The pandemic has hit the Indonesian payment market as consumers are avoiding non-essential purchases

Indonesia to meet post-COVID recovery in card payments: here’s when. Source: unsplash.com

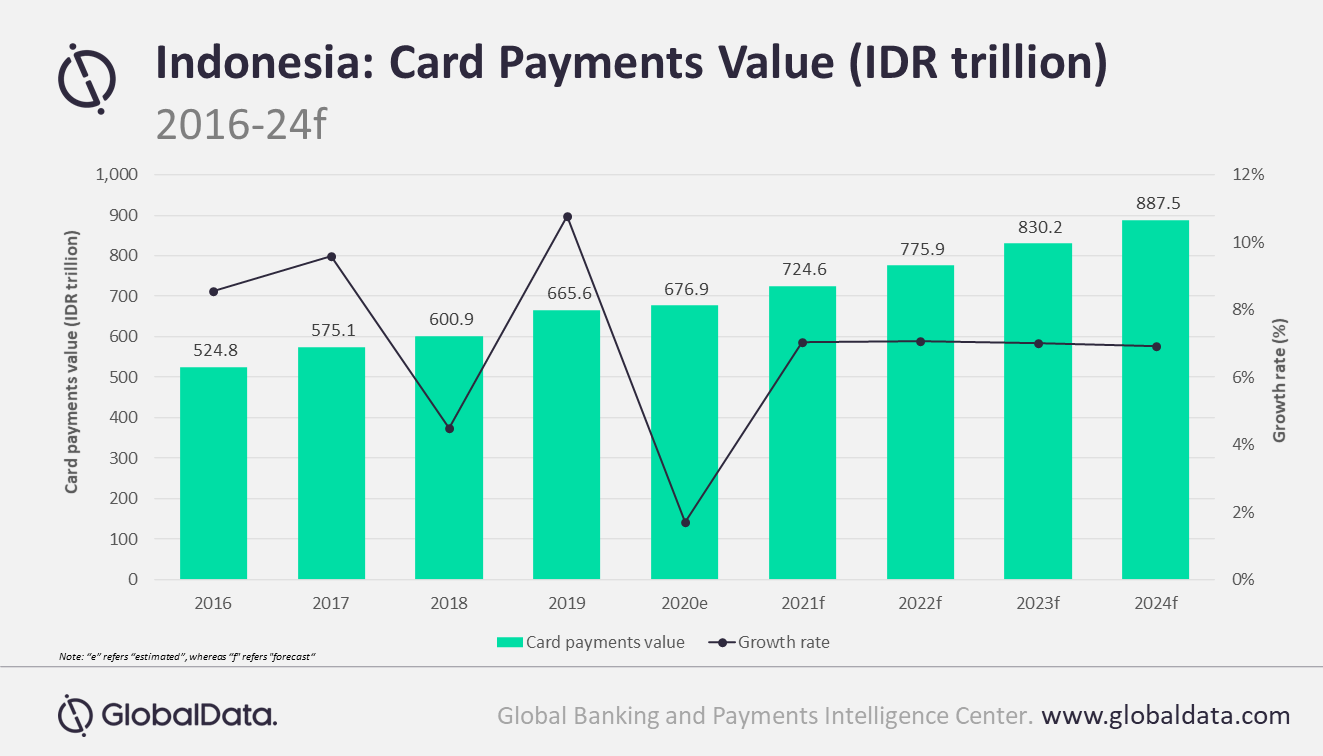

GlobalData has found that the Indonesian payment market is anticipated to bounce back with a 7% growth in 2021 with expected recovery from COVID-19. Consequently, the card payments market is forecasted to reach $63.9 billion in 2024.

As to the overall card payment value, it will register a subdued growth of 1.7% in 2020, forecasts GlobalData, according to the report.

To provide relief to cardholders and push card usage, the government has reduced credit card interest rates from 2.25% to 2% per month. It also concerns minimum repayment from 10% to 5% of total outstanding, effective from 1 May 2020.

We’ve reported that the value of instant payments, where transactions are completed within ten seconds, will reach $18 trillion in 2025, up from $3 trillion in 2020; a growth of over 500%.

SEE ALSO: