Gen Z is gradually emerging as a major influential power in the e-commerce sector. Although Gen X still remains the biggest spender, Zoomers are expected to display the fastest spending power growth in the next 10 years. Here is how to cater to this increasingly important consumer category with a suitable fintech solution.

Who Are Gen Z?

Generation Z, often called Gen Z or Zoomers, is the demographic group born roughly between the mid-to-late 1990s and early 2010s, who are currently in their teens to mid-20s.

Also known as iGeneration or Net Generation, Zoomers are digital natives who never knew a world without widespread internet access, smartphones, and social media. Many Gen Zers start their careers early, using digital platforms to create side gigs or online businesses.

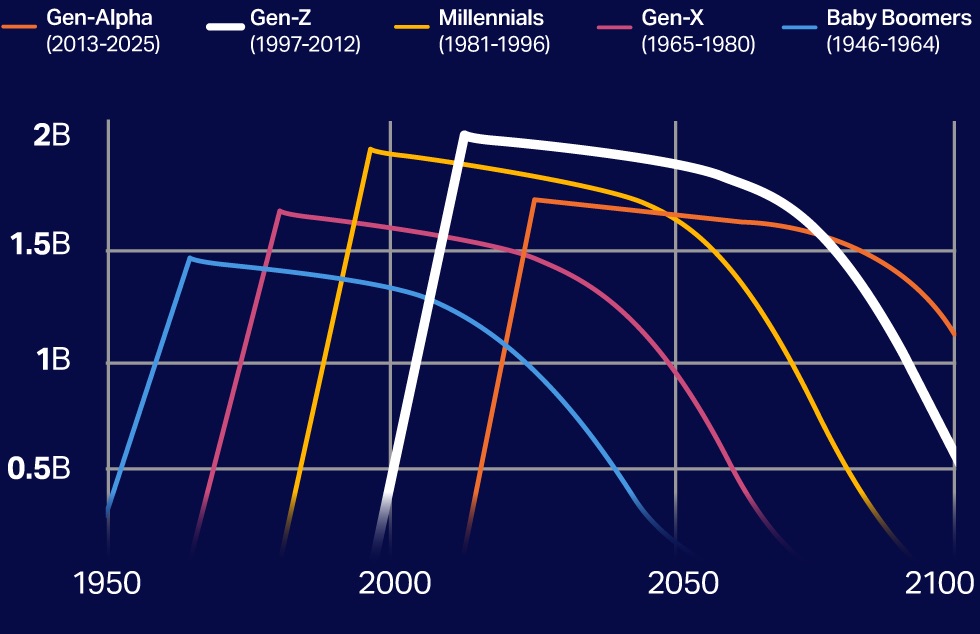

According to NielsenIQ and World Data Lab, Gen Z currently accounts for almost 25% of the world population, being the largest generation to date and likely to become the largest ever. Due to different birth rates in various regions, the overwhelming majority of Gen Z (9 out of 10 people) live in emerging economies.

Source: NIQ/World Data Lab, Generations Analysis

According to another report by the Bank of America, Gen Z’s income is supposed to surpass that of Millennials by 2031. Their spending power is expected to grow to $12T by 2030.

What Do Zoomers Like?

Gen Z representatives often become trend-setters in music, fashion, entertainment, and even workplace culture. They value authenticity and transparency from brands, media, and public figures, often being socially and environmentally conscious, supporting causes related to climate change, inclusivity, and social justice.

Besides paying attention to ESG components, Gen Zers favour brands that prioritise convenience, speed, and mobile accessibility. Naturally, this digitally native generation expects a seamless digital experience from brands and retailers on social media, websites and apps.

To market an item or service to a Zoomer, a company should not bombard them with unrelated info. Gen Z wants the information to be purposely targeted to them and be highly personalised. About 38% of Gen Zers want online ads to be linked to their browsing history or entertainment preferences.

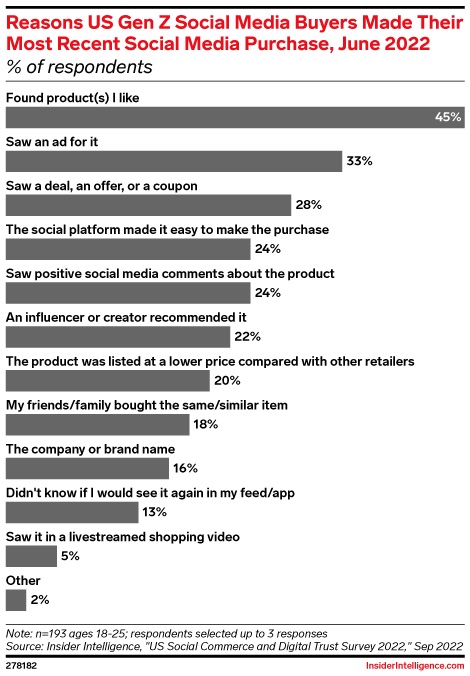

When it comes to purchasing decisions, Gen Z mainly buy from social media when they discover a product they like. Recommendations of creators or influencers are a driving factor only for one-fifth of young shoppers, about the same as opinions of friends and family. Brand names matter to even fewer people of this age cohort (16%). We must note, however, that these numbers are true for US consumers and may differ in other countries/regions.

Most Gen Z representatives (69%) pay attention to the way businesses operate, valuing their commitment to privacy, social impact and environmental responsibility. They are more loyal to brands and businesses viewed as transparent and accountable. At the same time, brand loyalty is not the most important factor in Gen Zers’ purchasing decisions, as they also consider the price and convenience of shopping experience.

