Robinhood Markets reports that its customers are switching to high-yield deposits.

Changes in the financial behavior of consumers are taking place against the background of the recent turmoil in the banking sector. Robinhood CEO Vlad Tenev, during a speech at the Bernstein Strategic Decisions Conference at the end of last week, said that the total volume of contributions to the Gold Sweep program exceeded the $10 billion mark. He also said that this indicator continues to show growth dynamics even after the last earnings report.

Vlad Tenev believes that the increase in consumer interest in high-yield deposits is due to the fact that traditional banks cannot provide the acceptable level of the corresponding indicator.

Robinhood Chief Financial Officer Jason Warnick informed investors during the April earnings report that the company retains the liquidity of assets, separately noting that the firm is not a standard lender, which due to current circumstances in the banking sector cannot provide a similar guarantee.

Robinhood management representatives often draw attention to the fact that when launching new products and subsequent distribution, their absolute priority is to ensure a high level of customer security. Jason Warnick called security the main corporate value of the company.

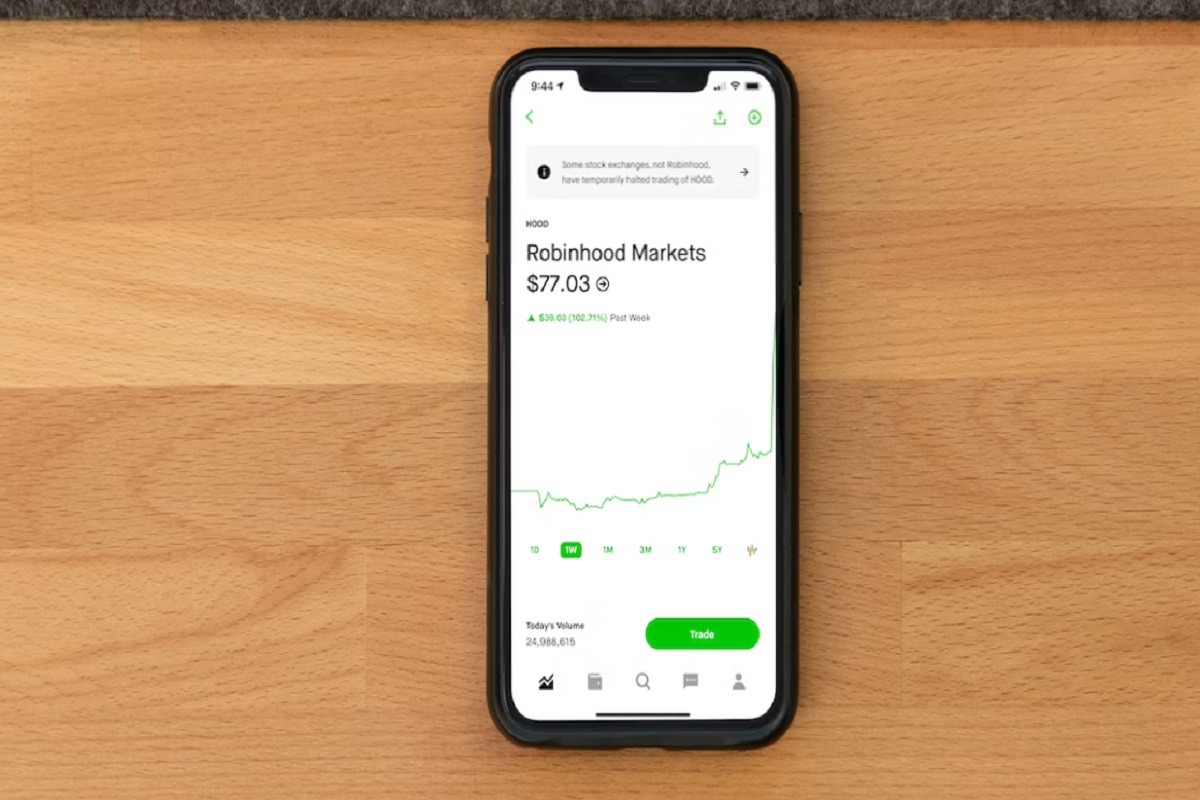

The growth rate of Robinhood’s net deposits was 29% in the first quarter of 2023 and 18% at the end of last year. Also in the April earnings report, it was recorded that the firm’s net interest profit is equal to $208 million and for the first time exceeded the profit from transactions, which amounted to $207 million.

The crisis situation in the banking sector, according to experts and analysts, has formed a tendency to switch to alternatives to traditional services and standard methods of work in this industry. For example, in March it became known that investors were transferring assets to money market funds. According to the results of the first quarter of this year, $508 billion was placed on such accounts. This trend has led to the fact that 5.2 trillion dollars are currently stored in the accounts of the US money market. This figure is a record.

Current trends in the financial industry are a strategic opportunity for organizations that are focused on digital technologies. Such lenders in these conditions can attract customers who intend to interact with virtual banks.

Vlad Tenev said that Robinhood recorded the growth of individual retirement accounts of a company called Roth (IRA). According to him, this is due to a decrease in the level of trust in the traditional social protection system.

Research results show that in the United States, those who work from paycheck to paycheck, 60% of the population, perceive retirement as something unattainable. Many assess retirement as a concept of existence without means to maintain an acceptable level of material security.

As we have reported earlier, Robinhood CEO Says Every Company to Transition Into AI Company.