Both nations attracted high-value VC investment deals worth over $100 million both in terms of volume and value

Here’s who accounted for over 60% of high-value VC investments in Q2 2021. Source: unsplash.com

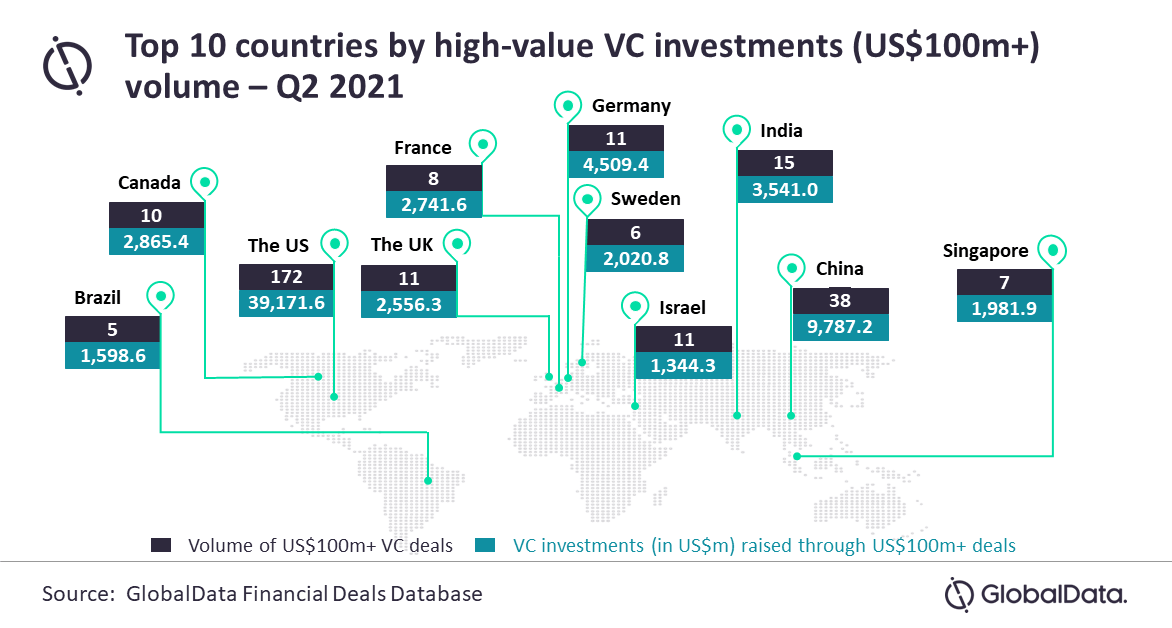

GlobalData has found that the US and China remained the preferred destinations for venture capital investors globally in Q2 2021.

In fact, the US and China collectively accounted for 66.2% and 61.8% of high-value VC investment deals volume and value during Q2, respectively.

The US accounted for 54.3% and 49.5% of high-value VC investments deal volume and value during Q2, followed by China’s corresponding shares which stood at 12% and 12.4%, respectively.

Besides, of the top 10 countries by high-value VC investment deals volume, 2 were headquartered in North America, 4 in Europe, 3 in Asia-Pacific, and 1 in the South and Central American region.

India occupied the 3rd position in terms of high-value VC investment deals volume, followed by Germany, the UK, Canada, France, Singapore, Sweden, and Brazil.

We’ve reported that EVO Payments acquires UK-based omnichannel payment gateway.

SEE ALSO: