change in the geography of production activities in Asia against the background of growing tensions between Beijing and the capitals of Western countries.

Amkor Technology did not respond to a media request for comment on the transfer of machinery from China to Vietnam.

US Intel, which had a large booth last week at Vietnam’s first international semiconductors exhibition near Hanoi, has in this Southeast Asian country the largest chip manufacturing plant in its global network.

It is worth noting that Vietnam’s growth in the back-end segment of the microcircuits industry is encouraged by the administration of the current President of the United States Joe Biden. To a large extent, this state of affairs is due to the increasing trade tensions between Beijing and Washington. The mentioned tensions may rise after the inauguration of Donald Trump, which will take place in January.

In a report published in May by the US Semiconductor Industry Association and Boston Consulting Group, it was noted that, against the background of significant foreign investment, Vietnam’s share in global capacity in chip assembly, testing, and packaging (ATP) by 2032 is expected to range from 8% to 9%. It is worth noting that in 2022, the corresponding figure was fixed at 1%. Local companies are also expected to contribute to the mentioned expected growth.

Vietnamese technology company FPT is currently building a testing plant close to Hanoi. This was reported by the media, referring to insiders who used the right of anonymity, since the mentioned information does not belong to the category of public. One insider noted that the operation of the new plant, which covers an area of 1,000 square meters, is expected to begin early next year with ten testing machines. By 2026, according to preliminary information, the capacity of this facility will increase threefold with investments of up to $30 million. At the same time, FPT continues to seek for strategic partners. The firm did not respond to a media request for comment.

The Vietnamese investment company Sovico Group is also currently looking for a foreign partner to jointly invest in an ATP facility in Danang, a coastal city located in the central part of the country. The corresponding statement was made by Le Dang Dung, a senior adviser to the mentioned firm.

Vietnam is currently also striving to become a player in front-end chip manufacturing. Viettel, a state-owned defense and telecommunications company, plans to build the country’s first foundry. This was reported by the media, citing sources at the mentioned firm. The specified foundry can be described as a move towards the goal of the Vietnamese government to launch at least one relevant plant by the end of the current decade. Viettel did not respond to a media request for comment.

Vietnam has a significant chance of becoming a kind of beneficiary of the current configuration of reality in the geopolitical space. The realization of the corresponding probability to a large extent depends on foreign companies and investors.

As we have reported earlier, Samsung Plans to Invest $1.8 Billion More in Vietnam.