Zoomers like flexibility in their payment choices, being the most active buy now, pay later (BNPL) service users and embracing other emerging digital payment technologies e.g. mobile wallets, contactless solutions, and peer-to-peer payment apps.

What Fintech Solutions Are Most Suitable for Gen Z Lifestyle?

Growing up with electronic devices and the internet at their disposal, generation Z conducts a major part of their lives online and with their mobile phones. Therefore, their banking services have to be mostly or exclusively digital. Legacy banking institutions often do not compete in this realm. Thus, a half (51%) of Gen Z consumers consider a fintech company to be the most trusted financial institution.

Mobile Banking

Preferably, the banking apps appealing to Gen Z should offer convenient, user-centred experiences and enable customer support communication via digital platforms. Let’s not forget about this generation’s preference for transparency and control over their finances. The apps with personalised spending insights, transparent fee and loan structure, real-time notifications, clear descriptions of transactions, reminders for scheduled payments, tutorials, FAQs, and educational content have more chances with Gen Z.

Budgeting Apps

Gen Zers are financially conservative and prioritise financial wellness. Surprisingly, their use of cash is higher than you might think. In two different 2024 studies, between one-fourth and one-third of Gen Z respondents reported using cash for most of their purchases. The reason might be an enhanced need for budgeting. Cash is often a payment method of choice for people who don’t want to overspend and aim for better expense categorisation and visualisation of available funds. Thus, a budgeting hack with cash divided into category envelopes has been trending on Gen Z’s social media feeds.

Budgeting apps can offer a healthy digital alternative to that with clear visualisation for different target spending categories. They might provide an ability to divide one’s income into different purpose accounts (maybe even in the form of envelopes) so that Zoomers have better control over their spending limits in a certain category. It’s better to focus on prepaid card solutions rather than credit ones since they decrease the possibility of compulsive and excessive spending.

Gen Z also favours apps with clear, straightforward guidance on budget management as they only start their way with finances. They enjoy setting savings goals and might appreciate AI-driven insights to support personalised finance management.

Micro-Investing and Social Investing

Gen Zers who have already joined the workforce increasingly realise the importance of investing from an early age. A recent study found that 62% of today’s 18-24 year-olds are investing, with 57% of them using apps for that purpose. Since many Zoomers have not yet accumulated a lot of wealth, micro-investing might be just the perfect suit for their financial needs.

It is important to offer ESG (Environmental, Social, and Governance) investment options, catering to Gen Z’s interest in supporting socially responsible companies. Besides, many Zoomers would appreciate educational content within such apps, being novices to the investing segment.

Gen Z also finds the concept of social investing appealing. Thus, investing platforms which incorporate social features, like viewing other users’ portfolios, exchanging insights, creating stock “wishlists” with their friends, and discussing market trends, increasingly align with Gen Z’s preference for community-driven learning and a habit of online collaboration and sharing.

Credit-Building Solutions

Gen Z enjoys the flexibility of fintech BNPL options for purchasing items without immediate credit card debt. However, with that alone, you cannot typically build a solid credit history required later in life. There are many fintech solutions that offer credit-building programs for young Gen Z individuals without a formal credit history. These tools are often personalised, providing tailored small loans, secured credit cards, or credit lines to help people build a positive credit score in their specific conditions. Besides, these platforms may enable credit score monitoring and offer incentives for responsible spending, which Gen Z will find helpful in developing healthy financial habits.

Socially and Environmentally Responsible Apps

According to a report by Gen Z content studio Adolescent Content, 94% of Gen Zers have big life goals, and 75% are going to make the world a better place. Zoomers are very keen on social and environmental causes and would like their fintech apps to contribute to their responsible lifestyle. So, they would appreciate financial and e-commerce tools which promote sustainable customer behaviours, bring greater transparency to shopping decisions, enable carbon footprint measuring, and reveal opportunities to shift their spending to businesses that better align with their values.

Zoomers prefer purpose-driven brands with a transparent mission that aligns with the causes they support personally. Therefore, an app of their liking must clearly state how it contributes to ESG goals (e.g. invests in reforestation, supporting local communities, tackling financial inclusion, etc.).

Automated and Goal-Based Saving Tools

Gen Zers understand the power of early savings but would like them to feel more effortless. That is possible with automated and goal-based options. Automated savings tools enable users to set customised savings targets and apply “round-up” or “save the change” features to help them reach set goals. AI-powered savings platforms can even analyse customers’ income streams and spending habits to allocate funds into designated savings accounts automatically or advise on sensible spending or saving habits. Apps of this kind can help users find better deals on subscriptions and services or suggest ways to reduce their grocery bills so that they have more extra cash to put towards their savings targets.

Crypto and DeFi

Finally, Gen Zers are embracing innovative financial instruments like cryptocurrencies. Different studies have shown that nearly 94% of cryptocurrency buyers are Gen Z and Millennials, while Gen Zers are more likely to own crypto than stocks as an investing opportunity. Stocks were preferred investment choice only for 18% of the younger generation.

Meanwhile, cryptocurrency and DeFi platforms offer user-friendly onboarding, educational resources, and beginner-friendly trading tools, as well as social features, making them popular among young people interested in the digital economy and alternative assets.

Summary

Gen Z is an important demographic group for fintech providers to target. Their growing spending power, native tech-savviness, and responsible attitude towards personal finances make Zoomers ideal clients for the innovative fintech sphere. However, they would not agree to just any fintech product. To appeal to Gen Z, one must market the solution with right ethical messages, hyper-personalisation, and seamless customer experiences. Some of the best tools for this age cohort include automated and goal-based savings, crypto and DeFi apps, credit-building solutions, micro- and social investing, ESG-focused apps, mobile banking and budgeting apps.