Bader Al Hussain

PaySpace Magazine Analyst

The advent of COVID-19 devastated the world’s economy at a global scale, triggering health and social crises all over the world. However, there were some countries that mitigated the damage caused by this novel virus through effective and evidence-based policy making and its implementation. China is one of those countries and it remains the only major economy that has attained positive growth in its economic output. China successfully has navigated itself through the pandemic phase and its swift vaccination rollout has further brightened the prospects of its economic output in future. Considered as the second-largest economy in the world, the country is expected to surpass the United States within the next decade. Further, China is a growing influence on other developing economies through trade, investment, and ideas.

China’s economic forecast 2021: what’s coming next?. Source: pixabay.com

Economy at glance

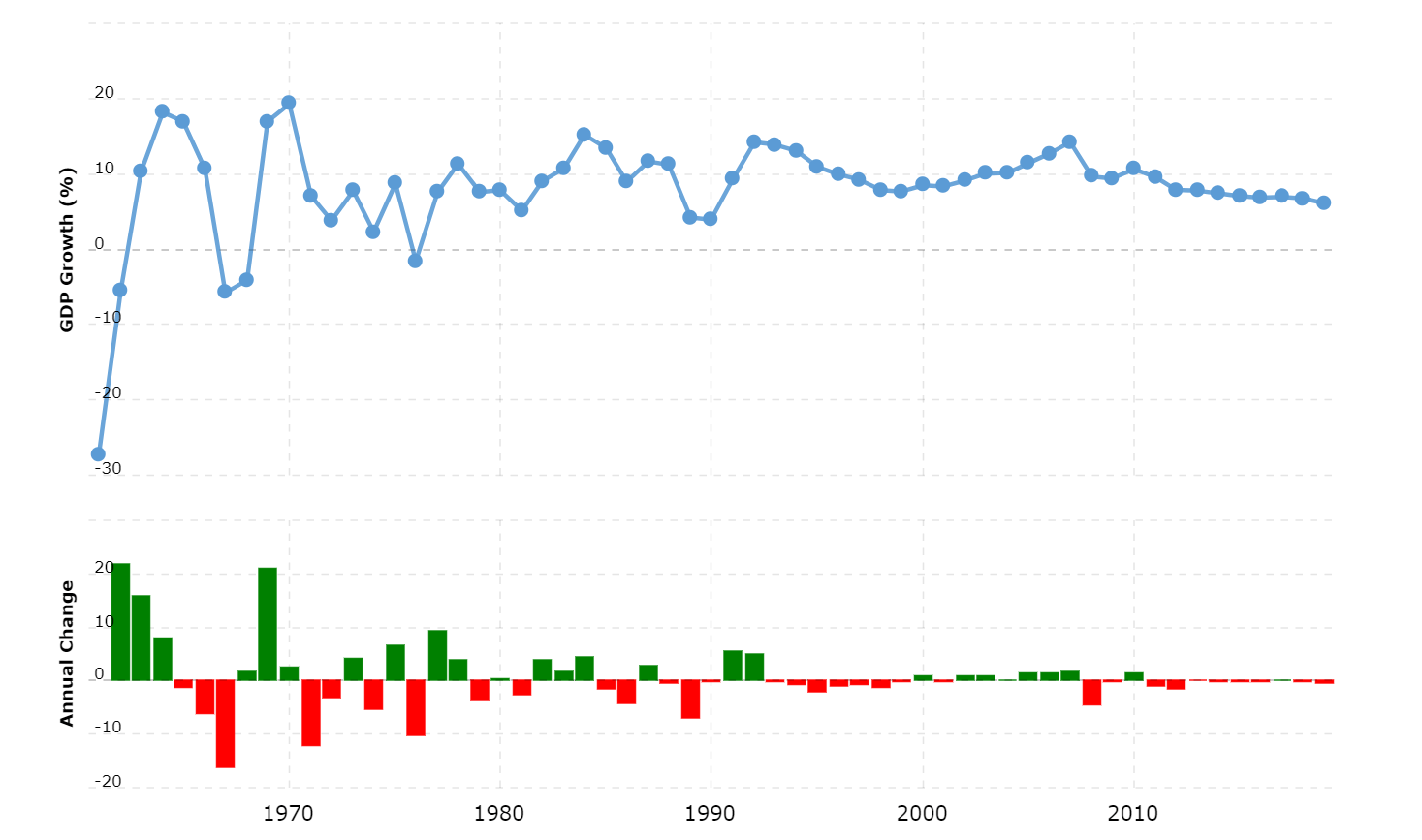

The transition in the Chinese economy from a tightly controlled state-led economic system to a mixed economy has been a remarkable one in recent history. Since the country embarked on economic reforms in 1978, GDP growth averaged almost 10 per cent a year, lifting more than 800 million people out of poverty within a few decades. This economic miracle retains its uniqueness in recorded human history. Additionally, apart from economic success, the country also registered significant improvements in its social indicators such as education and healthcare.

