How to distinguish Fintech from Techfin?

The difference between Fintech & Techfin. Source: shutterstock.com

In 2020, Fintech is not a new definition, and most people have some understanding of it. One way or another, people are able to decipher the abbreviation and put together “finance” and “technology”. Thus, it makes the definition far less complicated and more understandable even for inexperienced users, if we are talking about technology and finance sectors. But if “Fintech” causes no trouble for users, the fancy word “Techfin” seems to be a real pitfall. What is it? Are they the same, and if not, what is the crucial difference between them? How to distinguish these two definitions? So many questions…

PaySpace Magazine has figured out what are Fintech and Techfin, and offers you to consider how they differ.

What is the difference between Fintech and Techfin?

Actually, it is not that complicated. The primary difference between Fintесh and Tесhfin is to found in the construction of the words (in the order of root and prefix, to be accurate). This, in its order, defines the origin of the underlying organization. Normally, Fintech refers to a financial institution that is eager to find a better way of delivering financial services. Thus, financial companies look for technology to improve their service and customer experience.

A traditional bank that offers mobile banking service is a good example of Fintech. Nevertheless, most often, Fintech is about non-traditional financial institutions such as PayPal, Zеllе, and Vеnmо in the United States, or online-only Starling Bank, Mоnzо and Rеvоlut in the United Kingdom.

On the other hand, Techfin refers to a technology firm that wants to deliver financial products on the basis of existing tech solutions. Classic examples of Techfin institutions include Google, Amazon, Fаcеbook and Apple (GAFA) in the United States, and Bаidu, Аlibаbа, and Tеnсеnt (BAT) in China.

The success factor for both Fintech and Techfin lies typically in the ability to ensure large financial institutions:

And in summation, the difference in the approaches defines this thin line between Fintech and Techfin:

After all, it is not about the differences between (almost) similar definitions. It is about the ability of tech and finance companies to collect and analyze massive data sets, learn from the insights to improve personalization and digital engagement in real time and expand offerings in response to consumer needs. The distinction between words can become blurred, while the real advanced solutions will define the real leaders of the market.

Examples of Fintech and Techfin solutions

Let’s consider how to distinguish Fintech from Techfin in practice:

Plaid Technologies

This US startup was launched in 2013 with the aim to “democratize financial services through technology”. The firm has developed a toolkit, which protects interactions and data exchanges between customers, banks and third-party applications.

The description helps us unambiguously define that this startup is Fintech, since it is a financial service company that tries to improve the service through technology.

Alipay

This is an online payments platform, developed by tech giant Alibaba.

Alipay is an online payments platform, developed by tech giant Alibaba. Source: alizila.com

In March 2019, Barclays and Alipay announced their partnership. Aliрау will now be available with several merchants across the United Kingdom, and allow for a seamless payment experience for half a million Chinese residents, tourists and students in the UK.

That’s the classic case of Techfin, because Alipay is a subsidiary of Alibaba Group, which is a tech company. Thus, the technology firm has found a way to deliver a seamless instant payment option.

Circle

This Boston-based Fintech startup offers four products: Circle Invest, which simplifies investing in cryptocurrencies for the average user; Circle Pay, a peer-to-peer payment platform; Circle Trade, a cryptocurrency trading platform that processes $2bn worth of crypto payments per month; and Poloneix, one of the world’s largest cryptocurrency exchanges.

This firm also uses technology to deliver financial (cryptocurrency) service. Therefore, it is a Fintech company.

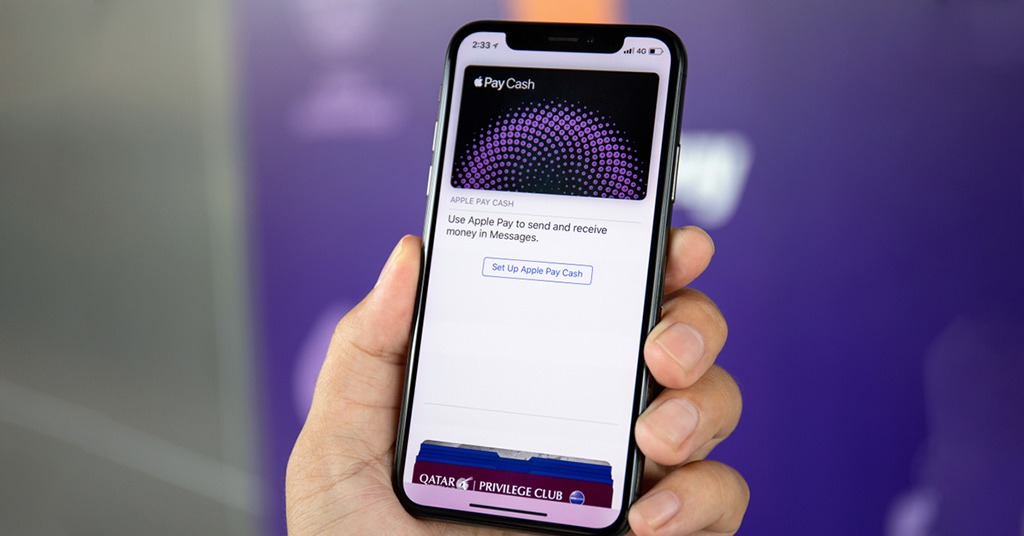

Apple Pay

Apple Pay is a mobile payment and digital wallet system developed by Apple.

It’s a mobile payment and digital wallet system developed by Apple. Source: shutterstock.com

On 25 March 2019, the tech company announced that the Apple Card would be available in summer 2019. Actually, it is a payment card, which cooperates with Goldman Sachs and MasterCard.

This is another Techfin situation. In this case, Apple (being a technology firm) developed its ecosystem and managed to launch its payment system.

WeChat Pay

WeChat Pay, which is an electronic wallet that works as a transaction service, is an excellent example of Techfin.

In other words, WeChat Pay is a payment solution integrated into the popular Chinese messenger called WeChat owned by Tencent. The only way to access the wallet option is to tap the “Wallet” tab in the messenger app. Basically, the option allows users to send money to other users, pay for goods and services online, top up mobile accounts, invest funds, pay different bills, book/pay for a taxi, book/buy tickets, book hotels, and more.

WeChat Pay is integrated into the multifunctional WeChat app, and this is why the service is compatible with any smartphone (on which it is installed).

WeChat Pay is integrated into the multifunctional WeChat app. Source: shutterstock.com

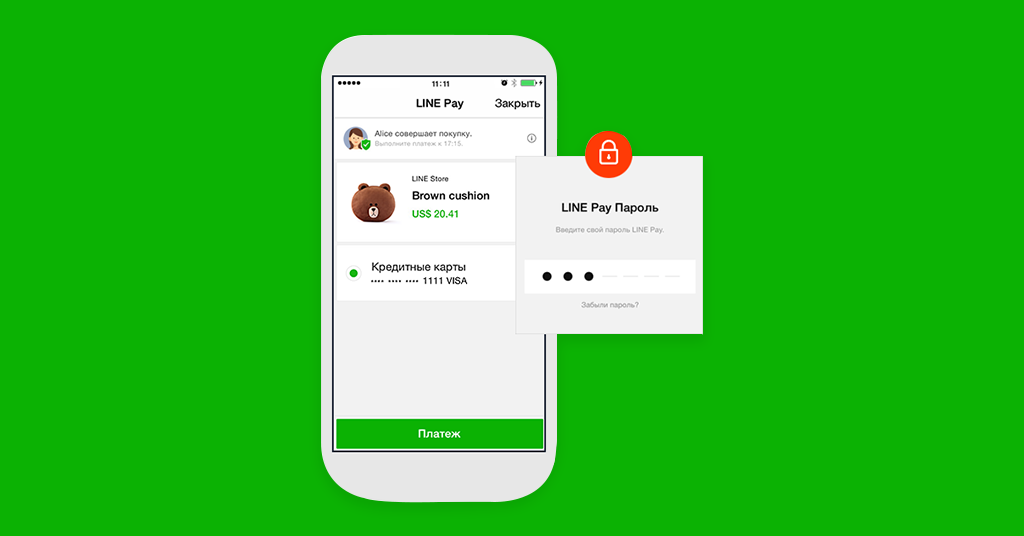

LINE Pay

Line Pay is a somewhat similar (to WeChat Pay) service. We do not mean the principle of work of these two services is 100% similar, but in terms of affiliation to Techfin, we can call these two payment services similar.

Line is an application for smartphones and PCs, and basically, is an instant messenger (text, audio/video calls, file transfers) of Korean origin. On the other hand, Line Pay is a payment service that allows you to make purchases from Line Pay Merchants. You can also send money and split bills with your Line friends. You can make payments easily with your credit card without registering, and if you register for Line Cash (a Line Pay account), you can make payments with your balance, as well as request money and make requests to split bills.

One way or another, it is clear now that the Line app has found a way to deliver financial options as part of a broader offering of services (in this particular case, it is about a popular messenger with a broad audience). Therefore, Line Pay can rightfully be called a Techfin solution.

Line Pay is a somewhat similar (to WeChat Pay) service. Source: payspacemagazine.com

Adyen

Adyen was created in 2006. This Dutch company offers entrepreneurs and bigger companies a single platform for payment acceptance. The payment option will work via any sales channel in any place in the world. In other words, Adyen is an internet provider of payment systems. With major offices in offices in Sao Paulo, London, and Berlin (and these are just some of the most important ones), Adyen allows its customers the ability to accept almost any payment method (electronic payments, credit and debit card transactions, and even regular bank transfers). Netflix, Spotify, Facebook, L’Oreal, and Uber already actively use the services of this company. Moreover, nowadays, no less than 4,500 actively use the service (mobile/online/in-store mode).

As you can see, originally, this company planned to be a payment service provider, which nowadays seeks for better technological advancements and stuff to empower its core financial service. This is what you can call Fintech.

Qudian

Qudian is a Chinese company that was formed in 2014. Basically, Qudian is a provider of online services for obtaining small consumer loans. The company is aimed at a large number of potential customers who, for various reasons, cannot gain access to traditional financial instruments. This is particularly relevant for Asia, where banking services lag behind the needs of the population, and the network of bank branches and internet banking are poorly developed. At the same time, the potential demand is high, as young people demonstrate high consumer activity, and the average income in the region is increasing.

Qudian offers small loans that can be obtained using the mobile application. At the same time, Qudian is an online-only app, and consumers can access it only in real time. The company uses advanced technologies, in particular, big data analysis and machine intelligence in order to improve the quality of services and reduce business risks.

According to all the info we have, it is clear that Qudian is also a Fintech firm.

SEE ALSO: