![]()

Bader Al Hussain

PaySpace Magazine Analyst

The economy is the cardinal part of human society and its existence since time immemorial, and given its significance in the rise and fall of empires and modern nations in the present era, human history is littered with economic booms and collapses. Therefore, mankind’s effort to find the perfect economic solution, whereby the economic system performs in a robust and sustainable way has been eternal. In the recent past, two major economic systems that emerged after the end of World War II spawned the era of cold war between the two economic blocs: the capitalist system led by the United States, and communist system headed by the USSR. However, the breakdown of the USSR due to the inherent flaws in the centrally planned and controlled economy resulted in the emergence of only one viable economic system in the world.

This article aims to address the inherent flaws in the current economic system along with some narratives pertaining to the inevitable collapse of the global economic system in 2021.

Everything you need to know about economic collapse 2021. Source: unsplash.com

Is economic collapse inevitable?

There were experts who presumed the imminent global economic and stock market collapse after the advent of the novel COVID-19 pandemic. These opinions were largely based on the fact that after the lockdown in major trading centers of the world, business activity was going to halt, resulting in the collapse of economies. Nevertheless, these experts discounted the technology revolution, especially in the fields of e-commerce, blockchain, and artificial intelligence. These technologies are expected to form the core and integral part of the future digital economies of the world.

Further, credit should be given to the advancement in medical technology that enabled developed countries to create a vaccine against COVID-19 within a few months of the pandemic being declared by the United Nations. Never in human history has a vaccine been created in such a short period. This points to the technological prowess in the medical field that was achieved by mankind.

Is a satock market collapse inevitable?

The experts’ warning for an impending stock largely based on the realisation of the following factors and these factors will be adequately addressed. These factors are:

- Exponential rise in the valuations of companies

- Concern for inflation

- Resurgence of the potent new COVID-19 strain

Exponential rise in the valuations of companies

Bearish commentators believe that the meteoric rise in the valuation of companies all over the world is largely on the back of the huge influx of cash that has been pumped into the respective economies in order to stimulate them towards growth. They contend that retail investors used that cash to invest haphazardly in financial assets.

We believe that there is some credence in the above-mentioned reasoning, however, this is not the only reason. If we analyse the data of the stock exchanges meticulously, then we will come to learn that the biggest beneficiary of the growth in valuations are technology companies. This is because these companies such as Zoom, and Amazon fared well when compared to traditional cyclical companies. Further, the ability of these companies to scale and sell their products across international borders is unmatched when compared to the bricks and mortar entities.

Concern for inflation

As we have alluded to earlier, the huge influx of cash to households has raised concerns pertaining to inflation. From a valuation perspective, it is noteworthy to mention that a rise in the inflation rate warrants a rise in interest rates, and this increases the discount rate of the cash flows on which the company is going to be valued, resulting in a sharp decline in the stock prices of the respective companies.

We believe that these concerns for inflation are unwarranted on the back of these two factors. Firstly, the recent rise in commodity prices is chiefly the result of transient supply side disruptions, emanating from the halt in shipping lines due to COVID-19. Secondly, cash investment on the back of stimulus packages by the respective governments are efficiency-seeking in nature. This means that these investments are ultimately going to reduce the cost of goods or services delivered. Consequently, the temporary phenomenon of inflation is expected to be contained and tamed.

Resurgence of the new COVID-19 strain

The swift roll-out of vaccination campaigns has contributed to the decline in COVID-19 positive cases, along with a sharp drop in COVID-19 in the world in general and developing countries in particular. For instance, the on-going successful vaccination campaigns have resulted in zero COVID-19-related deaths in the country. This speaks volumes of the efficacy of vaccination doses. And according to medical experts, no matter how potent the mutant strain of COVID-19 is, a vaccinated individual can effectively deter it. Therefore, the point to consider is that vaccination is imperative, and it needs to be scaled up at a global level, especially for developing countries.

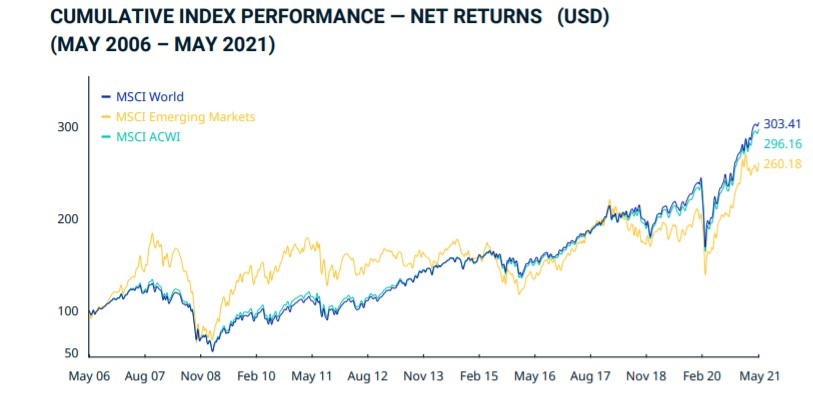

World stock market performance

In order to adequately gauge the performance of world equities, we have used the MSCI world Price index as its proxy. Given the dominance of the United States in terms of the economy and capital market, U.S. equities constitute approximately 66.57% of the whole index, followed by Japan and the United Kingdom respectively. Moreover, sector wise, information technology, financials and health represent approximately 21%, 14% and 12.3% respectively.

The graph above depicts the performance of MSCI world relative to its subsets of MSCI Emerging Markets and MSCI ACWI. Here it is pertinent to mention that there is no indication of any sort of impending collapse of the stock markets. This is because these markets had become much more volatile before any such event. Apart from that, given the sanguine global economic outlook of both cyclical and non-cyclical sectors, global stock markets have undertaken a V-shape recovery.

Conclusion

In the quarters to come, it will be interesting to observe the underlying trends in the economic and financial numbers in order to better understand the level of inflationary pressure and the rate of economic growth. For now, the numbers are too volatile to draw robust inferences. However, we believe that these inflationary pressures are transient in nature, and they will taper off, once the structural readjustment of the global economic landscape is over. Further, the moment global lockdowns are lifted, we expect a strong rebound in the global services industry.

SEE ALSO: