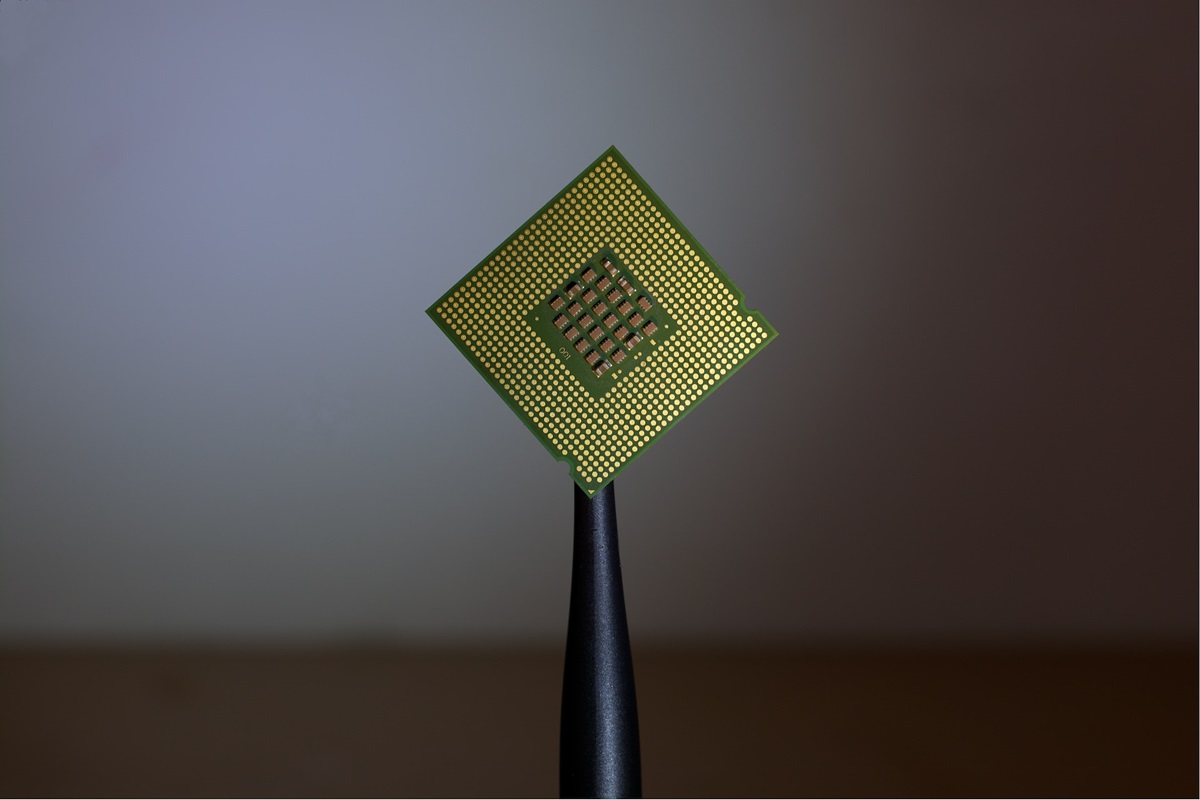

Leading manufacturers of equipment used in making microcircuits have recorded a sharp increase in the share of revenue they receive in the Chinese market.

Experts note that this trend is natural against the background of current geopolitical realities. Beijing is seeking to accumulate stocks of equipment needed by the chip manufacturing industry to minimize the negative consequences of restricting Chinese companies’ access to advanced microcircuits, which was introduced by Washington. Currently, the state of relations between the United States and China is in a phase of gradual movement towards a situation of deep crisis. Beijing is reacting to the restrictions above of Washington. As a countermeasure, China has curbed the supplies of germanium and gallium needed by the semiconductor industry. Beijing also plans to restrict exporting of graphite used in the production of batteries for electric cars.

According to the results of the third quarter of this year, the world’s largest equipment suppliers for making chips received more than 40% of their revenue from customers from the mentioned Asian country. Japanese company Tokyo Electron Ltd. has recorded record shipments to China. This manufacturer stated that the pause in investments among global chipmakers contributed to an increase in the share of sales in the Chinese market.

Dutch firm ASML Holding NV received a significant share of its revenue in the third quarter due to shipments to China. In this case, a remarkable fact is that the said company continues to cooperate with customers from an Asian country during the period of the ban on the supply of its most advanced equipment to this state.

The tightening of export restrictions, the decision which was made by Washington, regarding the most modern chip production technologies has not yet caused a drop in makers of the corresponding equipment sales in the Chinese market. Experts say that against the background of the mentioned measures of the American leadership, orders on the contrary increased. For example, the California-based company Applied Materials Inc. reported a growth in sales in China this fall. Also, representatives of this firm are convinced that supplies to the Asian country will remain at a high level shortly due to large volumes of exports to the customers of computer memory. The company predicts that over time, China’s share in the profit structure will return to its typical figures of about 30%.

Amir Anvarzadeh of Asymmetric Advisors believes that Beijing’s massive preloading of existing orders, designed to circumvent export restrictions, is likely to weaken. According to the expert, at some point, the market will cease to take into account the prospects for the development of the Chinese technology sector since the guarantee of this positive scenario is not sustainable in the medium term.