The crypto landscape of the European Union is diverse, and with the advent of Markets in Crypto-Assets Regulation (MiCA), it is also getting more secure and monitored. Today, over 50 traditional financial institutions, crypto-native firms, and challenger fintechs have gained regulatory approval across the EU. Let’s briefly overview the MiCA-licensed crypto providers in Europe.

As of October 2025, the European crypto regulatory landscape is expanding under MiCA, currently counting 53 MiCA-licensed firms, with 14 authorized stablecoin issuers and 39 Crypto-Asset Service Providers (CASPs), spread across multiple EU countries such as Germany, the Netherlands, Malta, France, and others.

The MiCA licenses enable both traditional and crypto-native providers to offer their services legitimately and securely across 30 EEA countries, enhancing consumer protection and market harmonization.

Here are some of the most prominent companies that managed to obtain the MiCA license so far:

Stablecoin Issuers (EMT)

-

Circle (July 2024, Multiple EU countries) – Issuer of USDC/EURC; among first MiCA-licensed stablecoins.

-

Quantoz (November 2024, Netherlands) – Issuer of EURQ / USDQ EMTs; early MiCA-compliant issuer.

-

Crypto.com (January 2025, Malta/MFSA) – Early authorized issuer under MiCA regime.

-

Membrane Finance (Paxos Europe) (February 2025, Finland/France-Luxembourg structure) – Acquired by Paxos; authorized EMT issuer under MiCA.

-

Société Générale (FORGE) (July 2025 approx., France/ACPR) – Licensed bank-backed stablecoin issuer.

-

Stablemint (July 2025 approx., Lithuania/BoL) – Licensed local stablecoin issuer.

-

StablR (July 2025 approx., Netherlands/DNB) – Licensed EU-wide stablecoin issuer.

Crypto-Asset Service Providers (CASP)

-

OKX (January 2025, Germany/BaFin, passported from Malta) – First MiCA license confirmed for OKX in EU under passporting.

-

Bitpanda (April 2025, Austria/FMA Österreich) – Licensed platform; key player in Austrian crypto regulation.

-

Bitstamp (May 2025, Luxembourg/CSSF) – Licensed crypto exchange under MiCA; EU operations base.

-

Bybit (May 2025, Austria/FMA) – MiCA license recorded by the Austrian FMA.

-

Robinhood Europe (May 2025, Germany/BaFin) – Licensed platform for crypto trading in the EU.

-

Coinbase (Luxembourg entity) (June 2025, Luxembourg/CSSF) – MiCA license confirmed; central hub for EU operations.

-

Kraken (June 2025, Ireland/CBI) – MiCA authorization granted; major US exchange with EU base.

-

BBVA (July 2025 approx., Spain/CNMV) – Among the first banks to obtain MiCA authorization.

-

N26 (July 2025 approx., Germany/BaFin) – Licensed fintech challenger bank offering crypto.

-

eToro (July 2025 approx., Cyprus/CySEC) – Licensed multi-asset fintech platform under MiCA.

-

Lunar (October 2025, Denmark/Danish FSA) – First Scandinavian fintech licensed under MiCA.

-

Revolut (October 2025, Cyprus/CySEC) – Licensed for EU-wide regulated crypto services.

-

Clearstream (October 2025, Luxembourg/CSSF) – Traditional market infrastructure firm under MiCA regime.

-

Blockchain.com (October 2025, Malta/MFSA) – Focused on institutional and custodial wallet services.

-

Relai (October 2025, France/AMF) – Swiss Bitcoin-only app; among first BTC-only firms licensed.

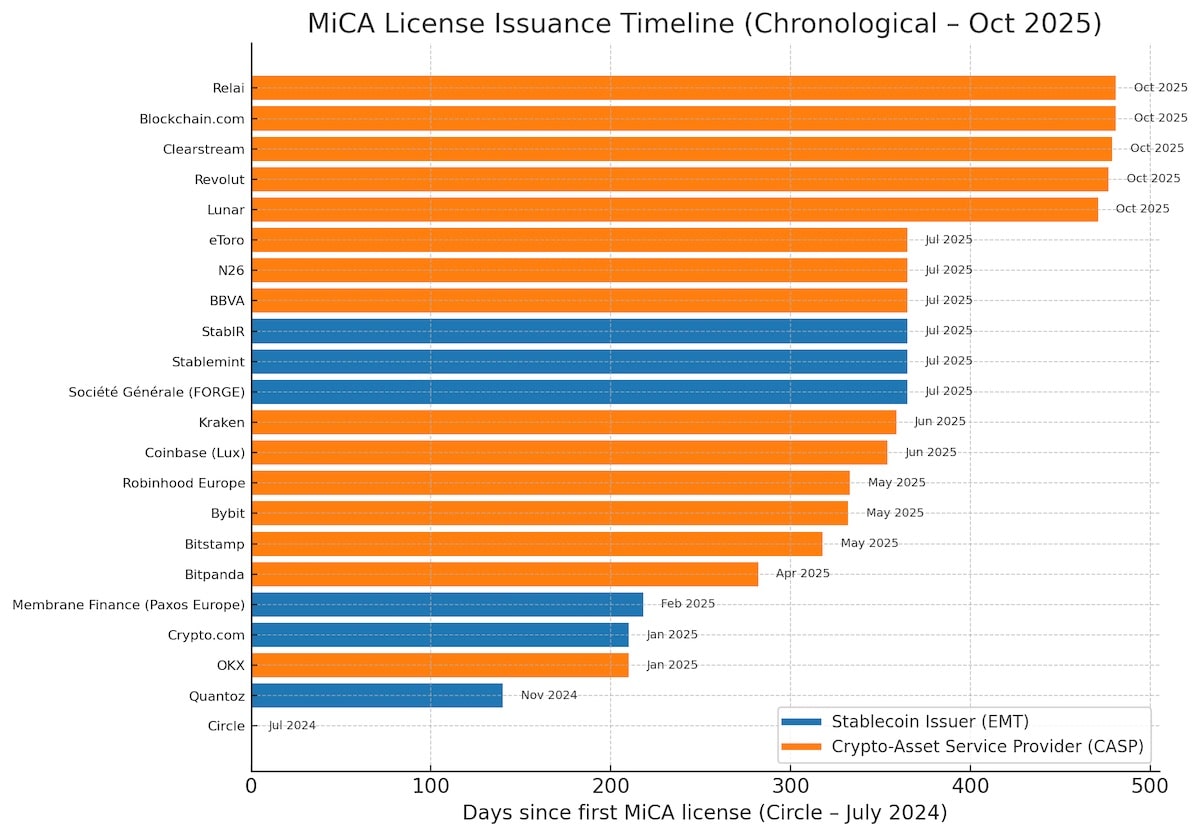

Here is a timeline-ordered chart of notable MiCA-licensed crypto providers in the EU as of late 2025, incorporating the most prominent firms and latest licensees.

Among the other notable crypto company achievements under the MiCA regime, Dutch crypto launchpad Decubate has become one of the first platforms in the EU to secure full MiCAR approval, allowing it to run legally compliant token fundraising.

Notably, some of the major global crypto providers, like Binance and Tether (creator of USDT stablecoin – top stablecoin by market cap), remain unlicensed under the EU’s MiCA regulation.

Tether’s exclusion from MiCA licensing stems from concerns over its transparency and audit practices. The company has been criticized for failing to provide an independent audit of its reserves, relying instead on attestations, which may not meet MiCA’s stringent requirements.

Meanwhile, Binance’s absence from the MiCA-approved list is primarily due to ongoing regulatory scrutiny and compliance challenges, as well as its recent legal issues in other jurisdictions (e.g. U.S.).