China is categorised as an upper-middle-income country. The country’s leadership is now focused on the vulnerabilities of the remaining poor population that have been left behind, or could not reap the benefits of the remarkable economic growth witnessed by their country. Presently, China’s high growth is contingent on resource-intensive manufacturing, exports, and cheap labor. Nevertheless, as the country’s income per capita is rising, the low-paid labor advantage is gradually dissipating. Therefore, in order to address such issues, the Chinese economy is now undergoing a structural change. It is transforming itself from low-end manufacturing to high-end manufacturing and services economy, and from investment to consumption.

As the graph above depicts, Chinese GDP growth has been moderate in recent years. The reasons behind these trends are the presence of structural constraints in the form of declining labor-force growth, diminishing returns to investment, and slowing productivity. These bottlenecks need to be addressed in order to unlock another era of productivity growth of the economy.

One of the perennial challenges encountered by China is the need to bridge institutional and reform gaps. The reason behind this is that China’s economic growth is outpacing its institutional development. Mitigating these gaps is imperative for a high-quality and sustainable growth path.

Presently, China is faced with similar developmental challenges that are also confronted by other countries, and these are, but not limited to, transitioning to a new growth model, rapid aging, building a cost-effective health system, and promoting a lower carbon energy path.

China economy outlook for 2021 and beyond

As the only major economy to register growth in its economic output, China’s economic rebound from this pandemic has been speedy, but not even. Boosted by the expansionary fiscal and monetary policy together with resilient exports, the Chinese economy furnished 2.3 per cent growth in its output last year. Further, it is expected that GDP will return to its pre-pandemic levels by the middle of this year. However, the pandemic has exacerbated the pre-existing challenges such as: imbalances in the structure of aggregate demand have re-emerged, as households increased savings, government support stressed investment, and external imbalances have widened.

Public and private debt stocks—already high before the pandemic—have increased further. Vulnerabilities in fiscal, corporate, and banking-sector balance sheets, together with rising debt service costs could weigh on China’s growth, following this year’s strong cyclical rebound. These challenges require attention during the post-COVID recovery with short-term macroeconomic policies and structural reforms aimed at reinvigorating the shift to more balanced high-quality growth.

The government aims to undertake an ambitious political, economic and social reform agenda in order to reduce economic inequality, while expanding the productivity of the Chinese economy. The priorities of the structural reforms are as follows:

- Healthcare: Reduce the share of out-of-pocket payments of healthcare costs to limit the burden on the poor.

- Facilitate labour mobility and improve skills provision to foster reallocation in the labor market.

- Strike a better balance between liberalisation and regulation in financial markets and level the playing field to further strengthen the competition and regulation.

- Combat non-compliance with laws and regulations in order to uphold the governance and rule of law.

- Increase ambition and enforcement of environmental policies to incentivise the growth of a green or carbon neutral economy.

China stock market performance

There are two main stock exchanges in China namely: Shanghai stock exchange and Shenzhen stock exchange with the market capitalisation of USD 6.92 trillion and USD 2.504 trillion respectively. This makes China a home to one of the largest stock exchanges in terms of market capitalisation in the world. Moreover, it is pertinent to note that mostly large and state-owned enterprises are listed on the Shanghai stock exchange, whereas smaller and more entrepreneurial companies are traded on the Shenzhen stock exchange, making the Shenzhen stock exchange similar to the NASDAQ of the United States. The following table shows the sectoral compositions of both stock exchanges:

The Shanghai Stock Exchange Composite Index (SHCOMP) tracks the Shanghai exchange while Shenzhen Index (SZCOMP) tracks the stock prices of all A and B shares on the Shenzhen exchange. SZCOMP is a capitalisation-weighted index.

The Shanghai Stock Exchange performed well during last year, and the year to date this year, giving one-year and year-to-date returns of 21.75% and 1.61% respectively. On the other hand, a similar performance has been witnessed at the Shenzhen Stock Exchange furnishing one-year and year to date returns of 27.46% and -0.22% respectively. The performance of these exchanges was inline with that of other exchanges with similar characteristics where technology stocks significantly outperformed relative to traditional sectors.

Conclusion

Similar to other major economies, China is also transforming its economy into a knowledge-driven, high-tech and digital economy. Further, going forward, investment wise, the Chinese technology and construction-related sectors are expected to outperform others on the back of consistent and sustainable economic growth. Given its size, China is central to important regional and global development issues. China is the largest emitter of greenhouse gases, and its air and water pollution affects other countries. Global environmental problems cannot be solved without China’s engagement. Moreover, maintaining economic growth at reasonable levels has important spillovers for the growth of the rest of the world economy.

SEE ALSO: